Alphabet enters the next three years with strong fundamentals and a higher bar for execution. As of September 2025, the stock has advanced 48.65% over the past year and recently traded near 246.54, outpacing the S&P 500. The company reports $371.4B in trailing revenue with profit margin of 31.12% and operating margin of 32.43%, supported by $95.15B in cash versus $41.67B of debt. Google Cloud’s momentum, including a $58B revenue backlog, and ongoing AI investments are central to the growth narrative. Offsetting these positives, a recent DOJ antitrust ruling introduces remedy risk even as several brokers raised price targets. With a forward dividend yield of 0.34% and ample free cash flow, Alphabet has flexibility for buybacks and investment. This note outlines key drivers, scenarios, and risks into 2028.

Key Points as of September 2025

- Revenue: Trailing revenue of $371.4B; quarterly revenue growth (yoy) of 13.80%; revenue per share of 30.43.

- Profit/Margins: Profit margin 31.12% and operating margin 32.43%; net income (ttm) $115.57B; EBITDA $140.84B; ROE 34.83% and ROA 16.79%.

- Sales/Backlog: Google Cloud highlighted a $58B revenue backlog, underscoring multi‑year enterprise demand linked to AI and infrastructure.

- Share price: Last weekly close ~246.54; 52‑week change 48.65% with a 52‑week high of 256.00; 50‑day MA 215.38 and 200‑day MA 185.03; beta 1.01.

- Analyst view: Multiple firms (Evercore, Baird, Oppenheimer, KeyBanc) raised price targets; several commentaries see Alphabet weathering the DOJ ruling.

- Market profile: Institutional ownership 80.93%; short interest 1.16% of float (short ratio 1.78); average 3‑month volume 36.56M supports liquidity.

- Balance sheet: Total cash $95.15B versus total debt $41.67B; current ratio 1.90; debt/equity 11.48%.

- Capital returns: Forward annual dividend rate 0.84 (yield 0.34%); trailing dividend yield 0.41%; payout ratio 8.64%; last split 20:1 on 7/18/2022.

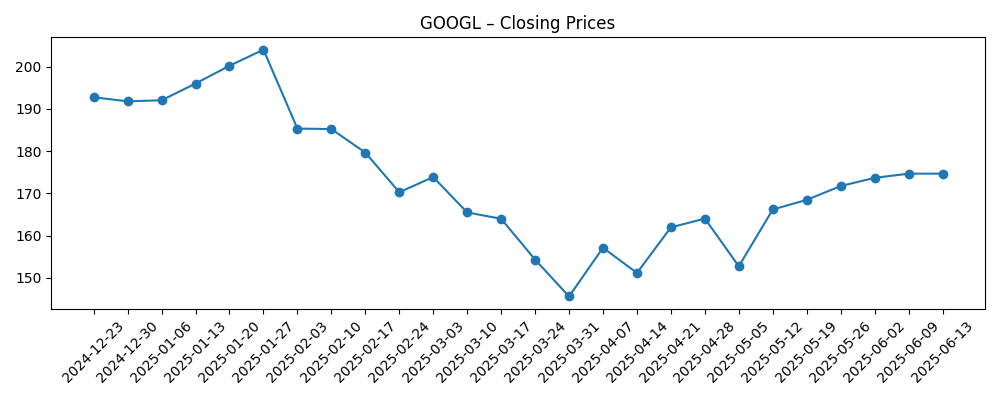

Share price evolution – last 12 months

Notable headlines

- Evercore Raises Alphabet (GOOGL) Price Target, Keeps Outperform Rating

- Baird Raises Price Target for Alphabet (GOOGL), Keeps Outperform Rating

- KeyBanc Boosts Alphabet (GOOGL) PT Post DOJ Ruling

- Oppenheimer Raises PT on Alphabet (GOOGL) Stock

- Why Analysts See Alphabet (GOOGL) Weathering DOJ Ruling With Ease

- Alphabet Inc. (GOOGL): Rapid Google Cloud Growth Drives $58B Revenue Backlog

- Google Just Made Cipher Mining An AI‑Crypto Hybrid Bet

- Analyst Sees Alphabet (GOOGL) as AI Leader, Lifts Price Target to $280

- Jim Cramer Still Can’t Believe The Verdict Of Alphabet Inc. (GOOGL)’s Antitrust Lawsuit

Opinion

The past six months show a decisive reset in sentiment. Shares fell into late March before reversing, and the subsequent climb to a 52‑week high of 256.00 coincided with stronger prints from Search, YouTube, and Cloud and a series of price‑target increases. The stock now sits above both the 50‑day and 200‑day moving averages, suggesting momentum investors have re‑engaged. At the same time, fundamentals underpin the move: trailing revenue of $371.4B, profit margin of 31.12%, operating margin of 32.43%, and net income of $115.57B. With beta near 1.01, Alphabet has behaved roughly in line with the broader market but outperformed on a 52‑week basis. Into the next three years, the question is less about survival and more about the pace of compounding and the durability of elevated margins in an AI‑intensive era.

