Exxon Mobil enters the next three years with slowing top-line momentum but resilient cash generation. Over the past year, revenue cooled as oil and gas prices normalized, while downstream and chemicals margins moderated from 2022–2023 peaks. Still, the company’s scale, integration, and project pipeline underpin cash flow, and management continues to emphasize disciplined spending and portfolio high-grading. Trailing twelve-month revenue stands at 329.82B, and the forward dividend yield of 3.42% signals an income anchor investors watch closely. The stock has been range-bound because macro energy signals are mixed and policy visibility is uneven, yet operational execution and balance sheet strength remain supportive. Sector-wide, energy equities have lagged growth-led benchmarks as investors debate long-run oil demand versus the near-term need for supply security. For Exxon Mobil, the setup is a tug-of-war: softer year-over-year comparisons and regulatory friction on one side, potential LNG and upstream catalysts on the other. The result is a patience story driven by commodity prices, project delivery, and capital discipline.

Key Points as of October 2025

- Revenue: trailing 12-month revenue at 329.82B; latest quarterly revenue growth (yoy) at -12.30% reflects softer commodity realizations.

- Profit/Margins: profit margin 9.40%; operating margin 11.73% – healthy for an integrated major but below recent cycle highs.

- Cash generation: operating cash flow 54.3B; levered free cash flow 20.75B supports capex and the dividend.

- Balance sheet: total debt 38.99B vs cash 14.35B; current ratio 1.25 and debt/equity 14.44% suggest conservative leverage.

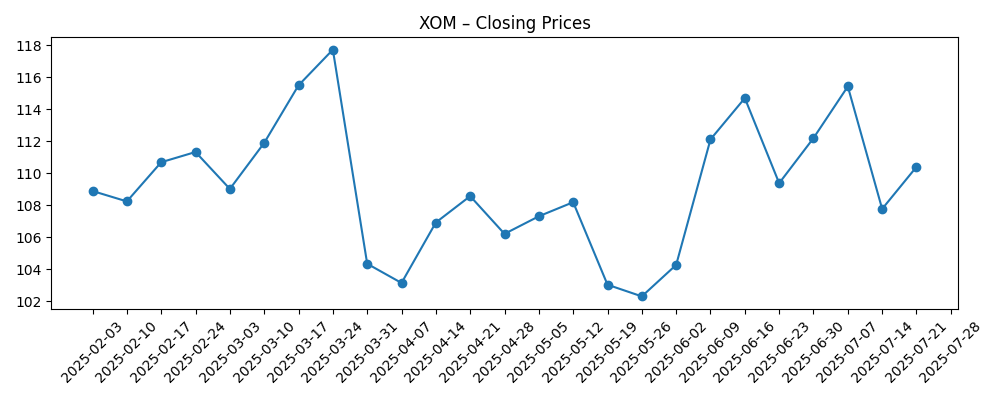

- Share price and volatility: last weekly close near 115.03; 52-week range 97.80–123.21; 52-week change -0.64%; beta 0.48 (lower volatility than the market).

- Dividend: forward annual dividend rate 3.96 (yield ~3.42%); payout ratio 55.68%; most recent ex-dividend date 8/15/2025.

- Market cap: not disclosed in the provided data; with 4.26B shares outstanding and a triple-digit share price, Exxon remains a mega-cap energy name.

- Positioning and outlook: headlines highlight LNG growth focus and potential upstream uplift tied to oil prices; regulatory scrutiny persists.

- Sentiment/short interest: shares short 39.97M; short ratio 2.55; short interest ~1.05% of float – limited bearish positioning.

