SoftBank Group (9984.T) enters the next three years with momentum and debate. The stock has surged, up 114.87% over 12 months, closing at 18,395 near its 52-week high of 18,660. Under the hood, reported ttm revenue is 7,360B with a 23.76% profit margin and 10.79% operating margin, alongside net income of 1,730B and EBITDA of 1,200B. Balance sheet leverage remains a watchpoint: total cash of 5.91T against total debt of 19.65T, a 144.41% debt-to-equity and a 0.84 current ratio. Capital returns are modest (dividend yield 0.24%; ex-dividend 9/29/2025), while free cash flow is positive on a levered basis at 3,420B despite negative operating cash flow. With Masayoshi Son sharpening focus on AI and funding costs in view after a hybrid bond sale, investors weigh upside from portfolio appreciation against refinancing risk and execution.

Key Points as of September 2025

- Revenue (ttm): 7,360B; quarterly revenue growth (yoy): 7.00%.

- Profit/Margins: Profit margin 23.76%; operating margin 10.79%; EBITDA 1,200B; net income 1,730B.

- Sales/Backlog: No disclosed backlog; operating cash flow -24.01B; levered free cash flow 3,420B; deal flow tied to AI and listings.

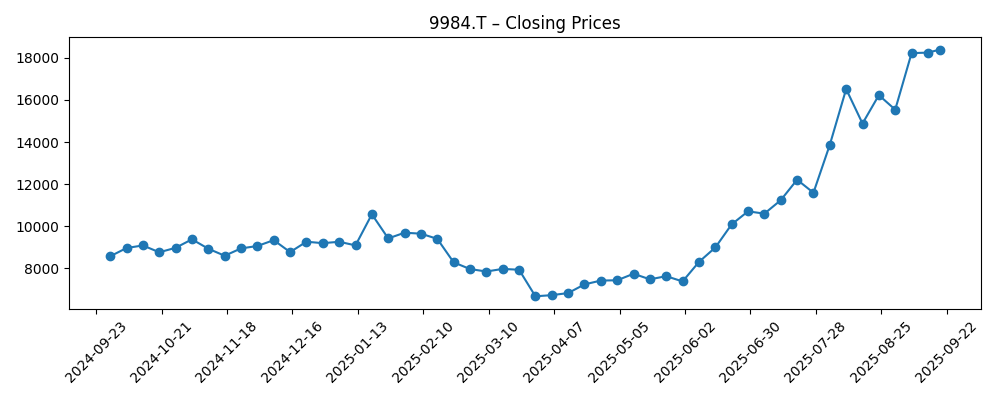

- Share price: Last weekly close 18,395 (2025-09-19); 52-week range 5,730–18,660; 50-DMA 13,752.10; 200-DMA 9,780.44; 52-week change 114.87%; beta 0.60.

- Analyst view: Focus on AI exposure and deleveraging; stance appears mixed and highly sensitive to portfolio marks.

- Market cap: Not provided in the supplied snapshot.

- Balance sheet: Total cash 5.91T vs total debt 19.65T; debt/equity 144.41%; current ratio 0.84.

- Ownership & trading: Shares outstanding 1.42B; float 912.92M; insiders 33.74%; institutions 28.67%; avg vol (3m) 12.51M; avg vol (10d) 15.19M.

- Dividend: Forward/trailing dividend 44; yield 0.24%; payout ratio 5.65%; next ex-dividend 9/29/2025.

Share price evolution – last 12 months

Notable headlines

- 【コラム】孫正義氏がOpenAIに全賭け、過去の過ちと類似点-レン (Bloomberg.co.jp)

- SoftBank Hybrid Bond Has Japan’s Highest Coupon This Year (Yahoo Entertainment)

Opinion

SoftBank’s share price has broken out decisively in recent months, climbing from spring lows to near record territory by mid-September. Momentum investors have latched onto the portfolio’s AI optionality, while the 50-day moving average rising well above the 200-day underscores a supportive technical backdrop. Yet the price action is not linear: the six-month tape shows deep drawdowns in March–April before an accelerated rally in July–September, a pattern consistent with shifting risk appetite toward private-marked assets. In the next three years, this sensitivity should persist: quarterly markups and exits can amplify upside in strong markets but also introduce volatility when funding tightens. Given the 114.87% 52-week gain and proximity to the 18,660 high, expectations are elevated. Sustaining this level likely requires visible cash realization events, clearer deleveraging, or evidence that operating subsidiaries can compound earnings independent of private valuation cycles.

