Intel’s stock has rerated sharply as investors price in an AI‑driven PC refresh and a strategic push into contract chipmaking (foundry – manufacturing chips for other designers). The shares are up roughly 73% over the past year, while trailing revenue of $53.44B suggests the core business has stabilized but still needs margin rebuilding. The shift reflects early operating progress, cost discipline, and expectations that new products and process improvements will restore competitiveness. It also reflects the strategic value of U.S. manufacturing amid supply‑chain re‑shoring. Why it matters: Intel sits at the nexus of CPU competition, the rise of AI accelerators, and capital‑intensive manufacturing, where execution is the swing factor for earnings quality. Semiconductors are cyclical, but demand is broadening from PCs into data centers and edge devices. Over the next three years, success in winning external foundry customers and ramping efficient production will determine whether today’s optimism turns into durable cash generation—a key question for investors across the chip sector.

Key Points as of October 2025

- Revenue: Trailing 12‑month revenue stands at 53.44B with quarterly revenue growth (yoy) of 2.80%, signaling a slow, early‑cycle recovery.

- Profit/Margins: Profit margin is 0.37% and operating margin 6.28%; net income totals 198M with diluted EPS of 0.03, underscoring thin profitability.

- Cash flow: Operating cash flow is 8.57B while levered free cash flow is -5.01B, indicating capex and financing burdens outweigh internal cash generation.

- Balance sheet: Cash is 30.93B vs total debt of 46.55B; current ratio is 1.60 and debt/equity is 39.88%, providing liquidity but highlighting leverage sensitivity.

- Share price: Last close near 40; 52‑week change is 73.10%. Shares trade above the 50‑day and 200‑day moving averages of 31.69 and 24.11 respectively; short interest is 2.44% of float (short ratio 0.75).

- Market cap: Approximately $192B based on 4.77B shares outstanding and a share price around 40.

- Analyst view: Street stance appears mixed given thin margins and negative levered FCF; sentiment has improved as volume (3‑month avg ~128.84M) stayed elevated.

- Sales/Backlog: Backlog not disclosed; visibility is tied to PC and data center cycles and timing of external foundry engagements.

- Competitive position: Foundry push positions Intel as a U.S. alternative to offshore manufacturing; success hinges on process yields, product competitiveness, and design‑win traction against x86 and ARM‑based rivals.

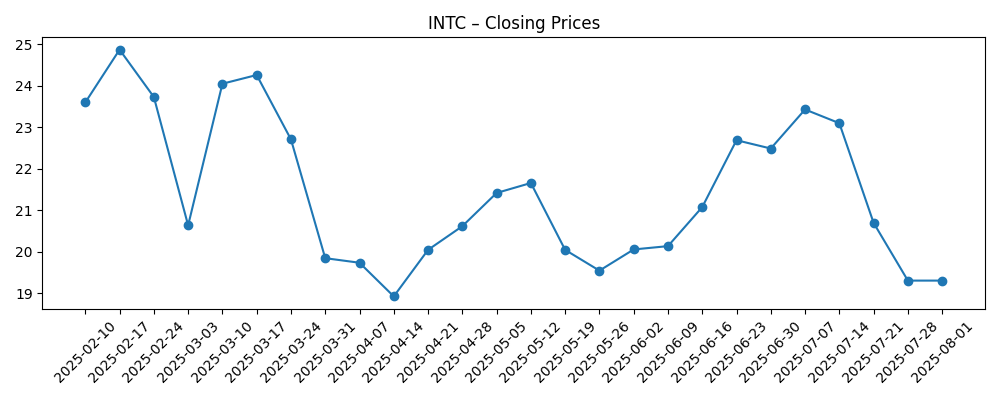

Share price evolution – last 12 months

Notable headlines

Opinion

The market has moved ahead of the income statement. A 73% 12‑month rally contrasts with modest 2.80% revenue growth and a 0.37% profit margin, which together suggest investors are underwriting future execution rather than current earnings power. Operating cash flow of 8.57B is a positive signal of durability through the downturn, but negative levered free cash flow of -5.01B reflects heavy investment and financing costs. Net income of 198M and EPS of 0.03 underscore that profit recovery is at an early stage. In short, the stock’s rerating is a bet on manufacturing progress, product competitiveness, and mix improvement over the next few years.

