PepsiCo’s setup into the next three years is one of slow growth, margin repair and disciplined capital allocation after a choppy year for staples. The stock has lagged the market as earnings momentum cooled and investors questioned how much pricing power remains once last cycle’s increases roll off. Trailing revenue of $92.37B shows the portfolio’s breadth, but quarterly earnings contracted year over year as mix, promotions and foreign exchange (FX) trimmed operating leverage. Management is also refreshing its finance bench, signaling a renewed focus on productivity and balance-sheet priorities. This matters because the narrative is shifting from price-led gains back to volume, innovation and cost control, which typically compresses valuation spreads across the sector. Consumer packaged goods peers face similar dynamics as shoppers trade down, retailers push for sharper price points, and regulators scrutinize sugar and packaging. Against that backdrop, PepsiCo’s low beta, global scale and dividend support still anchor the profile, but the path to re-acceleration hinges on volumes stabilizing and margins holding — not just price.

Key Points as of October 2025

- Revenue: Trailing 12-month revenue is $92.37B with quarterly revenue growth of 2.7% year over year.

- Profit/Margins: Profit margin is 7.82% and operating margin 16.90%; quarterly earnings growth is -11.20% year over year.

- Cash generation and dividend: Operating cash flow is $11.75B and levered free cash flow $7.14B; forward dividend rate is 5.69 with a 3.73% yield and a 105.61% payout ratio on trailing EPS.

- Balance sheet: Total debt is $50.85B; debt-to-equity 260.19%; current ratio 0.91; cash on hand $8.66B.

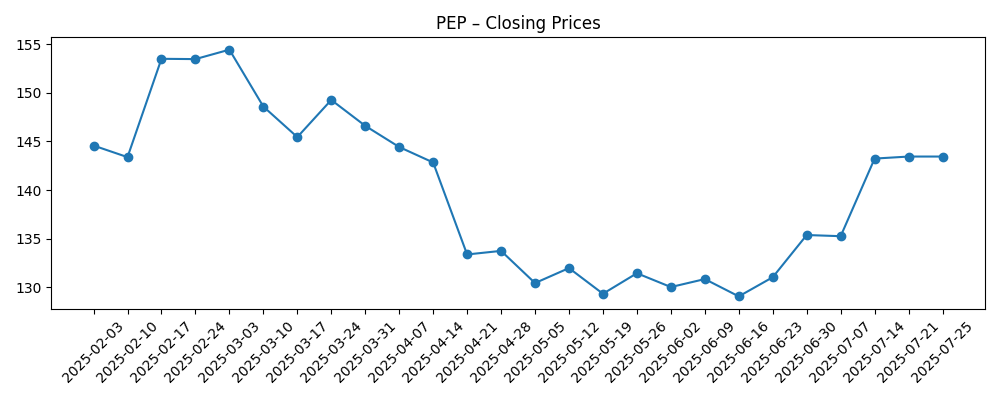

- Share price: Recent close near $150; 52-week change -8.17% with a 127.60–167.96 range; beta 0.46; short interest at 1.23% of float; 50D/200D moving averages at 146.05/142.49.

- Analyst view: Recent notes include UBS maintaining Buy and Wells Fargo at Hold; institutional ownership is 79.14%.

- Market cap: Implied by 1.37B shares outstanding at roughly $150 per share, market value is about $206B.

- Qualitative: Diversified snacks-and-beverages portfolio with broad distribution; FX exposure and sugar/packaging regulation remain ongoing risks; CFO transition underway.

Share price evolution – last 12 months

Notable headlines

- PepsiCo taps Walmart’s Steve Schmitt as CFO

- PepsiCo Reports Third Quarter 2025 Results

- Pepsico Non-GAAP EPS of $2.29 beats by $0.03, revenue of $23.94B beats by $90M

- UBS Maintains a Buy on PepsiCo (PEP)

- Wells Fargo Raises PT on PepsiCo (PEP), Keeps a Hold Rating

- Jim Cramer Says “It’s Been a Very Tough Time for Shareholders of PepsiCo”

Opinion

PepsiCo’s prints show a business transitioning from price-led expansion to a steadier volume-and-mix phase. Revenue growth of 2.7% year over year is still positive, but earnings contraction (-11.2% year over year) indicates that promotions, FX and input costs diluted operating leverage. The 16.90% operating margin remains solid for staples, yet the gap to net margin (7.82%) underscores heavier below-the-line items and interest burden. The quality of recent beats looks mixed: modest top-line outperformance alongside slower profit growth suggests PepsiCo is prioritizing share retention and brand equity over short-term margin maximization, a defensible stance if it stabilizes volumes into 2026.