Share price evolution – last 12 months

Notable headlines

- Reuters: Exxon expects upstream earnings boost from oil prices (Q3 context)

- UBS highlights Exxon Mobil’s long-term energy investment potential

- Why Exxon Mobil is a good option to invest in LNG

- ExxonMobil sues California over climate disclosure laws

- Commentary: Jim Cramer says it’s hard for Exxon to “get any traction”

Opinion

Exxon Mobil’s recent data show a cyclical comedown rather than a structural break. Revenue growth is negative year over year (-12.30%), and earnings growth has softened (-23.40%), largely because commodity realizations normalized and refining/chemicals spreads eased. Yet profitability is still solid for this point in the cycle: a 9.40% profit margin and 11.73% operating margin, with operating cash flow of 54.3B, suggest the business is generating enough cash to fund core projects. The forward dividend yield of about 3.42% sits on a 55.68% payout ratio, indicating room for investment and balance sheet upkeep even if macro conditions stay choppy.

Balance sheet and risk metrics support that view. Total debt of 38.99B against 14.35B in cash, a 1.25 current ratio, and a 14.44% debt/equity profile point to conservative leverage. Beta at 0.48 implies lower volatility than the market, which matters if oil prices swing. Short interest is modest (39.97M shares; ratio 2.55), showing limited outright bearishness. Together, these inputs imply Exxon has time to execute, even if pricing turns against it for a few quarters, because cash generation can cushion lulls and keep strategic projects moving.

Strategically, management faces two narratives. One is about cyclical sensitivity: upstream cash flows rise and fall with oil and gas prices, while downstream/chemicals margins hinge on global inventories and demand. The other is about durable growth options, notably LNG, where headlines suggest a sustained push to leverage scale and integrated marketing. If LNG and select upstream projects come online on schedule, Exxon could defend margins and mix even without a strong commodity tailwind. That would support a steadier multiple as investors attribute more value to visible, contracted cash flows.

Conversely, regulatory and policy headwinds can complicate capital allocation. The California climate-disclosure lawsuit underscores rising compliance burdens and potential legal costs. At the same time, energy-transition debates influence refining investments and carbon intensity targets, factors watched closely by institutions that hold roughly two-thirds of shares. In this context, execution quality and emissions strategy will shape the story and the valuation range: clear project delivery and disciplined spending could offset macro noise, while delays or policy surprises would likely compress expectations for returns and growth.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Oil balances remain tight and LNG projects progress smoothly, improving upstream mix and stabilizing downstream/chemicals margins. Cash flow comfortably funds capex and dividends, policy risk is manageable, and investor confidence in long-cycle projects lifts the valuation narrative. |

| Base | Commodity prices normalize around mid-cycle levels. Project execution is mostly on time, with occasional delays. Cash generation covers the dividend and selective growth, and the stock tracks energy indices as investors await clearer catalysts. |

| Worse | Global demand disappoints while policy and legal costs rise. Refining and chemicals margins soften, upstream realizations stay weak, and project slips reduce visibility. Valuation compresses toward defensiveness until new catalysts emerge. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil and gas prices and OPEC+ supply policy, which drive upstream realizations.

- Refining and chemicals margins, especially if demand or inventories shift abruptly.

- Execution on LNG and large upstream projects affecting mix, cost, and timing.

- Regulatory and legal developments, including climate-related disclosures and litigation.

- Capital allocation discipline versus free cash flow variability through the cycle.

- Macro sentiment toward energy equities versus growth sectors, affecting relative multiples.

Conclusion

Exxon Mobil’s setup blends cyclical normalization with durable cash strength. The numbers show compressed growth off a high base, yet margins and cash flow remain solid for an integrated major, and leverage is conservative. That combination gives management time to prosecute LNG and upstream options while sustaining dividends. The debate is less about survival and more about the cadence of delivery and macro tides that set the multiple. If projects de-risk and policy visibility improves, the narrative can pivot from “range-bound cyclicality” to “visible cash compounding.” If not, the stock likely trades as a lower-volatility energy proxy. Watch next 1–2 quarters: upstream realizations versus oil price trends; refining/chemicals margin capture; LNG project milestones; cash conversion after capex; and any developments in climate-disclosure litigation. These will shape confidence in earnings quality and determine whether valuation leans toward defensiveness or begins to embed more growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.