Infineon Technologies enters this three-year window with stable top-line momentum but compressed earnings, a sign that the power-semiconductor cycle is normalizing after an exceptional period. Reported revenue over the last twelve months stands at 14.64B, while the profit margin is 4.78%, underscoring that underutilization and pricing discipline are now the swing factors for returns. What changed is the balance between resilient automotive and industrial demand and a slower replenishment cycle as customers work down inventories. Why it changed largely reflects the sector’s typical oscillation: when backlog clears, wafer loading and product mix become decisive for margins, especially across power discretes and microcontrollers. Why it matters for investors is that the next leg of value creation will depend less on volume spikes and more on executing a mix upgrade toward higher-value power devices and design wins tied to electrification. Sector context remains constructive: semiconductors that convert and manage energy sit at the heart of electric mobility, renewables, and efficient data centers, even as near-term orders stay selective.

Key Points as of October 2025

- Revenue: 14.64B (ttm); quarterly revenue growth (yoy): 0.10% – indicating a soft landing versus a classic downcycle.

- Profit/Margins: Profit margin 4.78%; operating margin 11.45% (ttm); quarterly earnings growth (yoy): -24.30% – margin pressure remains the focal issue.

- Sales/Backlog: Order/backlog detail not disclosed in provided materials; mix shift toward automotive and industrial power remains the core narrative.

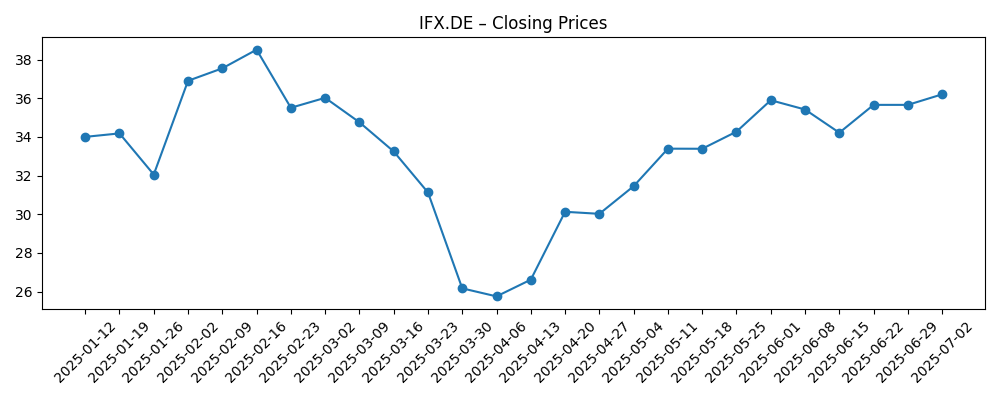

- Share price: Last weekly close ~€32.02; 52-week high/low: 39.43 / 23.17; 52-week change: 3.14%; 50-day MA 34.09; 200-day MA 33.87; beta 1.62.

- Analyst view: No rating/target data provided; sentiment likely tied to margins, utilization, and EV/industrial demand cadence.

- Market cap: Data not disclosed in the provided materials.

- Balance sheet/liquidity: Cash 1.54B; debt 5.37B; current ratio 1.77; debt/equity 32.14% – manageable leverage with liquidity support.

- Cash flow & capital returns: Operating cash flow 2.91B; levered FCF ~966.25M; forward dividend rate 0.35 (yield 1.09%); payout ratio 36.84%.

- Qualitative: Strong position in power semiconductors (including automotive microcontrollers and power discretes such as SiC/GaN) with exposure to EVs, renewables, factory automation, and data-center power.

Share price evolution – last 12 months

Notable headlines

Opinion

Infineon’s latest run-rate shows a company holding revenue broadly steady while absorbing a profitability reset. Flat year-on-year sales growth coupled with a sizable decline in quarterly earnings growth points to the classic pattern of a power-semiconductor digestion phase: as customers normalize inventories, unit volumes and mix soften, and underutilization weighs on gross margin. The operating margin remains positive, supported by scale and product breadth, but the compression between operating and bottom-line margins highlights below-the-line headwinds (financing costs, mix, and possibly currency). On cash, the business still throws off meaningful operating flow, and a moderate dividend indicates confidence in medium-term resilience without overcommitting capital during a transition period.

