Li Auto (LI) enters September 2025 with strong liquidity and moderate profitability amid a cooler China EV backdrop. The stock closed at 23.35 on August 29, 2025, sitting below its 50‑day and 200‑day moving averages (26.52 and 25.61) and trading within a 52‑week range of 18.11–33.12. Over the past year, LI is up 22.89%, modestly ahead of the S&P 500’s 16.84%. On fundamentals, trailing‑twelve‑month revenue is 143.32B with gross profit of 29.58B, EBITDA of 11.52B and net income of 8.08B, implying a 5.64% profit margin and 2.73% operating margin. Quarterly revenue growth is -4.50% year over year, while quarterly earnings growth is -0.90%. The balance sheet features 106.92B in cash against 16.92B of total debt, a 1.74 current ratio, and levered free cash flow of 1.42B. We outline a three‑year outlook to September 2028.

Key Points as of September 2025

- Revenue: TTM 143.32B; quarterly revenue growth -4.50% year over year; gross profit 29.58B.

- Profitability: Profit margin 5.64%; operating margin 2.73%; EBITDA 11.52B; ROE 11.82%; ROA 3.36%.

- Cash and liquidity: Total cash 106.92B vs total debt 16.92B; current ratio 1.74; operating cash flow 14.97B; levered free cash flow 1.42B.

- Share price and trend: Last weekly close 23.35 (Aug 29); 52‑week range 18.11–33.12; 50‑DMA 26.52 vs 200‑DMA 25.61; beta 0.93.

- Momentum/volume: 3‑month average volume 5.24M vs 10‑day 7.16M; 52‑week change +22.89% vs S&P 500 +16.84%.

- Capital structure: Shares outstanding 835.38M; implied shares 1.13B; float 1.09B; total debt/equity 22.98%.

- Ownership and positioning: Insiders hold 0.01%; institutions 5.94%.

- Short interest: 22.19M shares short (5.50% of float); short ratio 4.14.

- Income and distributions: Diluted EPS (ttm) 1.07; book value/share 73.19; no dividend, payout ratio 0%.

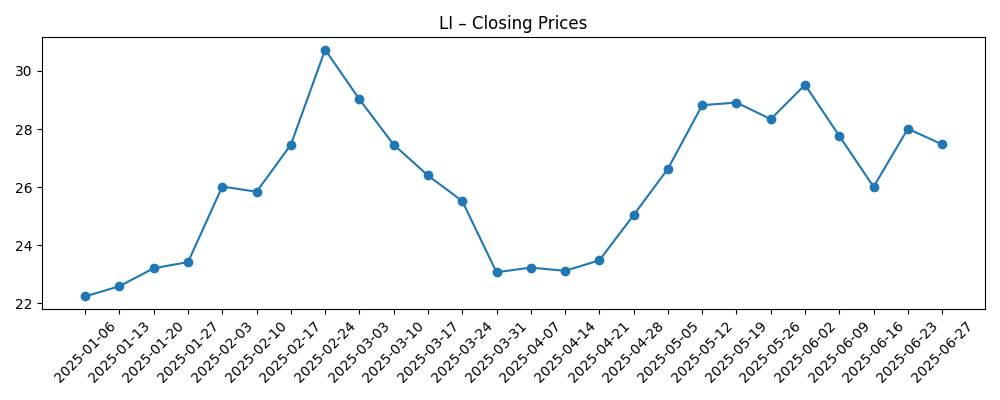

Share price evolution – last 12 months

Notable headlines

Opinion

Price discovery over the last six months suggests investors are reassessing growth durability. LI rallied from late‑January levels near 23.21 to a mid‑July weekly close of 31.80 before slipping back to 23.35 by August 29. Trading below the 50‑ and 200‑day moving averages (26.52 and 25.61) signals a reset in near‑term expectations. That is consistent with fundamentals showing quarterly revenue growth at -4.50% year over year and quarterly earnings growth at -0.90%. The long‑term bull case hinges on whether Li Auto can convert its substantial cash (106.92B) and operating cash flow (14.97B) into sustained product, technology, and market initiatives that reignite top‑line growth while protecting margins. With a 52‑week change of +22.89% and beta at 0.93, the shares have outperformed on a one‑year view but now trade like a show‑me story.

