Panasonic Holdings’ three‑year story is pivoting harder toward automotive and energy as the stock climbs back toward its one‑year highs. Shares are up 41.18% over the past year, helped by milestones such as mass production at its new Kansas EV‑battery plant, AI‑enabled car components, and a solid‑state battery collaboration with Toyota. Under the hood, reported revenue of 8.23T yen masks uneven trends: autos and energy are gaining strategic weight while legacy electronics are more mixed; free cash flow is pressured by investment, yet liquidity and leverage look manageable. Sector context: EV adoption is re‑accelerating in Europe even as traditional auto production faces cost and employment pressures, and critical‑minerals supply remains tight. For investors, the “so what” is execution—if Panasonic converts capacity adds into dependable orders and stabilizes profitability, its earnings power and narrative could reset; if ramps slip or input costs bite, thin margins leave little cushion. The next few quarters will set the tone for how far the multiple can stretch into 2028.

Key Points as of October 2025

- Revenue: trailing twelve months at 8.23T yen; gross profit 2.6T; quarterly revenue growth year over year at -10.60% indicates a reset base.

- Profit/Margins: profit margin 4.46% and operating margin 4.63%; ROE 7.85% with EBITDA 808.08B suggests modest operating leverage.

- Sales/Backlog: backlog not disclosed; Kansas EV‑battery mass production (Reuters) and auto‑tech launches imply improving forward visibility.

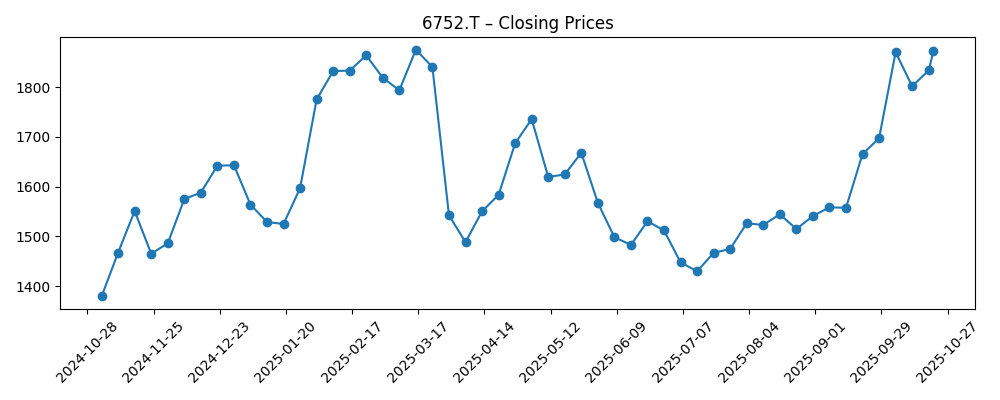

- Share price: 1,872 yen (Oct 21, 2025), near the 52‑week high of 1,919; 52‑week change 41.18%; 50‑day MA 1,598.15 vs. 200‑day MA 1,614.83.

- Analyst view: Street consensus not disclosed; momentum and rising volumes (avg 3‑month 8.67M) contrast with below‑market beta (0.73), implying steadier risk.

- Balance sheet/Cash: total cash 912.17B vs. total debt 1.56T; current ratio 1.29; operating cash flow 748.45B with levered free cash flow at -45.09B (investment phase).

- Dividend: forward annual dividend rate 40 (yield 2.18%); payout ratio 30.61% indicates room if earnings hold.

- Qualitative: automotive mix rising (AI car parts; in‑car systems), energy storage ramping (Kansas), and sustainability target to cut emissions 50% by 2030 may support access to green demand and financing.

- Market cap: not disclosed in provided data; by scale of revenue, Panasonic remains a large Japanese industrial with diversified end‑markets.

Share price evolution – last 12 months

Notable headlines

- Panasonic's new Gigafactory in Kansas to start mass production of EV batteries (Reuters)

- Panasonic to cut carbon emissions by 50% by 2030, outlines strategy (Financial Times)

- Japan's Panasonic launches AI-powered car parts to boost autonomous driving (Bloomberg)

- Panasonic and Toyota collaborate on solid-state batteries for EVs (Bloomberg)

- Plans to invest $1 billion in sustainable car parts (Wall Street Journal)

- Panasonic accelerates automotive segment growth amid increased EV demand (Nikkei Asia)

- Panasonic develops next‑gen in‑car entertainment systems (Reuters)

Opinion

The latest prints depict a company in mid‑transition. Top‑line contraction year over year and slim operating margins underscore that legacy businesses are still normalizing, yet earnings growth remains slightly positive, pointing to early benefits from mix shift and cost control. Cash generation from operations is solid, but negative levered free cash flow signals an investment cycle—consistent with EV‑battery capacity builds and automotive electronics launches. The quality of the beat/miss debate therefore hinges less on quarterly revenue swings and more on whether new capacity ramps on time with yields and scrap rates under control. If that happens, today’s modest profitability can widen without heroic pricing.

