Lear Corporation (LEA) enters late 2025 with mixed signals for the next three years. Revenue is essentially flat year over year, with trailing sales of 22.89B, while profitability is thin at a 2.05% margin. After a sharp spring sell‑off and a summer rebound, the stock remains range‑bound as investors parse Q3 updates, a renewed electrification push, and a deepening partnership with a major North American OEM. What changed is the balance between stable vehicle builds and ongoing price‑down pressure from automakers: input costs and program transitions continue to constrain margins, but cash generation and disciplined capital returns help steady the story. The “why” is straightforward—auto suppliers are seeing normalization in supply chains and fewer shocks, yet competition in seating and electrical systems stays intense, forcing continuous productivity gains. For investors, this matters because the path of margins and content per vehicle will likely drive multiple expansion or compression more than unit volumes. Sector‑wide, the supplier universe is consolidating and pivoting to EV architectures, making execution on software‑rich electrical systems just as important as classic seating scale.

Key Points as of October 2025

- Revenue: trailing twelve months at 22.89B; quarterly revenue growth is 0.30% year over year, indicating a flattish demand backdrop.

- Profit/Margins: profit margin 2.05% and operating margin 4.15%; diluted EPS 7.07; ROE 11.16% shows modest efficiency on shareholder capital.

- Sales/Backlog: order book and backlog not disclosed in the provided data; recent GM partnership and electrification focus suggest a pipeline skewing toward e‑systems.

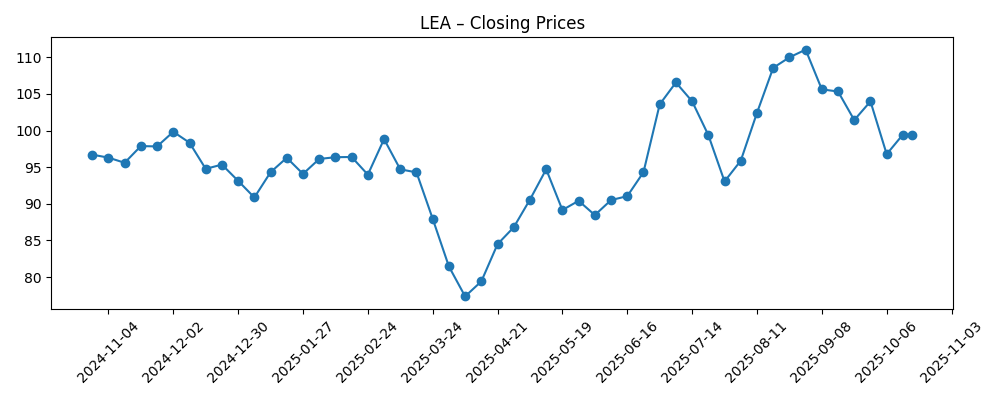

- Share price: recent weekly close near 99.46 (Oct 17, 2025); 52‑week high 113.10 and low 73.85; 50‑day MA 104.01 vs 200‑day MA 95.95; 52‑week change −5.38% vs S&P 500 +13.84%.

- Cash flow: operating cash flow 1.03B and levered free cash flow 484.56M; dividend rate 3.08 (~3.10% forward yield) with a 43.56% payout ratio.

- Balance sheet: total cash 895.1M; total debt 3.55B; current ratio 1.34 and debt/equity 68.15% reflect moderate leverage for an auto supplier.

- Analyst view: consensus estimates not provided here; short interest is 7.41% of float (short ratio 2.96), and beta of 1.33 signals cyclical sensitivity.

- Market cap: not disclosed in the provided data; implied by share count and recent price to be in the mid‑single‑digit billions.

- Qualitative: competitive pressure in seating and electrical systems remains high; EV programs and software‑heavy architectures are key to content‑per‑vehicle gains.

Share price evolution – last 12 months

Notable headlines

- Lear Corporation Announces Third Quarter 2025 Results

- Lear Corporation Highlights Electrification Strategy at Auto Show

- Lear Corp and GM Expand Partnership for Electric Vehicle Components

Opinion

The latest figures paint a picture of resilience with clear constraints. Revenue is steady rather than expanding, and trailing profit margins sit in the low single digits, consistent with a period of OEM price‑downs and program transitions. Quarterly revenue growth is barely positive while quarterly earnings growth is negative, implying mix and cost friction outweighed any incremental volume. Yet cash generation compares favorably to accounting earnings: operating cash flow exceeds net income, suggesting solid cash conversion and some discipline on capital intensity. In short, the story hinges less on units and more on rebuilding margins through cost recapture and richer content per vehicle in both seating and electrical systems.

