Microsoft Corporation (NASDAQ: MSFT) is a global software and cloud leader whose portfolio spans Azure cloud services, Microsoft 365 productivity, Windows, LinkedIn, gaming via Xbox, and AI Copilot experiences built with OpenAI. Its main competitors include Amazon (AWS), Alphabet (Google Cloud and Workspace), Apple in devices and ecosystems, and enterprise software vendors such as Salesforce.

Financially, Microsoft reports trailing‑12‑month revenue of $281.72B, gross profit of $193.89B, EBITDA of $156.53B, and net income attributable to common of $101.83B. Profit margin stands at 36.15% and operating margin at 44.90%, with quarterly revenue growth (yoy) of 18.10% and quarterly earnings growth (yoy) of 23.60%. The balance sheet shows $94.56B in total cash against $112.18B of total debt (current ratio 1.35), operating cash flow of $136.16B and levered free cash flow of $61.07B. Capital returns include a forward annual dividend rate of $3.64 (0.72% yield) and a payout ratio of 23.75%.

Key Points as of September 2025

- Revenue and growth: trailing‑12‑month revenue of $281.72B, with quarterly revenue growth (yoy) of 18.10% and quarterly earnings growth (yoy) of 23.60%.

- Profitability: gross profit of $193.89B; EBITDA of $156.53B; profit margin at 36.15% and operating margin at 44.90%.

- Sales momentum: headlines highlight Azure and AI adoption as primary drivers of recent results and guidance, supporting multi‑year demand for cloud and data platforms.

- Share price and volatility: recent weekly close around $511.46 (week ended Sep 26, 2025); 52‑week range $344.79–$555.45; 50‑day MA 512.11; 200‑day MA 449.88; beta 1.04; 52‑week change 18.46% vs S&P 500 at 15.10%.

- Analyst and media view: coverage initiation (China Merchants Securities) and reaffirmed Buy calls tied to OpenAI integration; Q2 beat/raised commentary in recent notes.

- Ownership and liquidity: 74.50% held by institutions; insider ownership 0.07%; float 7.42B shares; average 3‑month volume 20.4M; short interest 0.88% of float with a short ratio of 3.09.

- Balance sheet and cash generation: total cash $94.56B vs total debt $112.18B; current ratio 1.35; operating cash flow $136.16B; levered free cash flow $61.07B; total debt/equity 32.66%.

- Capital returns: forward dividend rate $3.64 (0.72% yield) and trailing rate $3.32 (0.65% yield); payout ratio 23.75%; dividend date 9/11/2025; ex‑dividend date 11/20/2025.

- Regulatory and strategy updates: EU Teams unbundling avoids an antitrust fine; adjustments to China cyber early‑warning access; governance actions around Azure usage amid protests.

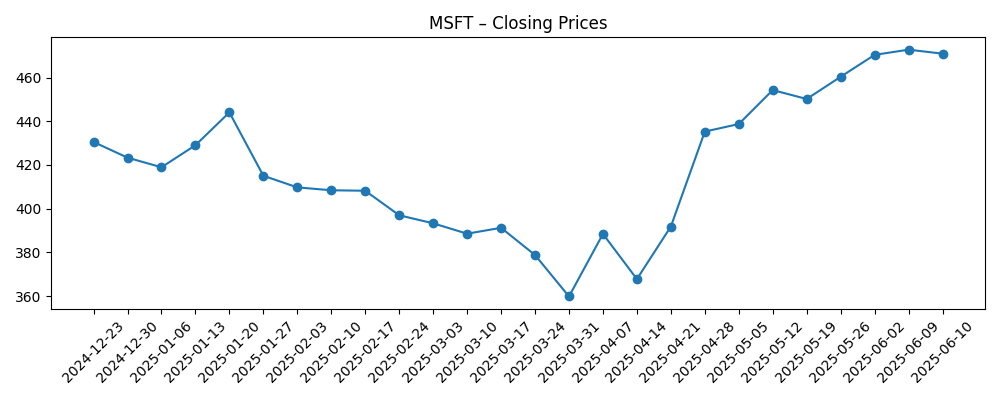

Share price evolution – last 12 months

Notable headlines

- Microsoft Avoids EU Antitrust Fine by Agreeing to Unbundle Teams from Office Software

- Microsoft (MSFT) Tightens Chinese Access to Cyber Early Warning System

- Microsoft Corp (MSFT) Cracks Whip amid Protests on Azure Use by Israel Military