Margins are positive but slim, with a 5.64% profit margin and 2.73% operating margin on 143.32B of trailing revenue. In a competitive EV landscape, pricing and mix can quickly compress operating leverage. The company’s cash cushion and moderate leverage (total debt 16.92B; current ratio 1.74) provide room to invest through cyclical softness or competitive price moves, but execution discipline will matter. A credible path would emphasize efficiency, cost controls, and careful capacity planning to raise EBITDA (11.52B) yield on revenue without sacrificing growth options. If management can defend gross profit (29.58B) and convert more operating cash flow into free cash flow (currently 1.42B), equity holders could see improved resilience to sector volatility and a higher quality of earnings that supports multiple expansion over time.

Ownership and trading dynamics are supportive but not decisive. Institutional ownership remains modest at 5.94% and insider ownership is negligible at 0.01%, leaving a broad retail and index base to interpret new information. Short interest—22.19M shares, or 5.50% of float, with a short ratio of 4.14—adds sensitivity to positive surprises but is not extreme by growth‑stock standards. Liquidity is adequate (3‑month average volume 5.24M; 10‑day 7.16M). In the absence of clear, company‑specific catalysts in recent headlines, the share price may hew closely to reported deliveries, pricing actions across China’s EV market, and signs of stabilization in year‑over‑year revenue and earnings trends. A sustained move back above the 200‑day moving average would likely require evidence that the revenue contraction has bottomed.

Looking out to September 2028, the decisive variables are growth reacceleration, margin trajectory, and capital allocation. The starting point includes durable liquidity, positive free cash flow, and return on equity of 11.82%. If growth reaccelerates without eroding unit economics, Li Auto can compound from a position of financial strength. Conversely, an extended price war or costly platform transitions could keep operating margin subdued and limit free‑cash‑flow conversion. With beta at 0.93, the stock may remain less volatile than many EV peers, but idiosyncratic execution risk remains meaningful. On balance, we see a wide range of outcomes over three years, with the skew determined by management’s ability to monetize R&D and protect gross profit while navigating a competitive domestic market and any expansion efforts.

What could happen in three years? (horizon September 2028)

| Scenario | Narrative |

|---|---|

| Best | Growth reaccelerates from current softness, supported by disciplined pricing and new products that lift mix. Operating efficiency improves from today’s levels, converting more operating cash flow into sustainable free cash flow. Strong cash is deployed into high‑return projects, with balance‑sheet strength preserved. Shares re‑rate as revenue stability and margin expansion become visible. |

| Base | Revenue stabilizes after a period of volatility, with modest growth and steady but modest margins relative to current profitability. Cash remains a strategic buffer, funding iterative product upgrades and measured expansion. Execution stays consistent, yielding gradual improvement in free‑cash‑flow conversion and range‑bound valuation anchored by fundamentals. |

| Worse | Intense price competition sustains pressure on gross profit and operating margin. Investment needs rise while free cash flow remains thin, forcing tougher capital allocation choices. Growth underwhelms, investor confidence softens, and the stock de‑rates until clearer signs of margin recovery and demand normalization emerge. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Revenue trajectory versus -4.50% year‑over‑year quarterly comparison and the speed of any stabilization or reacceleration.

- Margin resilience amid pricing competition, with emphasis on sustaining gross profit and lifting operating margin from current levels.

- Capital allocation effectiveness—use of 106.92B cash to drive returns while maintaining balance‑sheet flexibility.

- Regulatory and macro conditions affecting China’s EV market, including incentives, input costs, and consumer demand.

- Product cycle execution and technology roadmap that can support mix improvement without materially elevating cost base.

- Market technicals: positioning, short interest (5.50% of float), and recovery above key moving averages (25.61 and 26.52).

Conclusion

Li Auto approaches the next three years with enviable liquidity and proven ability to generate profits, but also with near‑term growth softness and thin operating margins that demand careful execution. The latest print shows revenue contraction (-4.50% year over year) and a modest profit profile (5.64% profit margin; 2.73% operating margin). Against that, the company’s 106.92B cash, 14.97B operating cash flow, and positive levered free cash flow provide strategic time and options. Share performance has cooled after a mid‑summer rally, and the stock sits below key moving averages, indicating that investors want clearer evidence of stabilization before re‑rating the multiple. Over a three‑year horizon to September 2028, the setup is balanced: upside if management translates cash and scale into higher‑quality growth, downside if competitive pricing and investment needs keep margins subdued. Patience, cost discipline, and measured capital deployment are likely to be rewarded.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.