The share price has been volatile, reflecting a tug-of-war between cyclical normalization and long-duration electrification demand. Technical markers (moving averages close together) reinforce a range-bound narrative until clearer evidence of margin recovery or new design-win ramps emerges. Leverage metrics suggest flexibility to keep investing through the cycle, but return ratios signal that the near-term focus must be on utilization and pricing discipline. In short, the quality of any upcoming “beat” will depend less on headline revenue and more on evidence that high-value power devices (e.g., automotive traction inverters, industrial drives, and data-center power stages) are taking a larger share of shipments.

Within the industry, Infineon occupies a strategically advantaged niche: power semiconductors that convert, control, and condition energy. The structural drivers are intact – electrification of vehicles, grid-scale renewables and storage, factory automation, and more energy-intensive compute. Competitive dynamics hinge on manufacturing know-how in wide-bandgap materials, module integration, software-enabled power control, and qualification depth with automotive OEMs. Regulatory currents from Europe to China can shift demand timing (e.g., EV incentives, industrial policy, export rules), but the secular need for efficient power electronics continues to underpin long-cycle orders and reinforces customer stickiness.

That positioning influences valuation narratives. If Infineon demonstrates mix upgrade, better fab loading, and disciplined opex, investors could lean into a rerating on operating leverage and cash conversion. Conversely, prolonged auto softness, aggressive pricing by peers, or slower-than-expected ramps in next-gen power nodes could prolong margin pressure, keeping multiples tethered to mid-cycle levels. Over the next three years, the story may migrate from “holding the line” on revenue to “earning the right multiple” through sustained margin recovery, free cash flow consistency, and clear leadership in wide-bandgap power devices.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Automotive and industrial electrification accelerate, with strong adoption of wide-bandgap devices in EV powertrains, charging, and factory automation. Utilization improves, pricing stabilizes, and mix shifts toward higher-value modules and microcontrollers, lifting margins and cash conversion. Consistent execution and selective capacity additions support a premium narrative. |

| Base case | Demand normalizes at mid-cycle levels. EV and industrial projects progress unevenly but steadily; pricing is competitive yet rational. Margins recover gradually as utilization improves and cost actions take hold. Cash flow funds R&D and targeted capex while maintaining a measured dividend. |

| Worse case | Auto weakness persists, China competition intensifies, and customers delay projects. Underutilization lingers, pricing tightens, and mix skews to lower-margin products. Cash discipline offsets part of the impact, but margin recovery is delayed and the equity narrative remains cyclical. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Quality of margin recovery – utilization rates, pricing, and product mix across power discretes and automotive microcontrollers.

- EV and industrial demand cadence – policy incentives, OEM production schedules, and inventory normalization.

- Execution on wide-bandgap roadmap – yield, cost, and customer qualifications for SiC/GaN devices and power modules.

- Supply chain and regulatory shifts – export controls, regionalization, and input cost volatility (energy, wafers, substrates).

- Capital allocation – pacing of capex versus free cash flow and dividend commitments during a transitional cycle.

Conclusion

Infineon’s setup blends a cyclical earnings reset with durable secular demand for efficient power electronics. The numbers imply a company still growing at the top line but working through margin compression as customers recalibrate orders. Balance-sheet flexibility and positive free cash flow offer a cushion while management steers mix toward higher-value devices in automotive and industrial markets. Sector currents remain favorable: electrification and energy efficiency are multi-year themes, yet timing will be lumpy and competition active. The equity narrative over the near term hinges on evidence of margin traction and the pace of design-win conversions in EV, renewables, factory automation, and data-center power. Watch next 1–2 quarters: backlog conversion, fab loading/utilization, pricing discipline in power discretes, and proof points on wide-bandgap ramp and module content. If those vectors improve, the path to a steadier multiple is clearer; if not, the shares may continue to trade as a mid-cycle cyclical awaiting the next inflection.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.