Reckitt Benckiser enters the next three years with a mixed setup: the share price has recovered, yet the latest prints show softer sales and earnings as post-inflation pricing fades and volumes remain patchy. The company retains staple-like defensiveness and brand equity across hygiene, health and nutrition, but balance sheet and cash priorities keep discipline in focus. On valuation, a forward P/E of 15.70 implies a rebound in profits from recent weak comparisons, while the market cap of 38.27B anchors expectations around steady cash returns. What changed in recent months is the narrative: from pricing-driven growth to proof of volume traction and cost control, as retailers push for sharper shelf prices and private label stiffens competition. It matters for investors because the staples sector is rotating toward volume, mix and productivity to sustain earnings without outsized pricing. If Reckitt can translate category innovation and efficiency programs into consistent volumes and margins, sentiment can hold; if not, the valuation reset could stall as investors refocus on execution and balance-sheet resilience.

Key Points as of October 2025

- Revenue: trailing twelve-month (ttm) revenue of 13.98B; quarterly revenue growth (yoy) at -2.60% indicates a modest top-line dip.

- Profit/Margins: operating margin (ttm) 21.46% and profit margin 8.88%; EBITDA at 3.56B suggests healthy operating efficiency with below-the-line drag.

- Sales/Backlog: backlog not applicable/data not disclosed; quarterly earnings growth (yoy) at -16.10% highlights pressure from softer mix and volume.

- Share price: closed at 5,720 on 2025-10-13; 52-week change 23.76%; 50-day moving average 5,607.12; 52-week high 5,830.00; beta 0.08.

- Analyst view proxy: forward P/E 15.70 vs trailing 30.87; PEG 3.75; Price/Sales 2.79; forward dividend yield 3.57% with payout ratio 110.14% on trailing earnings.

- Market cap and valuation: market cap 38.27B; EV/Revenue 3.33 and EV/EBITDA 16.84; institutions hold 71.17% of the float.

- Balance sheet/liquidity: total debt 9.4B vs cash 963M; current ratio 0.56 and total debt/equity 148.11% frame deleveraging and cash conversion as priorities.

- Qualitative: diversified brands in hygiene, health and nutrition; exposed to retailer pricing dynamics, FX translation and consumer-health regulation; low-beta profile underscores defensive positioning.

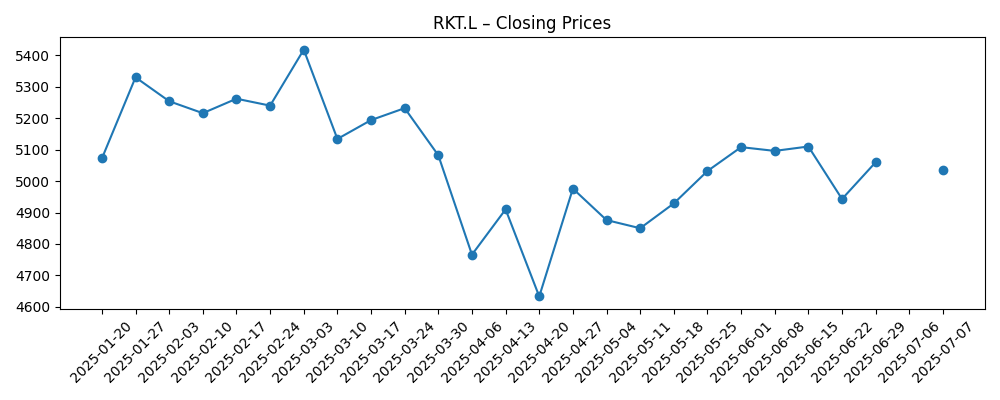

Share price evolution – last 12 months

Notable headlines

Opinion

The near-term numbers show a company transitioning from price-led growth to a more balanced model. Revenue slipped year over year and earnings contracted, consistent with staples peers that saw pricing normalize while volumes lag. That points to three drivers: tougher comparisons after multiple pricing rounds, more promotions as retailers seek value for consumers, and FX translation in international markets. Against this backdrop, the share price recovery suggests investors are looking through the dip toward operational stabilization. The key debate is whether volume can inflect positively without sacrificing too much price, and whether category innovation can support share in disinfectants, OTC health and nutrition.

