Grupo México (OTCMKTS: GMBXF) enters late 2025 with solid profitability and liquidity, but exposure to commodity cycles keeps the three‑year outlook balanced. Over the last year the stock is up 38.19%, recently near $7.49 versus a 52‑week range of $4.39–$7.50. On trailing twelve months, revenue stands at $16.41B with a 46.77% operating margin and 23.70% net margin; EBITDA is $8.33B and net income $3.89B. The balance sheet shows $7.28B in cash against $10.14B of debt (debt/equity 40.92%) and a strong 6.49 current ratio. Cash generation remains healthy (operating cash flow $5.62B; levered free cash flow $1.66B), supporting a forward dividend yield of 3.71% (ex‑dividend 9/4/2025). With insider ownership high and U.S. trading liquidity modest, we expect share performance to hinge on execution, copper demand trends, and capital allocation.

Key Points as of September 2025

- Revenue – TTM revenue is $16.41B; quarterly revenue growth (yoy) is -3.70%, highlighting sensitivity to commodity cycles.

- Profit/Margins – Operating margin 46.77% and profit margin 23.70%; EBITDA $8.33B; ROE 19.05% and ROA 11.86% underline efficient operations.

- Sales/Backlog – No backlog figure in the provided data; sales trajectory remains tied to copper volumes and realized pricing.

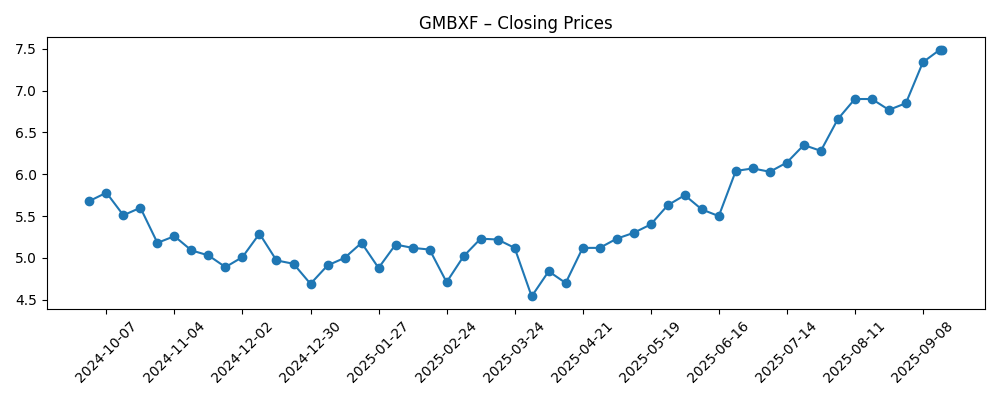

- Share price – Recent price about $7.49; 52‑week range $4.39–$7.50 and 52‑week change 38.19%; beta 1.17; 50‑/200‑day MAs at 6.55 and 5.52.

- Analyst view – Limited U.S. coverage indicated by low average volume; income appeal supported by 3.71% forward yield and 47.99% payout ratio (5‑yr avg yield 5.02).

- Market cap – Roughly $58B based on ~7.78B shares outstanding and the recent price; insider ownership is high at 63.77%.

- Balance sheet – Cash $7.28B vs debt $10.14B; debt/equity 40.92%; robust current ratio of 6.49 provides resilience.

- Cash flow – Operating cash flow $5.62B and levered free cash flow $1.66B support capex and dividends.

Share price evolution – last 12 months

Notable headlines

Opinion

The late‑August gap‑down captured in headlines was notable because it arrived after a steady multi‑month climb. Weekly closes show the shares advancing from mid‑$5s in May to the high‑$6s in August before the break, and then quickly regaining ground to about $7.49 by mid‑September as the 52‑week high of $7.50 came into view. Without speculating on the news flow behind that move, the technical picture suggests investors are willing to buy dips when fundamentals remain intact. The 50‑day moving average above the 200‑day, combined with improving price momentum and a one‑year gain of 38.19%, frames sentiment as cautiously constructive. For a commodity‑levered name, such patterns can reverse quickly, but the bounce after the gap implies underlying demand for the shares, likely anchored by cash generation and the dividend.

