Visa enters October with momentum: shares are up about 26.63% over the past year and profitability remains near record levels, with a profit margin of 52.16%. The improvement reflects resilient consumer spending, a steady recovery in cross‑border travel, and continued uptake of value‑added services such as risk tools, analytics, and acceptance solutions that deepen client ties and support stable pricing. Management’s recent commentary at an investor conference emphasized network investments and partnerships across cards and emerging account‑to‑account flows, which should broaden addressable volume while preserving the economics of a scaled, two‑sided network. For investors, this matters because sustained double‑digit top‑line growth on already high margins can extend cash generation, but also invites scrutiny from regulators and intensifies competition from real‑time payments and digital wallets. Payment networks typically compound with nominal consumption and travel, making the sector structurally advantaged yet sensitive to policy shifts and technology adoption. The next leg likely depends on operating discipline and whether travel and e‑commerce demand can offset incentives and regulatory friction.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue of 38.89B, with quarterly revenue growth (yoy) at 14.30%.

- Profit/Margins: profit margin 52.16% and operating margin 66.77%, underscoring strong scale economics.

- Sales/Backlog: no traditional backlog; earnings growth (yoy) at 8.20% as cross‑border and services support the top line.

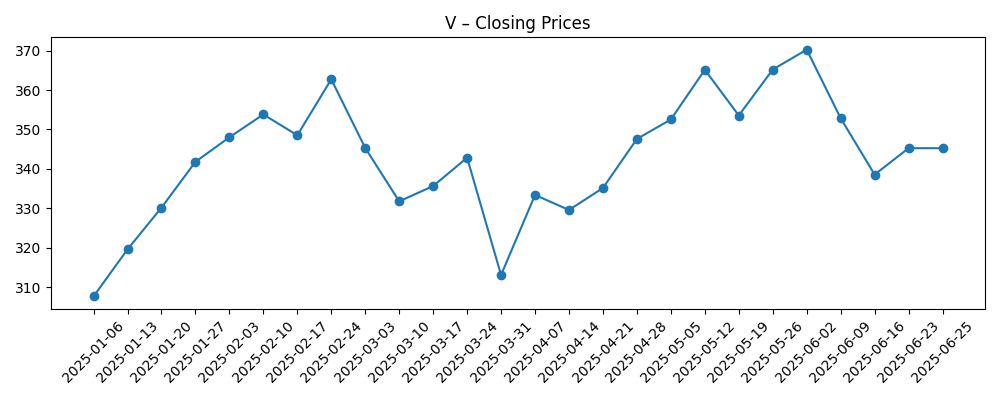

- Share price: 52‑week high 375.51 and low 275.35; 52‑week change 26.63%; recent weekly close 347.04 (2025‑10‑09).

- Analyst/Street color: company shared updates at the Goldman Sachs conference; short interest remains low at 1.57% of float.

- Market cap/ownership: market cap not disclosed in provided data; institutions hold 90.34%, float 1.76B, shares outstanding 1.7B; beta 0.90.

- Dividend: forward annual dividend rate 2.36 (yield 0.67%); payout ratio 22.36%.

- Balance sheet: total cash 19.18B vs. total debt 25.14B; current ratio 1.12; operating cash flow 23.48B; levered free cash flow 18.05B.

- Qualitative: global network scale and tokenization support competitive position, but regulation and real‑time payments could pressure pricing and routing.

Share price evolution – last 12 months

Notable headlines

Opinion

Visa’s current print shows healthy underlying momentum. Revenue growth of 14.30% year over year outpaced global GDP and retail sales, with the mix lifted by cross‑border travel and ongoing penetration of card and tokenized credentials in e‑commerce. Operating margin at 66.77% and profit margin at 52.16% underline the network’s scale economies: once transactions are on the rails, incremental volumes fall through at a high rate after incentives. That dynamic, combined with disciplined cost control, explains why earnings growth of 8.20% lagged revenue growth but still remained solid despite FX and client incentives. In short, results were driven more by volume than price, which is constructive for durability because it does not rely on outsized fee hikes. It also suggests that value‑added services are contributing to breadth rather than margin dilution, consistent with management’s focus on risk, acceptance, and issuer solutions to deepen relationships and stabilize take rates over time.