Margin quality looks better than the headline EPS trend. A 21.46% operating margin and 3.56B EBITDA indicate cost discipline and scale benefits, even as profit margin sits at 8.88%—a gap that likely reflects interest, FX and other below-the-line items. Leverage (9.4B total debt, current ratio 0.56) and cash priorities make working capital and deleveraging central to the equity story. The forward P/E of 15.70 versus a trailing 30.87 implies the market expects an earnings rebound; that spreads the burden of proof across volume, mix, and cost programs. Dividend cover appears tight on trailing earnings (payout ratio 110.14%), reinforcing the importance of free cash flow consistency rather than headline EPS alone.

Within global consumer staples, the battleground has shifted from taking price to winning and holding volume with sharper value propositions. Private label and discounters are still gaining share in some categories; that raises the bar for R&D, brand building and pack-price architecture. Input costs are more benign than in the last inflation spike, but the pass-through now runs both ways—meaning price investments may be needed to defend shelf space. Reckitt’s category breadth, scale procurement and low beta profile provide resilience, yet also create scrutiny: investors will likely benchmark execution against multinational peers with similar margin structures.

That backdrop shapes the multiple and the narrative. If volumes stabilize and innovation supports mix, the equity story evolves into “steady cash compounder,” sustaining a mid-teens forward earnings multiple as cost programs underpin margins. If price competition intensifies or regulatory hurdles rise in consumer health, a derating becomes plausible as investors reassess durability. Capital allocation will be pivotal: disciplined marketing reinvestment, selective deleveraging, and any portfolio pruning or bolt-ons will influence conviction. With a recovering share price and a valuation that bakes in improvement, the next few quarters of volume signals and cash conversion will likely determine whether enthusiasm consolidates or fades.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Volumes return across Hygiene and Health as innovation, pack architecture and e-commerce penetration drive share gains. Promotional spend normalizes, productivity savings hold, and FX is neutral-to-supportive. Operating discipline enables steady deleveraging and consistent free cash flow, anchoring a durable, defensive growth narrative. |

| Base | Category growth is steady but unspectacular; pricing moderates and volumes edge up in key markets. Margins remain broadly stable as cost savings offset price investments. Cash conversion funds the dividend and selective brand support, and valuation tracks sector peers with low volatility. |

| Worse | Retailer price pressure and private label advances force sustained promotions, while emerging-market FX and regulatory frictions weigh on earnings. Volume recovery stalls, margin compresses, and deleveraging slows, keeping the equity on a lower multiple until execution visibly improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on volume recovery and mix improvement in core Hygiene and Health categories.

- Retailer negotiations and private label competition affecting pricing, promotions and shelf space.

- Input costs (commodities, packaging, logistics) and the pace of cost-savings delivery.

- FX and emerging-market volatility impacting reported growth and margins.

- Regulatory and quality outcomes in consumer health and nutrition categories.

- Capital allocation choices: deleveraging pace, dividend sustainability, and any portfolio reshaping or M&A.

Conclusion

Reckitt’s setup blends resilience with execution risk. The data show a company with robust operating efficiency (solid operating margin and EBITDA) but softer top-line momentum and earnings owing to the shift from pricing to volume and mix. Valuation embeds improvement—forward P/E sits well below the trailing level—so delivery will be judged on volume traction, margin defense, and cash conversion while maintaining discipline with leverage and working capital. Sector dynamics are supportive of defensives, yet the competitive bar is high as retailers emphasize value and private label remains assertive. Watch next 1–2 quarters: volume trends; pricing elasticity and promotional intensity; retailer negotiation outcomes; free cash flow conversion; deleveraging progress. Clear evidence of stabilizing volumes alongside steady margins would reinforce the current narrative; setbacks on any of these dimensions could challenge the multiple in a market that is rewarding staples with visible, cash-backed growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.