Management’s strategic actions—Kansas mass production, AI‑assisted car components, and solid‑state R&D with Toyota—align with end‑markets where unit growth and content per vehicle can rise together. That combination can lift return on equity even if headline revenues remain choppy, because higher‑margin modules and software‑tethered features typically carry better gross profit per unit. However, execution risk is real: initial utilization rates and qualification cycles at new plants can dilute margins before they accrete. The dividend framework appears sustainable under current payout discipline, but capital allocation will likely prioritize ramps and automation until free cash flow stabilizes.

Industry dynamics may help. European EV uptake has re‑accelerated even as the broader car market stalls, suggesting content gains for suppliers positioned in battery and advanced electronics. At the same time, policy and supply constraints—such as tighter rare‑earth export rules—could pressure input costs or component availability. For Panasonic, diversified partnerships and localization (e.g., U.S. production) can mitigate some risk and unlock incentives, potentially smoothing earnings volatility and supporting a more resilient narrative with investors focused on visibility and quality of cash flows.

These drivers shape the multiple. If Panasonic demonstrates consistent ramp execution, mix improvement, and operating discipline, investors may be willing to underwrite a higher, steadier earnings base, which typically earns a stronger valuation in Japan’s industrial cohort. Conversely, any stumble on yield, customer qualifications, or supply chain (chemicals, rare earths) could re‑open the “low‑margin conglomerate” debate and keep the equity anchored near book‑value‑type frameworks. Over the next three years, the story will likely pivot on evidence of durable returns in auto energy and electronics rather than on headline growth alone.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | EV‑battery ramps in the U.S. and Asia hit plan with improving yields; AI‑enabled automotive electronics gain share across Japanese and global OEMs; solid‑state R&D progresses to limited commercial introduction with a flagship partner. Mix shift and cost control expand margins, free cash flow inflects positive, and the market rewards higher visibility with a stronger, more stable multiple. |

| Base case | Battery and auto‑tech programs scale gradually with periodic bottlenecks; legacy businesses stabilize. Operating metrics improve modestly year over year, but capex remains elevated as new lines are qualified. Earnings quality improves, though valuation stays sensitive to cycle headlines and currency. |

| Worse case | Ramps slip on yield or customer qualification, input costs rise on materials constraints, and auto demand softens in key regions. Margins compress, free cash flow remains constrained, and the equity reverts to a conglomerate discount until restructuring or portfolio actions reset expectations. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution at the Kansas EV‑battery plant and follow‑on capacity ramps (yield, utilization, scrap).

- Automotive demand and content per vehicle trends, including take‑rates for AI‑enabled components and in‑car systems.

- Input costs and supply security for battery materials and rare earths amid shifting export controls.

- Operating discipline and capital allocation—pace of capex versus free cash flow stabilization.

- Policy incentives and trade dynamics in key markets (U.S. and EU EV frameworks, localization benefits).

- Currency movements affecting export competitiveness and translated earnings.

Conclusion

Panasonic’s equity narrative into 2028 hinges on turning strategic wins in EV batteries and automotive electronics into durable returns. The company enters this phase with thin but positive margins, solid operating cash generation, and an investment profile oriented to growth categories. Sector tailwinds in EV adoption and software‑rich vehicles are offset by supply‑chain complexity and policy frictions, making execution the main swing factor for the multiple. If new capacity achieves reliable yields and the product mix tilts toward higher‑value modules, earnings quality can improve even without rapid top‑line growth. Conversely, delays or cost inflation would strain already modest profitability. Watch next 1–2 quarters: Kansas ramp milestones; auto‑electronics order intake and program wins; pricing versus input costs; free‑cash‑flow trajectory as capex peaks; and any updates on solid‑state milestones with partners. Evidence of steady progress should clarify whether Panasonic’s transition supports a more resilient, higher‑quality earnings base.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.