Mercedes‑Benz Group (MBG.DE) enters Q4 2025 balancing a high dividend with a tougher operating backdrop. Over the last twelve months, revenue reached 139.35B with a profit margin of 4.89% and operating margin of 3.09%, while operating cash flow totaled 20.87B. Net income stands at 6.81B. The share trades around 51.32, down 7.87% over 52 weeks versus a 16.33% gain for the S&P 500, and sits below its 50‑day and 200‑day moving averages (52.33 and 53.83). Leverage remains considerable with 106.02B total debt (debt/equity 115.59%) against 21.21B cash and a 1.33 current ratio. The forward dividend is 4.3 per share (8.27% yield; payout ratio 60.82%). With EV launches like the C‑Class EV and product updates underway, investors are weighing income support against margin pressure and execution risk.

Key Points as of September 2025

- Revenue: 139.35B (ttm); quarterly revenue growth (yoy) at -9.80%.

- Profit/Margins: Profit margin 4.89%; operating margin 3.09%; EBITDA 12.95B; net income 6.81B.

- Cash flow & liquidity: Operating cash flow 20.87B; cash 21.21B; current ratio 1.33.

- Leverage: Total debt 106.02B; total debt/equity 115.59%.

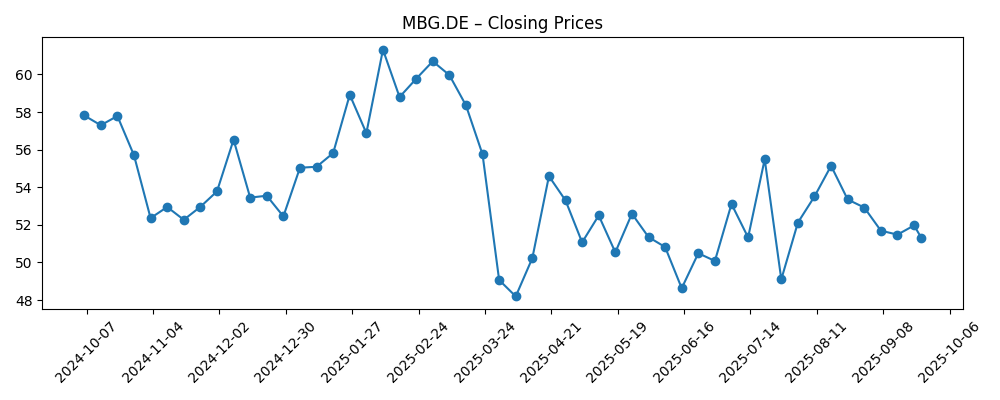

- Share price & trading: Last close 51.32; 52‑week high 63.17 and low 45.60; 50‑day MA 52.33; 200‑day MA 53.83; Beta 0.89; 52‑week change -7.87% vs S&P 500 at 16.33%.

- Dividend: Forward 4.3 per share; yield 8.27%; payout ratio 60.82%; ex‑dividend 5/8/2025.

- Market cap: Approximately 49.4B based on last close and 962.9M shares outstanding.

- Analyst view: Income appeal vs EV execution and margin recovery; tone cautious given -69.70% quarterly earnings growth (yoy).

- Sales/Backlog: No backlog disclosed here; promotional offers in Malaysia highlight regional demand support.

Share price evolution – last 12 months

Notable headlines

- Mercedes‑Benz G‑Class Cabriolet Set to Return (HYPEBEAST)

- Mercedes C‑Class EV to rival new BMW i3 with 497‑mile range (Yahoo Entertainment)

- Mercedes‑AMG GT XX covers Earth’s circumference in multi‑record run (New Atlas)

- Get a Mercedes‑Benz EQ from as little as RM218,000 via Hap Seng Star (Paul Tan)

- Celebrate Malaysia Day in luxury with Mercedes‑Benz, from RM1,998 a month with Step Up Agility+ (Paul Tan)

Opinion

Price action underscores a market balancing yield against cyclical and execution risk. MBG.DE rallied into February 2025 (weekly close 61.32) before selling off sharply to late‑March lows (49.06), and now trades near 51.32. The 8.27% forward yield and a 60.82% payout ratio are appealing, yet they hinge on earnings that have turned down: quarterly revenue growth is -9.80% year on year and quarterly earnings growth is -69.70% year on year. With the stock below its 50‑day and 200‑day moving averages, investors appear to be waiting for clearer signs that margins can stabilize and that capital returns remain supported by cash generation rather than balance‑sheet stretch.

