Ahold Delhaize (AD.AS) enters the next three years with steady top-line growth, resilient cash generation and a defensive profile, but with margin and balance-sheet constraints to navigate. Over the last year, revenue reached 91.65B while profit and operating margins stood at 2.02% and 3.98%, respectively. The stock has traded in the mid-30s in recent months, with low beta (0.27) underscoring its defensive nature. Investors continue to focus on execution in the U.S., digital profitability, and disciplined capital returns. The forward dividend rate is 1.18 (yield around 3.5%) with a payout ratio of 57.92%. Recent headlines include a sustainability initiative with Danone and The Nature Conservancy, a Jefferies upgrade on the ADR, and a reported rise in short interest on the U.S. OTC line—all shaping sentiment. With cash flow (OCF 6.54B; LFCF 3.09B) and scale, Ahold looks positioned for stability, though pricing, cost inflation, and debt remain watch areas.

Key Points as of September 2025

- Revenue: 91.65B (ttm); quarterly revenue growth (yoy): 3.30%.

- Profit/Margins: Profit margin 2.02%; operating margin 3.98%; EBITDA 5.31B; net income 1.86B.

- Cash flow: Operating cash flow 6.54B; levered free cash flow 3.09B.

- Balance sheet: Total debt 19.56B vs cash 3.95B; current ratio 0.72; debt/equity 138.61%.

- Share price: Last weekly close 34.03; 52-week range 29.78–38.76; 52-week change +9.67% (vs S&P 500 +15.29%).

- Trend/volatility: Beta 0.27; 50-day MA 34.45; 200-day MA 34.67; average volume (3m) 1.7M.

- Dividend: Forward annual 1.18; yield ~3.47–3.50%; payout ratio 57.92%; ex-dividend 8/8/2025.

- Analyst view: Recent upgrade on ADR line noted; short interest increase reported on OTC ticker.

- Market cap: Approximately 31B based on recent price and 907.83M shares outstanding.

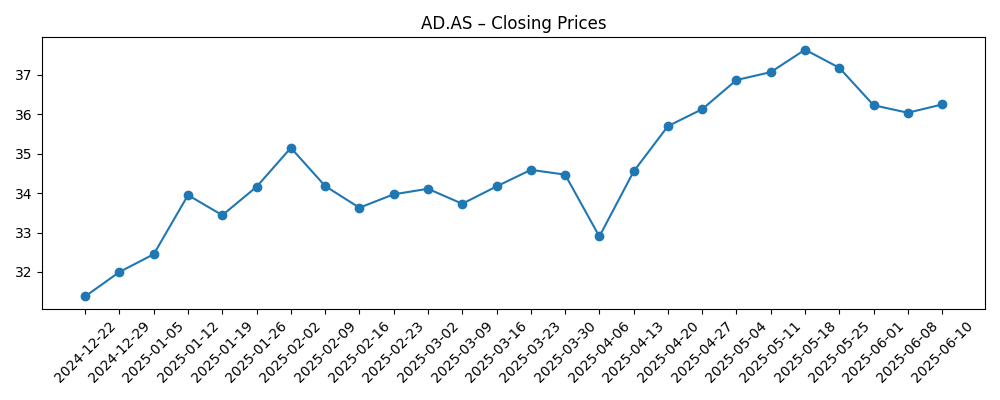

Share price evolution – last 12 months

Notable headlines

- Ahold Delhaize USA, Danone North America and The Nature Conservancy Embark on Joint Initiative to Support Sustainable Agriculture Practices on Dairy Farms

- Koninklijke Ahold Delhaize (OTCMKTS:AHODF) Sees Significant Increase in Short Interest

- Ahold (OTCMKTS:ADRNY) Upgraded at Jefferies Financial Group

Opinion

The stock’s defensive profile (beta 0.27) has been evident as shares oscillated around the mid-30s for much of 2025, with a 52-week change of +9.67%. The near-equal 50-day and 200-day moving averages suggest consolidation rather than a trending market, which aligns with a retailer balancing modest growth (3.30% quarterly revenue growth) with cost headwinds. In this context, the 3.5% dividend yield and a 57.92% payout ratio frame total-return potential while imposing discipline on capital allocation. Sustained operating cash flow of 6.54B and levered free cash flow of 3.09B provide room to fund store investments and digital capabilities even as debt stands at 19.56B. The setup supports stability—but not exuberance—unless margins inflect.

