Meta Platforms enters the next three years with firmer fundamentals and a sharper ad-tech toolkit. Over the past year, growth re-accelerated as product changes pushed more video and AI‑assisted formats into feeds, lifting advertiser demand and yielding quarterly revenue growth of 21.60% year over year. Profitability also improved thanks to cost discipline and better infrastructure utilization, with a reported profit margin of 39.99%. The near-term debate is whether heavier AI and metaverse investment can coexist with sustained margin strength. Management has trimmed legacy research, reallocated spend to monetizable AI surfaces, and leaned into targeting tools that may raise regulatory scrutiny but can improve ad return on investment. For investors, the setup blends an efficient core ads engine, optionality in messaging commerce, and a longer-dated Reality Labs bet that still needs clearer payback timelines. Sector context: digital advertising is stabilizing as budgets pivot back to performance channels, while privacy rules and competition from short‑video rivals keep pricing power and engagement in constant flux.

Key Points as of October 2025

- Revenue: Trailing-twelve-month revenue stands at 178.8B, with quarterly revenue growth of 21.60% year over year.

- Profit/Margins: Profit margin is 39.99% and operating margin (ttm) is 43.02%; return on equity is 40.65%.

- Sales/Backlog: Backlog not applicable for advertising; demand signaled by quarterly earnings growth of 36.20% year over year.

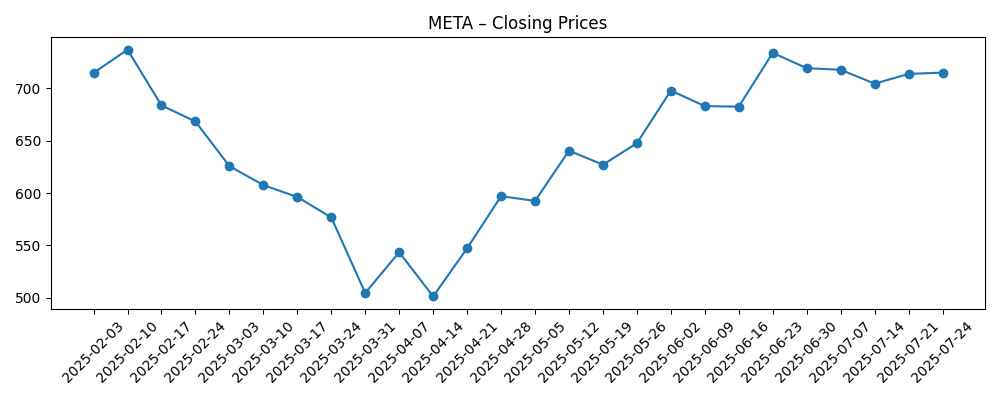

- Share price: 52‑week change is 27.71%; 52‑week high/low are 796.25/479.80; 50‑day moving average sits at 743.04 vs 200‑day at 675.93.

- Balance sheet: Total cash is 47.07B and total debt is 49.56B; current ratio is 1.97.

- Cash flow and returns: Operating cash flow is 102.3B; levered free cash flow is 31.99B; forward annual dividend rate is 2.1 with a 0.28% yield and a 7.44% payout ratio; last ex‑dividend date was 9/22/2025.

- Analyst/positioning: Institutions hold 79.90% of shares; short interest is 1.13% of float with a short ratio of 1.92.

- Market cap: Data not disclosed in provided snapshot; shares outstanding are 2.17B and implied shares outstanding are 2.51B.

- Qualitative: Competitive focus on Reels and AI ad tools; regulatory exposure elevated in the EU; privacy and teen-safety controls remain in focus.