How sustainable is the turn? For margins to normalize, Intel needs three things: better yields as new process technologies mature; healthier mix from higher‑value server, AI‑capable PCs, and networking silicon; and steady cost discipline to translate revenue into profit. Foundry—manufacturing for external customers—can help utilization and scale, but only if Intel secures credible, repeat customers and proves execution. The balance sheet offers room to invest (30.93B in cash), yet leverage (46.55B in debt) and negative levered FCF argue for careful pacing. With no trailing dividend, the equity story centers on growth, margin repair, and cash conversion rather than income.

Industry dynamics cut both ways. On one hand, AI adoption in PCs and data centers expands the total addressable market and can support pricing for differentiated products. On the other, hyperscale spending is prioritizing accelerators, intensifying competition around compute roadmaps and software ecosystems. Intel’s competitive position will be defined by the credibility of its process roadmap and by whether it can win external foundry business while regaining share in CPUs against x86 and ARM‑based challengers. Policy support for domestic capacity helps, but consistent manufacturing outcomes are what turn strategic value into earnings quality.

These factors shape the multiple. If Intel executes on process, wins long‑term foundry agreements, and delivers products aligned with the AI PC and server cycles, investors can shift the narrative from turnaround to compounding cash flows, supporting a stronger valuation. If execution slips—via schedule slippage, yield issues, or underwhelming design wins—the story reverts to a capital‑intensive rebuild with low returns, keeping the multiple constrained. For now, share momentum, higher volumes, and low short interest suggest improved confidence, but the proof point will be sustained gross‑margin expansion and visible backlog conversion from external customers.

What could happen in three years? (horizon October 2025+3)

| Best case | Manufacturing ramps smoothly, with competitive process technology restoring product leadership in key segments. Intel secures multiple external foundry customers, improving utilization and pricing power. AI‑capable PCs and data center demand support a richer mix, enabling sustained margin expansion and stronger cash generation. |

| Base case | Execution improves but is uneven. PC recovery and selective data center wins offset competitive pressure. Foundry signs a few anchor programs but scale builds gradually. Margins trend up from current lows, but investment needs keep free cash flow choppy, leaving valuation tied to progress milestones. |

| Worse case | Process delays and muted design wins limit share gains. Foundry traction disappoints, leading to under‑utilized capacity. Mix skews toward lower‑margin products while capex needs remain high, pressuring cash flow and balance‑sheet flexibility and narrowing strategic options. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on process technology ramps, yields, and product launch timing.

- External foundry customer announcements, scope of engagements, and long‑term agreements.

- Demand inflection for AI‑capable PCs and server CPUs versus continued prioritization of accelerator spending.

- Gross‑margin trajectory and operating expense discipline translating to cash conversion.

- Policy support, export controls, and supply‑chain reshoring affecting cost, demand, and customer mix.

- Balance‑sheet flexibility and the pace of investment relative to operating cash flow.

Conclusion

Intel enters the next three years with improved sentiment and a tougher financial baseline. Trailing revenue of 53.44B and a 0.37% profit margin signal early but incomplete recovery, while 8.57B in operating cash flow versus -5.01B in levered free cash flow highlights the capital intensity of the strategy. Liquidity (30.93B cash) helps absorb execution risk, but leverage (46.55B debt) argues for visible, stepwise progress. The 73.10% 52‑week share gain suggests investors now expect delivery on foundry and product roadmaps. That optimism will need validation through sustained gross‑margin improvement, concrete external customer wins, and resilient demand across PCs and data centers. Watch next 1–2 quarters: backlog conversion and foundry customer disclosures; pricing and mix in AI‑capable PCs and servers; inventory discipline; yield and manufacturing milestones; operating cash flow versus investment pace; and whether momentum in the share price remains grounded in fundamentals.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.