Quality and sustainability matter over the next three years. A dividend covered by free cash flow, moderate leverage, and a current ratio above 1 imply room to navigate investment needs and volatility. However, the spread between operating and net margins indicates that overhead absorption and pricing remain critical watch‑items. The positive side is an improving supply chain and fewer one‑off shocks; the negative is structurally tough buyer power from automakers. Execution around program launches, on‑time starts, and commercial negotiations will determine whether today’s cash discipline translates into durable earnings expansion rather than episodic beats.

Industry context is a double‑edged sword. Electrification is growing even as overall auto demand wobbles, which favors suppliers with credible e‑systems roadmaps and high integration capabilities. Recent headlines on strategy and partnerships point to Lear leaning into EV platforms, where wiring, power distribution, and software interaction can lift content per vehicle. At the same time, cost‑cutting moves across the supplier base underscore persistent price pressure, making productivity and design‑for‑manufacture essential. If Lear can convert strategic wins into sustained share gains without sacrificing price, it strengthens bargaining power and cushions cyclicality.

For valuation, the narrative likely pivots on margin trajectory more than volume. With a beta of 1.33, LEA remains tied to macro and production cycles; any turn in OEM schedules will move the stock. A credible path to better margins and stable free cash flow could support multiple normalization from a cyclically discounted level. Conversely, if price‑downs outpace cost relief or EV programs fail to scale, investors may focus on downside protection and capital return rather than growth, compressing the multiple. The next few quarters will shape which version of the future becomes the base case.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative to October 2028 |

|---|---|

| Best | OEM builds stabilize and tilt toward EV platforms where Lear wins key seating and e‑systems awards. Pricing recapture plus productivity lifts margins, while the GM partnership broadens into additional programs. Cash conversion stays strong, enabling continued dividends and selective investment, and the equity narrative shifts to “content‑led growth with improving returns.” |

| Base | Global production is choppy but roughly flat. Lear executes on major launches with gradual mix improvement into EVs and software‑heavy architectures. Margins grind higher through cost actions and design efficiencies, supporting steady free cash flow and a balanced capital return/investment approach. The stock tracks fundamentals with periodic cyclic swings. |

| Worse | Auto demand weakens and EV adoption is uneven, intensifying price‑downs from OEMs. Input costs re‑inflate and program delays hit utilization. Margins stall at low levels, free cash flow tightens, and the narrative reverts to defense—protecting balance sheet flexibility and prioritizing only essential projects. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- OEM production schedules and regional mix, including the pace of EV adoption versus ICE declines.

- Program awards and backlog conversion—especially execution on partnerships and on‑time launch performance.

- Input costs (steel, chemicals, semiconductors) and the ability to negotiate pricing recoveries with OEMs.

- Trade, tariffs, and labor agreements affecting North American and European supply chains.

- Cash generation and capital allocation discipline, including dividend sustainability and investment in electrification.

Conclusion

Lear’s three‑year setup revolves around margin repair and content‑per‑vehicle growth rather than a broad volume upcycle. The numbers show a steady top line with thin profitability, but also healthy cash generation and manageable leverage—ingredients that can fund execution on EV‑centric programs and continued productivity. Competitive intensity in seating and electrical systems remains high, so the company’s ability to secure price, deliver on launches, and scale software‑adjacent e‑systems will likely determine whether investors reward it with a stronger multiple. Sector peers are cutting costs and repositioning, which raises the bar but also opens share‑gain opportunities for consistent operators. Watch next 1–2 quarters: backlog conversion on new awards; margin progression from cost actions; commercial pricing outcomes with OEMs; free‑cash‑flow resilience through working‑capital cycles; cadence of EV platform launches. If Lear translates strategic wins into sustained returns, the narrative can shift from recovery to compounding; if not, the stock may continue to trade chiefly on cyclic production swings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.