Share price evolution – last 12 months

Notable headlines

- Meta Platforms, Inc. Reports Third Quarter 2025 Financial Results

- Meta's New AI Tools Aim to Bolster Revenue Growth

- Meta and Apple close to settling EU cases - Financial Times

- Meta is reportedly downsizing its legacy AI research team

- Meta Will Use AI Chat History to Serve You Even More Targeted Ads

- Read the leaked email Meta sent to the employees it just fired

- Meta is adding more parental controls for teen AI use

Opinion

Meta’s recent momentum looks primarily driven by engagement and ad product mix. More video and AI‑assisted ad formats tend to improve click‑through and conversion, which supports pricing without having to lean only on volume growth. The margin profile is strong, but its quality depends on management’s ability to keep infrastructure utilization high and resist diffuse spending. The reported profit margin and operating margin indicate discipline, yet the sustainability of those levels will be tested if compute, data center, and safety costs rise faster than revenue.

On cash generation, the company’s operating cash flow and levered free cash flow provide ample flexibility to fund elevated infrastructure and R&D while maintaining shareholder returns via a recurring dividend. That said, the mix shift toward AI inference at scale can bring step‑ups in capital intensity, and any ramp in headset or metaverse ecosystem funding could temper free cash flow conversion. The decision to streamline legacy research suggests tighter linkage between spend and monetization, which investors generally reward.

Strategically, Meta is consolidating its competitive position by making Reels and AI tools central to the monetization roadmap, while seeking to expand commerce inside messaging. This defends share against short‑video rivals and retail media networks by improving advertiser return on investment within Meta’s walled garden. However, integrating AI chat data into ad targeting and operating at global scale puts the company squarely under privacy and safety spotlights, especially in the EU where regulatory outcomes can shape product design.

These forces will shape the narrative and multiple. If Meta balances innovation with compliance, it can argue for a premium within large‑cap internet peers based on growth plus margin durability. If Reality Labs can articulate clearer milestones—developer traction, user retention, and practical use cases—the long‑dated investment could be reframed from drag to option value. Conversely, any policy setback or engagement erosion would re‑introduce a “show‑me” stance from the market, compressing the valuation spread versus slower‑growing ad platforms.

What could happen in three years? (horizon October 2025+3)

| Case | Narrative |

|---|---|

| Best | AI ad products materially improve advertiser performance and time spent; messaging commerce scales; Reality Labs narrows losses via focused hardware and developer tools. Margins hold resilient despite higher compute costs, and regulatory settlements provide product clarity, reducing volatility. |

| Base | Core ads grow steadily as Reels monetization matures and AI tools become table stakes across the industry. Investment in infrastructure stays elevated but predictable; Reality Labs remains a manageable drag with incremental ecosystem progress. Regulatory friction persists but is incorporated into operations. |

| Worse | Privacy and youth‑safety rules force targeting and ranking changes that weaken ad effectiveness. Engagement shifts to competitors; AI infrastructure spend outruns revenue benefits. Reality Labs fails to gain traction, extending losses and pressuring company‑wide margins and sentiment. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on AI‑driven ad products and Reels monetization relative to peers.

- Regulatory outcomes in the EU and U.S. affecting targeting, data use, and teen safety.

- Compute and data‑center spending needs versus free cash flow generation.

- Competitive dynamics with short‑video platforms and emerging retail media networks.

- Reality Labs milestones, including ecosystem development and user retention.

- Macro advertising demand sensitivity across consumer, tech, and SMB budgets.

Conclusion

Meta’s investment case into 2028 rests on a sturdy core ads franchise, strong profitability, and the ability to channel AI into measurable advertiser outcomes without triggering disruptive policy changes. The numbers point to an efficient model: high margins, robust operating cash flow, and a modest dividend that signals confidence while preserving flexibility. Yet the equity narrative hinges on two balancing acts—maintaining growth as AI and video reshape engagement, and pacing Reality Labs so that optionality does not overwhelm returns. Regulatory pressure will keep product teams on a tightrope, but negotiated clarity can be a catalyst if it stabilizes roadmaps. Watch next 1–2 quarters: adoption of new AI ad tools; Reels monetization and time‑spent trends; signals on infrastructure spending and free cash flow; regulatory headlines in the EU and responses in product design. The stock’s path is likely to follow how convincingly management proves that innovation and compliance can scale together.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.