ING Groep N.V. is a Dutch universal bank with strong retail and wholesale franchises across the Benelux, Germany and Central & Eastern Europe, complemented by a capital‑light global network for transaction banking. It competes with regional leaders such as BNP Paribas, Santander and Deutsche Bank, and continues to emphasize digital distribution, cost discipline and risk‑controlled growth in core markets. ING’s large deposit base and technology‑led model underpin its net interest income engine while supporting fee businesses in payments, wealth and corporate services.

Financially, ING reports trailing‑twelve‑month revenue of 19.59B and net income attributable to common of 4.79B, implying a 24.46% profit margin and a 53.08% operating margin. Return on equity is 9.30% with diluted EPS at 1.99, while quarterly revenue and earnings growth are -6.60% and -14.50% year over year, respectively. The stock has risen 30.13% over 52 weeks versus 16.76% for the S&P 500, trading near its 52‑week high of 22.00 (low: 14.24). Capital returns remain central: a forward annual dividend of 1.06 (4.92% yield) and a payout ratio of 53.27%, alongside an ongoing share buyback programme.

Key Points as of September 2025

- Revenue: Trailing‑twelve‑month revenue of 19.59B; quarterly revenue growth (yoy) at -6.60%.

- Profit/Margins: Profit margin 24.46% and operating margin 53.08%; diluted EPS (ttm) 1.99; ROE 9.30% and ROA 0.47%.

- Sales/Backlog: Bank top line led by net interest and fees; quarterly earnings growth (yoy) -14.50% indicates normalization after strong prior years.

- Balance sheet/liquidity: Total cash 237.14B and total debt 234.72B; operating cash flow (ttm) -68.64B reflects banking balance‑sheet flows.

- Share price and trading: Recent weekly close near 21.91; 52‑week range 14.24–22.00; 50‑day MA 20.65; 200‑day MA 18.10; 3‑month avg volume 7.48M (10‑day 8.71M).

- Dividend: Forward annual dividend 1.06 with a 4.92% yield; payout ratio 53.27%; last ex‑dividend date 8/4/2025.

- Analyst view: Morgan Stanley raised the stock to Overweight; broader brokerages cite a “Moderate Buy” consensus.

- Capital returns: Company reported progress on its ongoing share buyback programme in September 2025.

- Market cap/ownership: Market cap not disclosed here; 2.94B shares outstanding; institutions hold 49.75%.

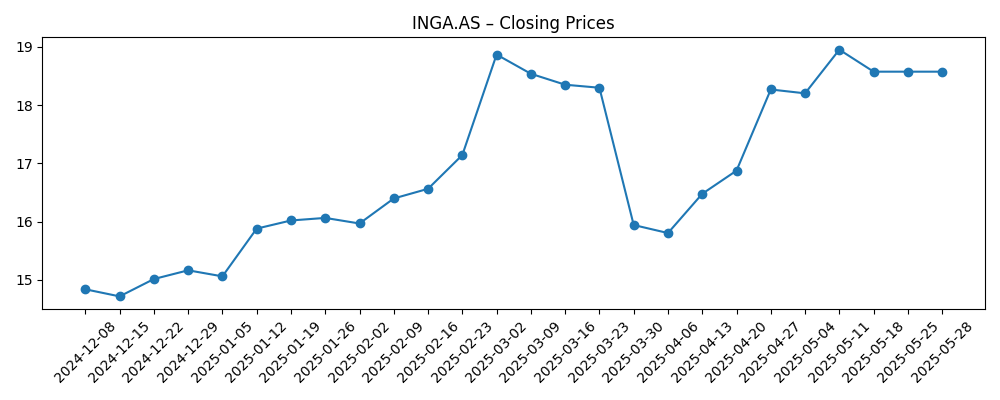

Share price evolution – last 12 months

Notable headlines

- ING Groep (ING) Boosted to Overweight Amid NII Growth Outlook

- Progress on share buyback programme

- ING Group (NYSE:ING) Raised to “Overweight” at Morgan Stanley

- ING Group, N.V. (NYSE:ING) Receives Consensus Rating of “Moderate Buy” from Brokerages

Opinion

Morgan Stanley’s upgrade and the broader “Moderate Buy” stance tilt sentiment in ING’s favor at a time when its operating metrics show both strength and normalization. A 53.08% operating margin and 24.46% profit margin underscore efficient underwriting and cost control, while a 9.30% ROE suggests room for improvement if rates remain supportive and fee income scales. The main counterpoint is top‑line and earnings deceleration (revenue -6.60% yoy; earnings -14.50% yoy), which likely reflects waning peak net interest income and selective growth. Against this backdrop, ING’s digital reach in core markets and its capital‑light international network can sustain volumes without outsized risk appetite. If credit quality remains benign, the combination of stable net interest spreads and fee traction could keep returns resilient, justifying constructive analyst views.