The product pipeline provides optionality. A C‑Class EV targets a core volume segment and, if priced and positioned well, could drive mix and utilization; the G‑Class Cabriolet refresh keeps the halo narrative alive and supports pricing power at the top of the range. Marketing spotlights, such as the AMG GT XX record run, help brand heat. Yet the headwinds are real: EV pricing pressure, intensifying competition (particularly from China), and regulatory costs can weigh on gross profit (24.04B ttm) and limit operating leverage. Execution in software, charging partnerships, and cost control will determine whether these headlines convert into revenue resilience.

Balance sheet and cash‑flow provide both support and constraints. Operating cash flow of 20.87B and levered free cash flow of 9.01B are meaningful, but they must cover investment in electrification, software, and compliance while servicing 106.02B in total debt. Cash of 21.21B and a 1.33 current ratio offer liquidity, yet a debt/equity profile of 115.59% leaves less room for error if the macro slows or pricing erodes. The dividend remains a central pillar; sustaining a 4.3 per‑share distribution without compromising strategic spend is the tightrope. In our view, steady cash conversion and disciplined capex cadence are prerequisites for any re‑rating.

Near‑term sentiment may remain muted. The 52‑week change (-7.87%) versus the S&P 500’s gain highlights relative underperformance, and a Beta of 0.89 suggests the stock might not snap back aggressively without company‑specific catalysts. Regional financing offers in Malaysia demonstrate tactical demand support, but investors will likely look for evidence of global order strength and contribution from new EVs. If margins stabilize and the EV roadmap lands on time, the high yield could anchor total return. Conversely, if revenues keep contracting and pricing pressure accelerates, attention will shift to dividend risk and balance‑sheet flexibility.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like | Implications for MBG.DE |

|---|---|---|

| Best | EV launches scale smoothly, premium mix holds, and cost programs improve efficiency; brand remains strong with successful halo refreshes. | Margins rebuild, cash generation comfortably funds the dividend and strategic investment; valuation and sentiment improve. |

| Base | Mixed EV uptake with steady combustion/hybrid support; pricing is disciplined, and costs are contained but not transformed. | Stable earnings and cash flow sustain the dividend; shares track fundamentals with bouts of volatility. |

| Worse | Pricing war in core markets, slower demand in Europe/China, and execution delays in software/EV platforms. | Margins compress, free cash flow tightens, and the dividend policy is revisited; de‑rating persists until visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- EV execution and uptake for the C‑Class EV and refreshed premium models, including pricing power.

- Competitive dynamics and policy (tariffs/emissions) in Europe, China, and key export markets.

- Margin trajectory versus input costs, recall/warranty expense, and software development progress.

- Capital allocation: sustainability of the 4.3 per‑share dividend versus investment needs amid 106.02B total debt.

- Macro and financing conditions affecting premium demand, leasing affordability, and residual values.

- Brand catalysts and quality signals (e.g., performance records, product launches) influencing pricing and mix.

Conclusion

Mercedes‑Benz Group faces a classic transition trade‑off: a generous dividend and resilient brand on one side, and cyclical softness and EV execution risk on the other. The data show pressure—revenue and earnings contracting year on year, shares lagging the broader market, and the price sitting below medium‑term moving averages. Yet liquidity is solid, cash generation remains meaningful, and high‑profile launches from core (C‑Class EV) to halo (G‑Class Cabriolet) can support mix and marketing momentum. Over a three‑year view, the path to better returns likely runs through margin stabilization, disciplined pricing, and steady EV scaling without overextending the balance sheet. If those elements align, the current yield could underpin attractive total returns; if not, the downside revolves around a tighter cash cushion, slower growth, and potential pressure on capital returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.