Cash generation helps. Trailing operating cash flow of $11.75B and levered free cash flow of $7.14B provide flexibility to fund capex, dividends and selective buybacks, even as the stated payout ratio sits above 100% on trailing EPS. That apparent tension reflects accounting earnings compression rather than cash shortfall. The balance sheet is more of a watch item: $50.85B of total debt and a 260.19% debt-to-equity ratio mean rate sensitivity and refinancing terms matter. A sub-1 current ratio is typical for staples with strong working-capital turns, but it leaves less buffer if demand slows faster than expected.

Strategically, the product mix remains an advantage. A balanced snacks-and-beverages portfolio, deep distribution and brand spend support pricing power relative to private label, even as retailers push for value packs and sharper price points. The CFO transition to Steve Schmitt (from Walmart) may signal an emphasis on procurement rigor, retail partnership dynamics and cost discipline. If productivity programs show through gross margin and SG&A lines while innovation keeps shelf space, margins can stabilize without relying on outsized price increases.

From a market narrative perspective, PepsiCo’s low beta (0.46) and 3.73% forward yield keep it in the defensive core of portfolios. The -8.17% 52-week share move and a 127.60–167.96 trading range suggest valuation has already adjusted to slower growth. Over the next three years, multiple direction likely hinges on two levers: volume recovery in key categories and proof that cash returns remain covered by free cash flow amid elevated leverage. Delivery on both would support a modest re-rating toward staples peers; misses would keep the stock range-bound as investors demand higher yield for growth risk.

What could happen in three years? (horizon October 2025+3)

| Case | Narrative |

|---|---|

| Best | Volumes recover across snacks and international beverages as pricing normalizes, with productivity gains lifting operating margins. FX is manageable, leverage trends down, and dividend growth remains steady. The market rewards visible cash conversion and consistent mid-single-digit top-line growth with a firmer multiple. |

| Base | Low-to-mid single-digit revenue growth driven by modest volume improvement and stable pricing. Margins hold near current levels as cost savings offset promotions. Dividend is maintained with measured increases, buybacks are selective, and valuation tracks the staples group. |

| Worse | Consumer trade-down and regulatory headwinds hit volumes, forcing sustained promotions. FX and commodity costs re-accelerate, compressing margins. Elevated leverage limits buybacks, and investors demand a higher yield, leading to a de-rating versus peers. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Volume trajectory in snacks and beverages versus promotional intensity and private-label competition.

- Gross margin outcomes from productivity initiatives versus commodity and packaging costs.

- FX movements and emerging-market macro conditions affecting international profitability.

- Capital allocation under the new CFO, including dividend growth, buybacks and deleveraging pace.

- Regulatory and retailer dynamics (sugar taxes, labeling, shelf space negotiations) shaping pricing power.

- Interest-rate environment impacting refinancing costs given the current leverage profile.

Conclusion

PepsiCo enters the next three years with durable brands, positive but slower sales growth, and ample cash generation to support its defensive profile. The key debate has shifted from “how high can pricing go” to “when do volumes and margins settle,” especially with earnings growth negative year over year and leverage elevated. If productivity savings offset heavier promotions while innovation keeps share, margins can stabilize and free cash flow can comfortably fund a growing dividend even as accounting payout optics look stretched. Conversely, a deeper consumer trade-down or renewed input-cost pressure would keep the stock range-bound. Watch next 1–2 quarters: volume stabilization in core categories; gross margin trend versus promotions; FX translation; cash conversion and leverage trajectory; signals from the new CFO on capital deployment and cost discipline.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.