The sustainability initiative with Danone and The Nature Conservancy may look peripheral to earnings, but it can enhance supply chain resilience and brand equity. Dairy is a traffic-driving category; partnering on regenerative practices could reduce input volatility and reinforce quality credentials. If communicated effectively, this may bolster customer loyalty across banners and support private label strength. The payoff window is multi-year, but even incremental improvements in supplier stability can help protect gross profit (24.28B ttm) and reduce operational noise. For a low-volatility grocer, reputational assets matter, and this initiative adds to a long-term moat narrative without significant near-term capital intensity, given the collaborative nature of the program.

On investor sentiment, the reported short interest increase on AHODF contrasts with a contemporaneous upgrade on ADRNY by Jefferies. The split signals a market in search of catalysts: bears may be leaning into margin pressure, high debt-to-equity (138.61%), and a thin current ratio (0.72), while bulls emphasize dependable free cash flow, disciplined dividends, and the potential for operating leverage if cost inflation cools. In our view, the equity story tilts toward steady compounding: low beta, mid-single-digit sales growth potential, and buyback/dividend support. However, the path to multiple expansion likely requires clear evidence of U.S. margin stabilization and e-commerce profitability improving, themes that have dominated the sector.

Technically, the share price failed to hold May’s strength near the 37–38 zone and reverted toward the mid-30s, with the 50-day (34.45) and 200-day (34.67) averages flattening. That pattern implies a wait-and-see stance into year-end distributions (ex-dividend 8/8/2025 already passed) and subsequent guidance updates. A move above the 200-day average on improving volumes (vs 1.7M three-month average) could attract incremental interest, while slippage toward the 52-week low (29.78) would likely require either sector-wide deflation pressure or company-specific cost surprises. Until then, the dividend anchors downside, and free cash flow argues for ongoing balance-sheet repair despite headline debt levels.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outcome by 2028 |

|---|---|

| Best | Stable food inflation, effective cost control, and improved online profitability lift operating discipline; steady buybacks and dividends sustain total returns; leverage trends lower as free cash flow is directed to debt reduction while maintaining strategic investments. |

| Base | Moderate sales growth continues; margin mix remains similar as productivity gains offset wage and energy pressures; capital returns stay consistent with the current payout framework; balance sheet gradually improves without aggressive shifts. |

| Worse | Food deflation and heightened price competition compress margins; labor and logistics costs outpace efficiencies; limited flexibility due to balance-sheet constraints pressures capex and returns; sentiment weakens as shares trade toward the lower end of the 52-week range. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- U.S. grocery pricing dynamics (inflation/deflation) and competitive intensity affecting margins.

- Execution in digital and online fulfillment profitability, including private-label and loyalty engagement.

- Cost trends in labor, energy, and logistics versus productivity initiatives and automation.

- Capital allocation balance between dividends, buybacks, and debt reduction given leverage metrics.

- Regulatory and ESG developments impacting sourcing (e.g., sustainability programs) and reputational risk.

- Currency movements and macro conditions that influence consumer demand and reported results.

Conclusion

Ahold Delhaize’s investment case into 2028 rests on steady execution: defend share, protect margins, and turn strong cash generation into compounding returns. The numbers point to a durable, low-volatility profile—beta 0.27, consistent operating cash flow (6.54B), and a shareholder return framework anchored by a 1.18 dividend and a ~3.5% yield. Offsetting this are balance-sheet constraints (debt 19.56B; current ratio 0.72) and structurally tight margins (2.02% profit margin; 3.98% operating margin), which limit flexibility if deflation or price wars intensify. Recent headlines underscore both opportunity and debate: sustainability collaborations reinforce long-term brand value, while the Jefferies upgrade and short-interest data highlight a split tape. Our read is that Ahold remains a defensive core holding for income-oriented investors, with upside contingent on visible U.S. margin stabilization and measurable progress in e-commerce profitability. Absent surprises, the base case is gradual value creation rather than rapid re-rating.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.