Under the hood, fundamentals look resilient even as top‑line growth softens. TTM revenue of $16.41B is offset by a quarterly revenue decline of 3.70% year over year, yet quarterly earnings growth of 10.00% indicates cost discipline and mix effects supporting profitability. With an operating margin of 46.77% and profit margin of 23.70%, Grupo México continues to convert a substantial share of sales into cash. EBITDA of $8.33B and operating cash flow of $5.62B provide flexibility to absorb price volatility. In a three‑year frame, that combination typically translates into room to maintain investment in sustaining projects and still fund distributions. If copper demand remains steady, these margins provide a buffer, and if the cycle firms, earnings could expand faster than revenue. Conversely, a prolonged soft patch would likely compress margins first.

The balance sheet and payout profile shape the risk‑reward. Cash of $7.28B versus $10.14B of debt, a 40.92% debt‑to‑equity ratio, and a strong 6.49 current ratio imply ample liquidity for near‑term obligations and optionality for capital allocation. Levered free cash flow of $1.66B and a forward dividend yield of 3.71% (ex‑dividend 9/4/2025) position the stock as an income‑and‑cycle hybrid. The stated payout ratio of 47.99% leaves room to adjust dividends across the cycle without overstretching the balance sheet. Over the next three years, investors will watch whether management prioritizes sustaining capital and selective growth over aggressive distributions. A steady, well‑funded dividend could anchor the share price during cyclical pauses, while disciplined capex may support long‑term value.

Ownership and liquidity dynamics may amplify moves. Insider ownership of 63.77% and a float of 3.13B shares, combined with modest U.S. trading activity (average three‑month volume ~14k), can increase the stock’s sensitivity to incremental news and set‑piece events. A beta of 1.17 suggests the shares move somewhat more than the broader market, which is typical for miners. Over a three‑year horizon, this structure can cut both ways: low float in the U.S. channel can deepen drawdowns on negative headlines but also support faster recoveries when fundamentals reassert. For valuation, the market’s tendency will be to focus on cash conversion, maintenance of margins, and the reliability of the dividend through the cycle. Clear communication around project pacing and capital returns could reduce volatility.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outlook to September 2028 |

|---|---|

| Best | Stable to improving copper demand supports strong realized pricing, sustaining high margins. Cash generation funds disciplined growth projects and a stable or rising dividend. Balance sheet remains conservative, preserving flexibility for opportunistic investments while keeping shareholder returns competitive. |

| Base | Copper prices are range‑bound and volumes steady. Margins remain healthy through cost control, and the dividend policy remains balanced with reinvestment needs. Share performance tracks cash flow stability and periodic project milestones, with valuation anchored to income characteristics. |

| Worse | A prolonged downturn in the commodity cycle and cost inflation compress margins. Regulatory or operational setbacks delay projects. Management prioritizes balance‑sheet protection, moderating capital spending and adjusting dividends to preserve liquidity, leading to a de‑rating until conditions normalize. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Commodity cycle – realized copper prices and demand trends impacting revenue and margins.

- Project execution and permitting – timelines, cost control, and regulatory outcomes across operating regions.

- Capital allocation – balance between sustaining/growth capex and dividends given free cash flow and leverage.

- Legal, labor, and environmental developments – potential disputes or compliance costs affecting operations.

- Liquidity and ownership structure – high insider ownership and low U.S. trading volume affecting volatility and valuation.

Conclusion

Grupo México enters the next three years with durable fundamentals: high operating margins, strong liquidity, and consistent cash generation. The shares have rebounded toward their 52‑week high, and the technical tone is constructive, yet the investment case remains tethered to the copper cycle. With TTM revenue of $16.41B, EBITDA of $8.33B, and operating cash flow of $5.62B, the company appears positioned to sustain disciplined capital spending and a dividend currently yielding 3.71%. Balance‑sheet flexibility (current ratio 6.49; debt/equity 40.92%) provides cushion should conditions soften. Key debates for investors through 2028 will center on project pacing, maintaining margins if top‑line growth is subdued, and the consistency of capital returns. On balance, a base‑case path of steady cash flows and measured dividends seems reasonable, while upside and downside will hinge on the commodity tape and execution against a predictable funding framework.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.