Royal Dutch Shell (Shell plc; ticker SHELL.AS) is a global integrated energy company spanning oil and gas exploration and production, liquefied natural gas (LNG), refining and marketing, chemicals, and power trading. It competes with ExxonMobil, Chevron, BP, and TotalEnergies across the supermajor peer group.

As of the most recent filings, Shell’s trailing‑twelve‑month revenue is 272.01B, with gross profit of 67.79B, EBITDA of 48.29B, and net income of 13.6B (profit margin 5.00%; operating margin 11.04%). Operating cash flow totals 49.07B and levered free cash flow 22.52B; liquidity stands at 32.68B in cash against 75.68B of debt and a current ratio of 1.32. Year‑over‑year quarterly revenue growth is -12.20%, while the forward annual dividend rate is 1.22 (4.05% yield) with a 62.68% payout ratio.

Key Points as of September 2025

- Revenue: TTM revenue stands at 272.01B; quarterly revenue growth is -12.20% year over year; revenue per share is 44.62.

- Profit/Margins: Profit margin 5.00% and operating margin 11.04%; gross profit 67.79B, EBITDA 48.29B; net income 13.6B; ROE 7.54% and ROA 4.79%.

- Cash flow and balance sheet: Operating cash flow 49.07B; levered free cash flow 22.52B; total cash 32.68B vs total debt 75.68B; current ratio 1.32; debt/equity 41.33%.

- Share price and volatility: Latest weekly close 30.51 (Sep 23, 2025); 52‑week range 26.53–34.22; 50‑day MA 30.88 and 200‑day MA 30.72; 52‑week change -3.24% vs S&P 500 +16.76%; beta 0.32.

- Dividend profile: Forward annual dividend rate 1.22 (4.05% yield); trailing dividend 1.42 (4.70% yield); payout ratio 62.68%; last ex‑dividend date 8/14/2025.

- Sales/backlog: Demand tied to commodity cycles (oil, LNG, refining margins); backlog metrics are not disclosed here.

- Ownership and liquidity: Shares outstanding 5.79B; implied shares outstanding 5.94B; float 5.76B; institutions hold 37.67% and insiders 0.04%; average 3‑month volume 4.48M (10‑day 5.37M).

- Market cap context: Mega‑cap scale implied by share count and price; exact market capitalization not provided in these figures.

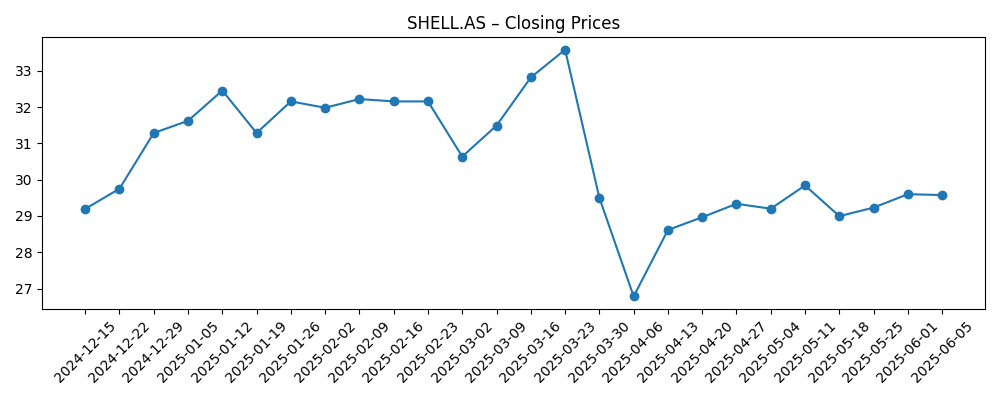

Share price evolution – last 12 months

Notable headlines

Opinion

Shell’s stock has been range‑bound over the past six months, with a dip to late‑April lows and recovery toward the low‑30s. The low beta and a 4%‑plus forward yield suggest investors are treating it as a cash‑generative defensive rather than a growth vehicle.

The comparative coverage versus pure‑play LNG peers underscores Shell’s edge in scale and portfolio diversity. While LNG remains a strategic pillar, the company’s integrated model spreads risk across upstream, refining, chemicals, and trading—helpful when quarterly revenue growth is negative.

Balance‑sheet flexibility looks adequate: cash of 32.68B against 75.68B of debt, supported by 49.07B operating cash flow and 22.52B levered FCF. That should underpin dividends through cycles, though the 62.68% payout ratio leaves limited room if margins compress.

Into the next three years, share performance will likely track commodity price trends and refining/LNG spreads. If macro tailwinds firm and execution holds margins near current levels, Shell could close the gap versus the broader market; otherwise, the yield may remain the core of total return.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like | Key conditions |

|---|---|---|

| Best case | Energy prices and LNG spreads improve; operating and profit margins hold at or above current TTM levels; dividend grows from the 1.22 forward base while payout stays prudent. | Disciplined capex, stable geopolitics, strong trading results, and continued balance‑sheet strength (current ratio and debt metrics broadly steady). |

| Base case | Mixed commodity backdrop; margins fluctuate around recent averages; dividend maintained; modest buybacks when cash flow permits. | Normalizing demand, balanced OPEC+ supply, and steady refining utilization; FCF covers shareholder returns and maintenance capex. |

| Worse case | Prolonged price softness and weaker refining margins; revenue pressure persists; payout ratio strains, forcing slower dividend growth or pauses. | Macro slowdown, LNG overcapacity, or operational disruptions; higher working‑capital needs reduce reported FCF. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Commodity prices and LNG spreads affecting revenue growth and margins.

- Refining and chemicals cycle, including crack spreads and utilization rates.

- Capital allocation discipline versus payout ratio sustainability and any buybacks.

- Balance‑sheet leverage and liquidity (debt/equity, current ratio, cash generation).

- Regulatory, environmental, and geopolitical developments impacting operations and costs.

- Relative performance versus supermajor peers and institutional demand.

Conclusion

Shell enters the next three years with the hallmarks of a resilient integrated major: diversified earnings streams, sizable operating cash flow (49.07B TTM), and a balance sheet that can accommodate cycles. The investment case today leans income‑first—anchored by a 4.05% forward dividend yield on a 1.22 rate and supported by 22.52B of levered free cash flow—while the low 0.32 beta signals dampened volatility relative to the market. Key swing factors remain exogenous: crude and gas prices, LNG and refining margins, and policy/geopolitics. Internally, sustaining the 11.04% operating margin and protecting the 62.68% payout ratio will be critical to compounding total returns. If demand normalizes and spreads improve, Shell could narrow underperformance versus the S&P 500’s recent gains; if not, the yield may continue to dominate returns. On balance, a base‑case path of maintained dividends, selective growth, and opportunistic buybacks appears achievable given current fundamentals.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.