Walmart enters the next three years with a stronger operational footing and a broader strategic aperture. The company’s scale remains its core edge, and that scale is increasingly amplified by automation, data and AI deployed across stores, supply chain and digital commerce. Revenue of 693.15B underscores the defensiveness of its grocery-led mix, while a 3.08% profit margin highlights the thin but durable nature of big-box retail earnings. What changed lately is the quality of growth: more digital advertising, marketplace services, and improved inventory discipline, alongside experimentation in fintech and last‑mile delivery. These shifts matter because they can lift returns without relying on aggressive pricing or cyclical demand. In a sector where competition is intense and costs are sticky, even modest efficiency gains compound. Over the medium term, the investment question is whether Walmart can convert its traffic advantage into higher-margin, capital-light revenue streams while keeping prices low enough to protect share. Execution on AI and partner ecosystems will likely determine the slope of that curve.

Key Points as of October 2025

- Revenue: trailing 12-month revenue of 693.15B; quarterly revenue growth (yoy) 4.80% reflects steady traffic and mix.

- Profit/Margins: profit margin 3.08%; operating margin 4.39%; EBITDA 42.88B points to scale benefits despite thin retail margins.

- Sales/Backlog: retail backlog not applicable; sales momentum tied to grocery, e-commerce and services; backlog data not disclosed.

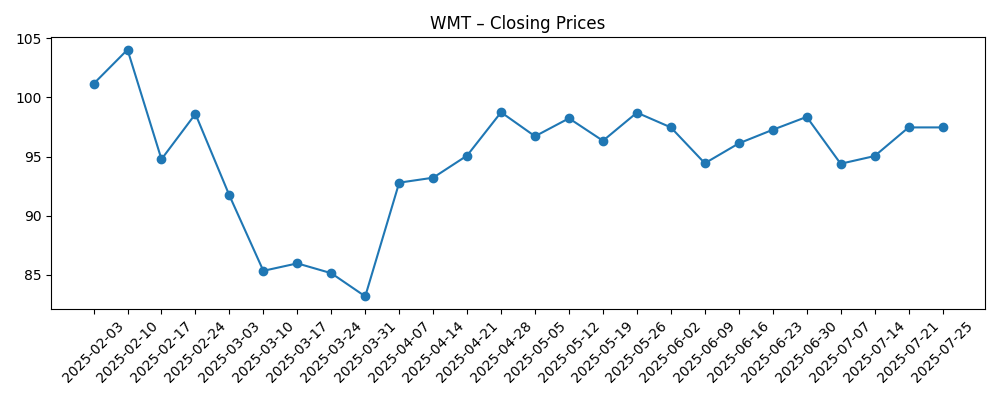

- Share price: 52-week change 27.87% with a 52-week range of 79.81–109.58; 50-day MA 102.34 vs 200-day MA 97.20; beta 0.67.

- Dividend/Capital returns: forward dividend rate 0.94 (0.89% yield); payout ratio 33.40%; last split 3:1 on 2/26/2024.

- Balance sheet & cash: total debt 66.56B; current ratio 0.79; operating cash flow 38.44B; levered free cash flow 8.34B.

- Analyst view & positioning: recent coverage highlights Walmart among promising dividend stocks; short interest low at 0.49% of float.

- Market cap: data not disclosed in provided materials.

- Qualitative: advancing AI in store ops and service chat, expanding drones for last‑mile, and exploring fintech via OnePay; ongoing renewable energy efforts.

Share price evolution – last 12 months

Notable headlines

- Walmart's Q2 2025 Earnings Surpass Expectations

- Walmart Announces Q3 2025 Earnings Release Date

- OpenAI's new deal with Walmart shows how AI is going to shake up the shopping experience

- Walmart CEO Discusses the Company's AI Strategy at Annual Meeting

- Walmart Inc. (WMT): CEO Says AI Will Change Every Job

- Walmart Expands Drone Delivery Service to 20 New Cities

- Walmart's New Partnership with Renewable Energy Supplier to Cut Emissions by 2026

- Walmart-backed fintech OnePay is bringing crypto to its banking app, sources say

- Analysts Say Walmart (WMT) Stands Out Among Today’s Most Promising Dividend Stocks

Opinion

Walmart’s recent prints show a company leaning into operating discipline while upgrading its growth mix. Top-line expansion in the low single digits, combined with a thin but consistent margin structure, suggests management is balancing price leadership with efficiency. The jump in earnings growth (yoy) looks strong, but the quality matters: cost control, inventory turns, and mix shift toward services are more durable drivers than short-term expense timing. Advertising, marketplace fees, and fulfillment leverage can accrete to margins without heavy capital needs. Because Walmart already has massive traffic, even small improvements in attachment rates and digital monetization can compound into meaningful profit support.