Capital returns are central to the investment case. The forward dividend of 1.06 (4.92% yield) and 53.27% payout ratio, paired with the ongoing buyback programme, provide clear visibility on shareholder yield. Buybacks can offset cyclical earnings softness by supporting per‑share metrics, especially with 2.94B shares outstanding. While banks’ cash flow statements can be volatile, ING’s reported liquidity (237.14B total cash versus 234.72B total debt) indicates balance‑sheet flexibility to continue distributions subject to regulatory buffers. The market has historically rewarded European banks that commit to stable, progressive capital returns; if management maintains discipline on costs and credit risk, distributions could remain a key pillar of total return over the next three years.

Even so, the recent fundamentals warn against complacency. Negative quarterly revenue and earnings growth, modest ROE, and a negative operating cash flow (as commonly observed in banks due to lending flows) argue for measured expectations. Rate sensitivity cuts both ways: if deposit betas rise faster than asset yields as the cycle evolves, net interest income could compress. Moreover, competition in Germany and CEE and any uptick in risk costs would test margins. ING’s advantage is its scale, technology and diversified fee base, which can partially offset cyclical pressures. Execution on cost control and selective growth, while preserving underwriting standards, will likely determine whether today’s margins and returns can be sustained.

Price action supports the improving narrative. The shares are up 30.13% over 52 weeks, near the 22.00 high and above the 50‑day and 200‑day moving averages (20.65 and 18.10). That momentum, combined with supportive analyst commentary and a visible dividend, can keep the stock in demand. Over the next three years, a steady rate backdrop, stable credit and ongoing buybacks would argue for continued compounding of per‑share value. Conversely, a faster‑than‑expected margin squeeze or regulatory headwinds could stall the trend. For now, the balance of evidence suggests a constructive, income‑led trajectory, with volatility around macro data and policy decisions.

What could happen in three years? (horizon September 2025+3)

| Scenario | Revenue/profit trajectory | Capital returns | Valuation/read‑through | Strategic milestones |

|---|---|---|---|---|

| Best | Top line stabilizes and grows modestly; margins hold near recent levels; ROE improves versus 2024–2025. | Dividend sustained with gradual growth; buyback pace maintained, supporting per‑share metrics. | Shares sustain a premium to book value per share of 17.36 as confidence strengthens. | Digital engagement and fee income expand; credit costs remain contained. |

| Base | Revenue flattish with mild swings; margins normalize but remain healthy; earnings variability manageable. | Dividend maintained around current run‑rate; buybacks continue subject to capital headroom. | Valuation tracks sector averages; performance driven by carry and distributions. | Steady progress in core markets; selective investment in technology and risk controls. |

| Worse | Macro slowdown and rate shifts compress net interest income; credit costs rise; earnings decline from recent levels. | Dividend held or trimmed to protect buffers; buybacks paused until conditions improve. | Shares trade closer to book value as risk premium widens. | Focus shifts to asset quality, costs and capital preservation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- ECB rate path and deposit/asset repricing dynamics affecting net interest income.

- Credit quality trends in core retail and wholesale portfolios, including any rise in impairments.

- Capital return policy execution (dividends and buybacks) versus regulatory capital requirements.

- Cost discipline and digital productivity gains relative to peers in Europe.

- Macro conditions in the Benelux, Germany and CEE, including employment and housing cycles.

- Market sentiment toward European financials and any sector‑specific legal or regulatory actions.

Conclusion

ING Groep enters the next three years with sturdy profitability, a visible dividend and continued buybacks, tempered by signs of top‑line and earnings normalization. Trailing revenue of 19.59B, net income of 4.79B and a 24.46% profit margin reflect a resilient model, while a 9.30% ROE suggests room to improve through mix, fees and ongoing cost control. The stock’s 30.13% 52‑week gain, proximity to a 22.00 high and positioning above key moving averages signal improving confidence, supported by recent analyst upgrades and a “Moderate Buy” consensus. Key swing factors are the rate path, deposit dynamics and credit quality. In the base case, ING sustains its dividend of 1.06 (4.92% yield) and methodical buybacks, allowing per‑share value to compound. In stronger conditions, margin resilience and fee growth could lift returns; in weaker conditions, capital discipline provides a buffer. Overall, the risk‑reward looks balanced to constructive for income‑oriented investors.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.