- Truist Reaffirms Buy on Microsoft Corporation (MSFT), Sees 32% Upside with OpenAI Boost

- China Merchants Securities Begins Coverage on Microsoft (MSFT) Stock

- Microsoft (MSFT) Rose in Q2 as Results and Guidance Update Surpassed Expectations

- Here’s Why Microsoft Corporation (MSFT) Rallied in Q2

- Jim Cramer Highlights Microsoft as Data Center Beneficiary

Opinion

For the next three years, Microsoft’s narrative will likely hinge on how effectively it balances structural AI and cloud demand with evolving regulatory and geopolitical constraints. The EU decision to accept an unbundling of Teams prevents an immediate financial penalty but may chip away at the company’s bundling advantage in Microsoft 365. The key question is whether end‑users still choose Teams on merit when it is not the default. Early indications suggest the productivity suite’s value remains intact, but procurement dynamics could lengthen sales cycles and intensify price scrutiny in some regions.

Actions to tighten Chinese access to a cyber early‑warning system underscore mounting security and compliance priorities. The direct revenue impact should be manageable given Microsoft’s global mix, yet any incremental restrictions could complicate operations and partner ecosystems. Over a multi‑year horizon, investors will watch whether policy shifts affect Azure’s footprint, localization requirements, or the cost of maintaining high security standards across jurisdictions.

On the growth side, multiple reports attribute recent share strength to Azure and AI catalysts, with Copilot and OpenAI services central to workload expansion. This aligns with robust fundamentals: strong margins, substantial operating cash flow, and a modest payout ratio that preserves balance‑sheet flexibility. Low short interest and high institutional ownership suggest confidence in the thesis. If enterprises keep prioritizing data center modernization and AI‑enabled productivity, Microsoft’s consumption‑based revenue should remain resilient through different macro backdrops.

Technically, the stock’s 52‑week change of 18.46% and a recent weekly close near $511.46 place shares close to the 50‑day average (512.11), after a summer move toward the 52‑week high of $555.45. With a 200‑day average at 449.88 and beta of 1.04, the setup points to moderate volatility relative to the market. Near‑term, consolidation around key moving averages would be healthy; over three years, execution in AI monetization and navigating policy risk should matter more than quarter‑to‑quarter swings.

What could happen in three years? (horizon September 2025+3)

| Scenario | Assumptions | Implications for MSFT |

|---|---|---|

| Best case | Azure and AI Copilot adoption remains robust; Teams unbundling has limited impact; security posture strengthens; macro is supportive; continued operational discipline. | Sustained outperformance vs. peers; valuation premium endures; steady dividend growth alongside strong buyback capacity; market leadership in enterprise AI solidifies. |

| Base case | Healthy but moderating cloud growth; balanced contribution from AI services; manageable regulatory frictions; steady enterprise IT spending. | Shares track earnings growth with periodic volatility; margin profile remains strong; capital returns continue within current payout discipline. |

| Worse case | Heightened antitrust remedies and pricing pressure in productivity; slower AI monetization; geopolitical restrictions weigh on international operations; softer IT budgets. | Multiple compresses; revenue growth slows; management prioritizes cost control while preserving long‑term R&D and cloud investments. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Antitrust and regulatory outcomes (e.g., Teams unbundling and any additional remedies in major markets).

- AI monetization pace across Copilot, Azure OpenAI services, and enterprise adoption of cloud‑AI workloads.

- Geopolitical and security policy changes, including China‑related access and compliance requirements.

- Competitive dynamics versus AWS and Google Cloud in infrastructure, data, and platform services.

- Enterprise IT spending cycles and macro conditions that affect cloud consumption and seat growth.

Conclusion

Microsoft enters the next three years with a compelling mix of scale, profitability, and balance‑sheet strength. Trailing‑12‑month revenue of $281.72B, profit margin of 36.15%, operating margin of 44.90%, and operating cash flow of $136.16B provide ample resiliency as the company invests behind Azure and AI. Headlines point to continued momentum in cloud and AI, while developments such as EU Teams unbundling and China‑related access changes illustrate the regulatory and geopolitical trade‑offs of operating at global scale. The stock has advanced 18.46% over the past year and trades near its 50‑day average, suggesting expectations are elevated but not euphoric. Our base view is that execution in AI‑led workloads and disciplined go‑to‑market will offset friction from policy shifts, keeping earnings and cash flow on a positive trajectory. Investors should monitor regulatory outcomes, enterprise spending trends, and evidence of durable AI monetization as the main catalysts for the MSFT story.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.