Sustainability is the key question. Grocery mix defends traffic but caps gross margin; non-food categories and private brands carry better margin but are more cyclical. AI-enabled labor scheduling, shelf intelligence, and automated distribution should keep SG&A growth below sales growth over time, but wage inflation and shrink remain stubborn headwinds. The cash flow profile—supported by large operating cash flows and positive, though variable, free cash flow—gives room to invest in tech and supply chain while maintaining the dividend. In short, the engine is steady; the upside depends on execution in higher-margin adjacencies rather than a step-change in core retail margins.

Within the industry, Walmart’s pricing power and scale continue to pressure competitors. If its AI and automation efforts compress unit costs further, it can reinvest savings into lower prices, widening the moat and potentially taking share in consumables and general merchandise. Expansion of last‑mile options—drones and store-fulfilled delivery—shrinks convenience gaps with pure-play e-commerce peers. A cleaner energy footprint helps on both cost and brand over the long run. Fintech experiments via OnePay, if integrated prudently, could improve customer stickiness, though regulatory oversight will be a constant gating factor.

For the equity narrative, Walmart increasingly screens as a defensive growth platform with a tech-enabled kicker. A low beta and modest yield support downside resilience, while AI, retail media, and marketplace scale inform the upside debate on the multiple. If investors gain confidence that services can lift margin mix without sacrificing price perception, the stock’s profile could migrate toward steadier compounding rather than episodic rerates. Conversely, a consumer downcycle, food deflation, or elevated investment in price could flatten earnings and cap multiple expansion. Over the next few years, proof points around e-commerce profitability, ad growth, and automation payback will shape sentiment.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Traffic stays resilient and mix shifts toward retail media, marketplace services, and profitable e-commerce. AI-driven automation lowers unit costs across stores and distribution, funding continued price leadership. Last‑mile options scale efficiently, and fintech experiments improve loyalty without regulatory setbacks. Margins expand modestly and cash generation supports ongoing investment and dividend growth. |

| Base | Sales grow in the low single digits with stable share in grocery and gradual gains in general merchandise. Services (ads, marketplace) grow steadily but remain a minority of profit. Automation offsets wage and logistics inflation, keeping margins roughly stable. Capital allocation remains balanced between growth capex and dividends, with a steady narrative of defensive compounding. |

| Worse | Consumer softness and food deflation pressure comps, prompting heavier price investment. Wage and transportation costs outpace productivity gains, compressing margins. Regulatory hurdles slow fintech and drone initiatives. E-commerce profitability lags expectations, and inventory mix requires markdowns. Narrative shifts toward pure defensiveness, limiting multiple support. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on AI, automation, and retail media monetization across stores and e-commerce.

- Consumer demand trends in grocery vs. discretionary categories, including inflation/deflation dynamics.

- Cost pressures from wages, shrink, and transportation; ability to offset with productivity.

- Competitive intensity from online and discount peers affecting pricing and share.

- Regulatory outcomes tied to fintech (OnePay), data/AI usage, and drone delivery operations.

- Holiday and back‑to‑school sell-through, inventory discipline, and promotions cadence.

Conclusion

Walmart’s investment case over the medium term hinges on converting scale and traffic into higher-quality earnings while preserving price leadership. The numbers point to a large, defensive base—strong revenue, thin but steady margins, and meaningful operating cash flows—while the strategy layers on services and automation to gently lift returns. This combination can smooth cyclicality without demanding an aggressive macro backdrop. The risk is that wage and logistics inflation, or consumer softness, absorb productivity gains before they reach the bottom line. Conversely, visible milestones in retail media, store‑fulfilled delivery, and AI-enabled operations could support a more durable growth narrative. Watch next 1–2 quarters: retail media and marketplace monetization; e-commerce unit economics and store-fulfillment efficiency; cadence of automation rollouts and any regulatory milestones for OnePay and drones. Clarity on these levers will shape expectations for margin mix and the sustainability of cash generation.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.