Cash generation remains a highlight. Over the trailing twelve months, operating cash flow was 23.48B and levered free cash flow 18.05B, leaving ample capacity to invest in network upgrades, fund selective acquisitions, and return capital via a growing dividend. Leverage appears manageable with 25.14B of total debt against 19.18B of cash and a current ratio of 1.12, while return on equity of 51.75% and return on assets of 17.05% reflect efficient capital deployment across a largely asset‑light model. Beta at 0.90 also underlines the stock’s relatively defensive behavior versus the broader market. The quality of beats and misses therefore hinges less on revenue volatility and more on the cadence of client incentives, marketing, and technology spend, which can be tuned without impairing the long‑term growth engine. With a payout ratio of 22.36% and a forward dividend yield of 0.67%, the company retains flexibility to prioritize growth if macro conditions soften.

Looking across the industry, the structural tailwinds remain intact: displacement of cash, contactless adoption, tokenization, and the digitalization of commerce. Yet competitive dynamics are shifting as real‑time payments, account‑to‑account transfers, and closed‑loop wallets seek lower‑cost alternatives, while merchants harness data and routing options to pressure economics. Visa’s response—positioning as a network‑of‑networks, embedding risk services, and deepening acceptance—aims to keep it central to credential issuance, authentication, and dispute resolution where its scale is hardest to replicate. Regulation is the swing factor: rulemaking on interchange, routing, and open banking could compress pricing power at the margin or alter incentives across issuers, acquirers, and merchants. Against that backdrop, the company’s competitive advantage hinges on the breadth of acceptance, security capabilities, and the ability to monetize services without eroding core economics.

Over the next three years, the stock’s narrative likely toggles between “durable compounder” and “regulated utility.” If mid‑teens revenue growth persists while margins hold near current levels, investors can justify a premium multiple supported by predictable cash flows and high returns. If, however, real‑time payments and wallet routing capture incremental share and regulators intensify scrutiny, growth could decelerate and the narrative may pivot toward steadier but slower expansion. The balance of probabilities still favors modest positive operating leverage as travel normalizes and services scale, but the bar for outperformance has risen after a strong 52‑week run. Ultimately, how management sequences investment, pricing, and incentives—while maintaining reliability and security—will shape whether the premium endures or compresses toward sector averages.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Cross‑border travel remains robust, tokenization and tap‑to‑pay deepen penetration, and value‑added services scale without diluting margins. Real‑time payments become complementary rather than substitutional as Visa monetizes account‑to‑account through partnerships. Regulatory outcomes are manageable, preserving pricing flexibility and supporting a stable premium narrative. |

| Base | Consumer spending moderates but remains positive; travel normalizes; services offset modest pricing and incentive pressures. Real‑time payments grow, but coexist with cards, nudging take rates slightly lower while operating discipline sustains healthy margins. The stock tracks earnings growth with periodic volatility around regulatory headlines. |

| Worse | Macro slows spending and travel; regulators tighten routing and interchange, and merchants push harder on pricing. Real‑time and wallet routing capture incremental share, pressuring economics. Higher incentives and compliance costs limit operating leverage, and the multiple compresses toward sector averages. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory actions on interchange, routing, and open banking in major markets.

- Cross‑border travel trends and FX volatility affecting international volumes and yields.

- Adoption of real‑time payments and wallet routing, and Visa’s success monetizing account‑to‑account flows.

- Client incentive intensity and merchant pricing dynamics, especially among large retailers and platforms.

- Consumer spending resilience across debit/credit and e‑commerce channels.

- Technology reliability and cybersecurity, including tokenization and fraud trends.

Conclusion

Visa exits October with a familiar combination of resilient volume growth, high margins, and strong cash generation, supported by ongoing recovery in travel and steady e‑commerce adoption. The company’s scale and services toolkit continue to reinforce its network effects, while a solid balance sheet offers room to invest and adapt as money movement diversifies into account‑to‑account rails. The counterbalance is rising scrutiny on routing and interchange and intensifying merchant efforts to lower acceptance costs, which could nudge take rates down over time. Near‑term performance will likely hinge on holiday demand, cross‑border seasonality, and management’s discipline around incentives and operating spend as it pursues growth in new flows. Watch next 1–2 quarters: cross‑border mix; client incentives; value‑added services growth; expense discipline; regulatory developments.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.