Advantest Corp. enters late 2025 with momentum typical of an AI‑led test equipment upcycle. The stock has climbed to 15,020 (as of the week ending September 19, 2025), near its 52‑week high of 15,195, and up 130.82% over 12 months. Fundamentals look strong: trailing‑12‑month revenue stands at 904.76B with quarterly revenue growth up 90.10% year over year, a 46.99% operating margin, and 25.14% profit margin. Cash of 273.41B versus 91.78B in total debt underpins a 2.26 current ratio, while ROE at 44.12% and operating cash flow of 305.14B highlight efficiency. With a modest dividend (rate 39; ~0.26% yield; 17.89% payout), the market is signaling a growth focus. This note outlines key drivers, plausible scenarios to September 2028, and risks that could sway the shares.

Key Points as of September 2025

- Revenue: TTM revenue 904.76B; quarterly revenue growth (yoy) 90.10%; gross profit 539.82B.

- Profit/Margins: Operating margin (ttm) 46.99%; profit margin 25.14%; EBITDA 346.87B; net income 227.48B; ROE 44.12%.

- Sales/Backlog: Backlog not disclosed here; growth rates suggest strong demand for advanced‑node/AI test capacity.

- Share price: 15,020 (week ending 2025‑09‑19), near 52‑week high 15,195; 52‑week change 130.82%; above 50‑day (11,405.20) and 200‑day (8,969.63) moving averages; beta 0.75.

- Market cap: 731.82M shares outstanding; implied market capitalization approximately 10,992B at the recent price.

- Balance sheet: Total cash 273.41B vs total debt 91.78B; current ratio 2.26; debt/equity 15.98%.

- Cash generation: Operating cash flow 305.14B; levered free cash flow 242.93B supports reinvestment and shareholder returns.

- Dividend/Policy: Forward and trailing annual dividend rate 39; yield ~0.26%; payout ratio 17.89%; last split 4:1 on 2023‑09‑28.

- Ownership: Institutions hold 61.38% of float; insiders 0.27%.

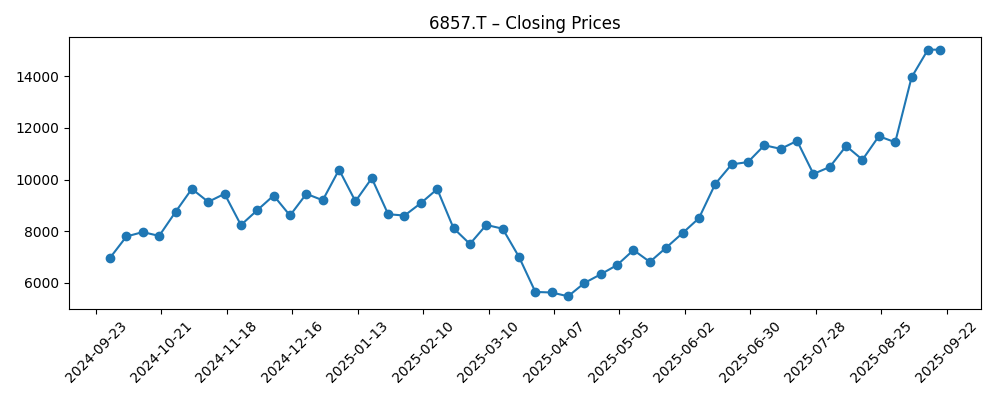

Share price evolution – last 12 months

Notable headlines

Opinion

Price action over the past six months frames a classic semiconductor capital‑equipment swing. From late March’s weekly close near 5,654, the shares recovered back above 10,000 by late June and reached 15,020 by mid‑September, breaking decisively above the 50‑day (11,405.20) and 200‑day (8,969.63) moving averages. The magnitude of the rebound aligns with an AI‑driven test demand cycle in advanced logic and memory, where throughput, parallelism, and test coverage requirements expand alongside complexity. While the tape can run ahead of near‑term bookings, the slope of the move—supported by improving breadth across weeks in June–September—suggests investors are discounting multi‑quarter revenue visibility rather than a single print. In our view, the price is now calibrated to a soft‑landing path for customer capex: not exuberant, but optimistic that the industry can grow into recent expectations.