Funding cost is the counterweight to the AI narrative. The recent hybrid bond—flagged as carrying Japan’s highest coupon this year—signals that investors are demanding a premium to finance the balance sheet. With debt at 19.65T versus cash of 5.91T, and a debt-to-equity ratio of 144.41%, the price of capital matters for equity value. Hybrids can support credit metrics, but coupons eat into distributable cash if asset monetizations lag. Over a three-year horizon, refinancing windows, spreads, and currency moves will shape how quickly SoftBank can de-risk without diluting equity or curtailing investment pace. A current ratio of 0.84 further argues for disciplined liquidity management. Should market conditions remain constructive, management could ladder refinancings and use proceeds from exits to retire higher-cost paper, improving interest coverage and stabilizing equity sentiment.

On strategy, Masayoshi Son’s intensified focus on AI—highlighted by commentary around an “all-in” posture toward OpenAI’s ecosystem—offers asymmetry. If commercialization broadens across enterprise software, silicon, and infrastructure, portfolio marks could lift, supporting margins already reflected in a 23.76% profit margin and 10.79% operating margin. Yet concentration risk cuts both ways. Private valuations can compress when expectations reset, and operating cash flow at -24.01B contrasts with robust levered free cash flow of 3,420B, spotlighting the importance of asset-level financing and timing. Over three years, the bull case is a sequence of exits and distributions that turn accounting gains into cash, while the bear case is a capital cycle that extends longer than anticipated, keeping equity tethered to sentiment rather than recurring cash generation.

Capital returns are a secondary, but telling, signal. The dividend yield is just 0.24% with a 5.65% payout ratio, leaving ample flexibility if management prioritizes buybacks after debt reduction or successful exits. However, with the stock near its 52-week high, repurchases would need to be opportunistic and balanced against leverage. The cadence of ex-dividend dates—next on 9/29/2025—can produce short-term trading noise, but longer-term performance should hinge on three levers: crystallizing value from AI-aligned holdings, managing refinancing at acceptable coupons, and maintaining investor confidence in governance and risk controls. If the company executes on even two of these levers, the next three years could support a higher-quality equity story; if not, the share price may revert closer to trend despite a structurally attractive AI backdrop.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like | Implications for shareholders |

|---|---|---|

| Best | Multiple successful monetizations in AI-adjacent holdings; steady deleveraging through asset sales and favorable refinancing; stable operating performance with disciplined investment pacing. | Improved balance sheet resilience, stronger cash returns optionality, and a premium multiple sustained by clearer cash conversion. |

| Base | Selective exits and mixed marks; refinancing achievable at manageable spreads; operating results broadly stable with periodic volatility tied to private valuations. | Range-bound valuation with episodic rallies; moderate balance sheet improvement; capital returns remain modest but dependable. |

| Worse | AI expectations reset; limited exit windows; higher-for-longer funding costs and adverse FX; risk appetite for private tech cools. | Pressure on equity from marks and interest expense; delayed deleveraging; elevated volatility and potential multiple compression. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Refinancing terms and the cost of capital, including any additional hybrid or senior issuance.

- Valuation and liquidity of AI-aligned portfolio companies, including timing and pricing of exits or listings.

- Balance sheet de-risking pace versus new investments, given debt/equity of 144.41% and a 0.84 current ratio.

- Cash generation and conversion: levered free cash flow versus operating cash flow trajectory.

- Dividend/buyback policy signals and the 9/29/2025 ex-dividend cadence as near-term trading catalysts.

Conclusion

SoftBank Group’s equity story into 2028 hinges on translating AI optimism into cash while keeping funding costs contained. The company’s reported profitability metrics are solid and the levered free cash flow profile is supportive, yet negative operating cash flow and a leveraged balance sheet argue for patience and discipline. After a 114.87% 12-month gain and a close near the 52-week high, the market is already discounting meaningful progress on exits and deleveraging. The hybrid bond’s elevated coupon underlines investors’ focus on credit quality; meeting that test would likely require a measured capital recycling program and prudence on new risk. For long-term holders, the path is clear but execution-heavy: crystallize value from AI-facing assets, refinance on acceptable terms, and maintain transparency on marks and liquidity. Do that, and the current premium narrative could endure; stumble, and volatility may reassert itself.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.