AI remains the central narrative thread. Google Cloud’s highlighted $58B revenue backlog and continued enterprise traction point to multi‑year visibility, while Alphabet’s efforts to embed generative models across Search, YouTube, Workspace, and Android can expand monetization levers. The recently reported collaboration involving data center capacity (e.g., support for Cipher Mining’s expansion) underscores management’s drive to secure compute supply and strategic partners. The trade‑off is cost: AI model training and inference can pressure unit economics and capital intensity, challenging the sustainability of current operating margins if revenue per compute does not scale. Over three years, investors will watch backlog conversion, Cloud profitability trajectories, and evidence that AI features lift engagement and advertiser ROI rather than cannibalize existing search behavior. Clear disclosures on AI costs and returns could narrow the band of outcomes.

The DOJ antitrust ruling introduces a persistent but analyzable overhang. While several analysts argue Alphabet can weather the outcome, remedy design matters. Behavioral remedies around distribution, defaults, or data portability could raise traffic acquisition complexity and add compliance costs; structural remedies would be more disruptive, though such outcomes are typically rarer and drawn out on appeal. Importantly, Alphabet’s diversified revenue base and product surface reduce single‑point‑of‑failure risk, but Search remains the profit engine. Over a three‑year horizon, the base case assumes incremental compliance rather than business model overhaul. Any clarity that reduces tail risk could be a positive catalyst, particularly if accompanied by continued execution in Cloud and AI. Conversely, uncertainty that delays enterprise commitments or ad budgets could elongate sales cycles and dampen multiple expansion.

Capital allocation is an additional support. With $95.15B in cash versus $41.67B in debt, a current ratio of 1.90, and levered free cash flow of $49.79B (ttm), Alphabet retains flexibility to invest through the cycle, secure compute, and return capital. The introduction of a dividend (forward yield 0.34%, payout ratio 8.64%) supplements buybacks without constraining balance sheet strength. Over the next three years, consistent repurchases and a methodical dividend cadence can buffer volatility and improve per‑share economics, especially if revenue growth moderates toward enterprise‑software‑like rates. The bull case hinges on translating AI leadership into premium pricing and higher advertiser productivity, with Cloud scaling margins as backlog converts. The bear case focuses on regulatory friction, higher AI costs, and competitive intensity in both ads and cloud, eroding operating leverage. Execution against this spread will define returns.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Signals to watch |

|---|---|---|

| Best | AI features enhance Search and YouTube monetization without cannibalizing intent, Cloud converts backlog efficiently and improves margins, and remedies from the DOJ case are limited to manageable behavioral changes. Revenue growth remains healthy and operating discipline sustains margins near current levels. | Steady ad growth across formats; Cloud margin expansion; continued analyst PT hikes; stable or rising dividend cadence. |

| Base | Advertising normalizes around macro trends, Cloud grows with moderate efficiency gains, and regulatory outcomes add some cost but little strategic change. Share performance tracks earnings growth with periodic volatility tied to AI spending cycles. | In‑line quarterly prints; backlog conversion consistent with guidance; balanced capital returns; modest multiple drift. |

| Worse | Remedies materially impact distribution or data use, AI compute costs rise faster than monetization, and Cloud faces pricing pressure. Margins compress and growth slows, leading to multiple compression and deferred enterprise projects. | Slower ad growth; rising TAC or compliance costs; Cloud deal slippage; cautious or reduced buybacks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory and legal outcomes tied to the DOJ antitrust ruling and any resulting remedies or appeals.

- AI economics: trajectory of model performance versus compute cost, and the monetization of AI features in Search, YouTube, and Workspace.

- Enterprise execution: Google Cloud backlog conversion, win rates, and progress toward sustainable profitability.

- Digital ad cycle: macro‑sensitive marketer demand, measurement changes, and shifts in user behavior across platforms.

- Capital allocation: pace of buybacks and the dividend policy relative to free cash flow and investment needs.

- Supply and partnerships for data center capacity, including chip availability and strategic alliances.

Conclusion

Alphabet heads into 2026–2028 with enviable assets: dominant consumer reach, durable advertiser demand, and a strengthening enterprise footprint. The numbers provide ballast — $371.4B in trailing revenue, margins above 30%, substantial cash, and positive free cash flow — while the stock’s 52‑week advance and position above key moving averages reflect improved sentiment. The core debate centers on whether AI expands or dilutes monetization and how much regulatory friction emerges from the DOJ ruling. A constructive base case assumes steady ad growth, gradual Cloud margin improvement, and manageable compliance costs, with capital returns cushioning volatility. Upside depends on demonstrable AI‑driven lift in engagement and advertiser ROI, plus faster backlog conversion; downside skews to heavier AI cost curves, tougher remedies, and competitive pressure. On balance, Alphabet appears positioned to compound, but the spread of outcomes remains meaningful, keeping execution and disclosure quality front and center for investors.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.