Underpinning the rally are unusually strong fundamentals for a test supplier at this point in the cycle. Advantest’s TTM operating margin of 46.99% and profit margin of 25.14% are historically high for equipment makers, reflecting favorable product mix, utilization, and discipline on operating expenses. ROE of 44.12% and operating cash flow of 305.14B indicate that growth is translating into returns, not just top‑line expansion. The balance sheet—273.41B in cash against 91.78B in debt—provides flexibility to support working capital, selective capacity adds, and product development without straining equity. The modest dividend (rate 39; ~0.26% yield; 17.89% payout) signals management priority on reinvestment while still maintaining a shareholder‑friendly stance, leaving room for opportunistic buybacks later in the cycle if cash generation stays robust.

Even so, investors should not forget how cyclical the tester market can be. Quarterly revenue growth at 90.10% year over year and earnings growth at 277.70% are unlikely to be linear. Order timing from a small number of very large customers can produce lumpiness, and visibility on backlog is limited in the data provided. Any pause in AI or HBM‑related capex, node transitions slipping, or a digestion phase after major customer deployments could compress the order run‑rate. If pricing pressure re‑emerges as peers compete for share in memory and SoC test, gross margin could normalize from current highs, which would likely push the stock to consolidate closer to the 50‑day average, especially after such a steep 12‑month climb. In that context, position sizing and patience across volatility matter.

Tactically, with the share price near its 52‑week high and comfortably above trend, the burden of proof shifts to sustaining orders and margins across the next few quarters. Institutional ownership at 61.38% suggests the shareholder base can support longer‑term narratives, but expectations are now embedded in the price. Watch for how management talks about capacity utilization, lead times, and mix between memory and logic testers, plus any commentary on service and software attach rates. Strong cash generation (levered FCF 242.93B) provides a cushion if conditions cool, while the 2023 split improved liquidity. In the absence of company‑specific headlines, the stock may track sector‑wide signals on AI infrastructure spend. Pullbacks toward the 50‑day could attract buyers if fundamentals hold; breaks below the 200‑day would argue for a deeper reset.

What could happen in three years? (horizon September 2025+3)

| Case | Business conditions | Financial markers | Stock implications |

|---|---|---|---|

| Best | AI and advanced‑node test demand broadens across logic and memory; services/software attach increases; supply chain remains smooth. | Margins stay near current TTM levels; cash remains comfortably above debt; steady cash generation supports reinvestment and shareholder returns. | Shares sustain leadership above long‑term averages; valuation supported by durable growth and high returns on equity. |

| Base | Growth moderates as customers digest capacity; mix normalizes but remains favorable; competition manageable. | Revenue growth cools from recent highs; margins normalize but remain solid; disciplined capex and working capital. | Stock tracks earnings trajectory with periodic consolidations around trend lines. |

| Worse | Customer capex pauses or is delayed; aggressive pricing in key segments; macro or policy shocks weigh on orders. | Order push‑outs and mix pressure compress margins; working capital builds; cash deployment turns defensive. | Shares revert below moving averages and rerate until demand clarity returns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Magnitude and timing of AI, advanced‑logic, and memory (including HBM) test‑capacity spending by top customers.

- Pricing and competitive dynamics in SoC and memory testers, including feature differentiation and service/software attach.

- Macro, currency, and policy factors that affect export approvals, supply chains, and customer capex budgeting.

- Execution on product roadmap and manufacturing lead times, which influence gross margin and delivery credibility.

- Capital allocation choices (dividends at rate 39, potential buybacks, M&A) versus reinvestment in R&D and capacity.

Conclusion

Advantest’s setup into 2028 combines strong fundamentals with elevated expectations. The company’s TTM revenue of 904.76B and high margins indicate it is benefiting from a favorable mix and scale, while a solid balance sheet (cash 273.41B versus debt 91.78B) and robust cash generation (305.14B operating cash flow) provide strategic flexibility. The share price near a 52‑week high, well above the 50‑day and 200‑day averages, suggests the market is discounting a multi‑year AI‑driven test cycle. From here, sustaining orders and margins matters more than beating a single quarter. Absent company‑specific headlines, sector capex signals may dominate the tape, creating opportunities on volatility. The dividend remains modest, reinforcing a growth‑first stance with room to adjust capital returns if conditions stay favorable. Overall, execution on product leadership and disciplined capacity planning will likely determine whether the stock consolidates gains or extends them over the next three years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.