Aptiv enters late‑2025 with a clearer set of signals for the next three years: the stock recovered from a spring sell‑off to hit a one‑year high after a revenue beat and analyst upgrades, while fundamentals remain mixed. Trailing‑twelve‑month revenue stands at 19.79B, but earnings volatility and modest growth point to uneven demand and program timing. Operating margin of 11.00% underscores solid cost discipline in wiring, connectors, and active safety, yet quarterly earnings swings flag limited pricing power with automakers and potential one‑offs. The move reflects a sector backdrop where European EV adoption is rising even as the broader car market stalls, and major suppliers are cutting costs and refocusing. For investors, what changed is confidence in content‑per‑vehicle growth across high‑voltage, ADAS (driver assistance), and software‑defined vehicle programs; why it changed is a combination of execution on launches and improved sentiment; and why it matters is that sustained cash generation and backlog conversion will determine whether the multiple can expand as the EV/Safety cycle matures.

Key Points as of October 2025

- Revenue: trailing‑twelve‑month revenue 19.79B; latest quarterly revenue growth (yoy) 3.10% – steady but not breakneck.

- Profit/Margins: operating margin (ttm) 11.00%; profit margin 5.12%; diluted EPS (ttm) 4.42; quarterly earnings growth (yoy) −58.10% indicates volatility and likely mix/one‑time effects.

- Sales/Backlog: detailed backlog disclosure not provided; outlook hinges on 2026–2027 program ramps in high‑voltage and ADAS content.

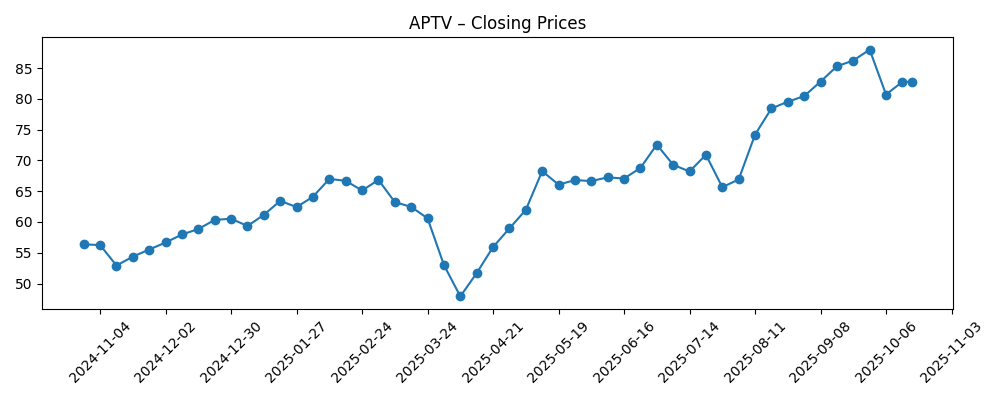

- Share price: 52‑week high 88.80 vs low 47.19; 50‑day and 200‑day moving averages 81.08 and 68.14; beta 1.55 highlights higher‑than‑market volatility.

- Analyst view: average price target reported at 85.73; recent upgrade coincided with a new 1‑year high and improving sentiment on catalysts.

- Market cap: data not disclosed in provided materials.

- Balance sheet & cash: total debt 8.35B vs cash 1.45B; current ratio 1.76; levered free cash flow (ttm) 1.57B supports investment and deleveraging flexibility.

- Ownership/sentiment: institutional ownership 101.82% (reflects lending/derivatives mechanics); short interest 2.58% of float; short ratio 2.14.

- Qualitative: strong positioning in EV architecture, wiring and ADAS; no current dividend (trailing yield 0.00%), signaling reinvestment focus.

Share price evolution – last 12 months

Notable headlines

- Aptiv (APTV) Reports Q2 Earnings, Beats Revenue Estimates – Yahoo Finance

- Aptiv Sets New 1‑Year High on Analyst Upgrade – ETF Daily News

- Aptiv Receives $85.73 Average PT from Analysts – ETF Daily News

- Analyst Explains Catalysts for Aptiv (APTV) Stock – Yahoo

- EU EV sales surge as overall car market stalls – Euronews

- Bosch to cut 13,000 jobs in auto parts – Euronews

- German chancellor calls auto summit amid industry job losses – DW

Opinion

Aptiv’s latest prints suggest the recovery in 2025 has been driven more by sentiment and program visibility than by a step‑change in growth. The revenue beat in Q2, alongside 3.10% yoy quarterly growth, indicates steady demand for its core wiring and active safety businesses. However, the −58.10% yoy quarterly earnings change signals either tough prior‑year comparisons or temporary headwinds such as launch costs, volume mix, or price give‑backs to automakers. On a trailing basis, an 11.00% operating margin and 5.12% net margin show healthy underlying economics for a tier‑one supplier with scale in connectors, harnesses and ADAS. The quality question is whether margins can hold as EV programs scale and OEMs intensify cost‑downs. Free cash flow capacity (1.57B ttm) helps bridge volatility and fund R&D and tooling without stressing liquidity.

The balance sheet is serviceable but not trivial: 8.35B of total debt against 1.45B in cash and a 1.76 current ratio implies headroom, provided execution avoids prolonged margin compression. Institutional ownership above 100% (mechanics of lending/derivatives) and a modest short interest (2.58% of float; short ratio 2.14) point to active positioning but no consensus bet against the story. Share action through mid‑to‑late 2025 — recovering from a March–April downdraft to a new 52‑week high — aligns with the narrative of stabilizing launches and improving visibility in high‑voltage wiring, domain controllers, and radar/camera content. The absence of a dividend keeps capital focused on growth and potential deleveraging as cash flow permits.

Industry context is pivotal. EU EV penetration is rising even as the broader market stalls, which favors Aptiv’s content‑per‑vehicle in high‑voltage and safety systems. Simultaneously, cost reductions and restructuring among peers (e.g., job cuts at large European suppliers) signal a more disciplined supply base and potential share shifts. Policymaker attention — such as Germany’s auto summit — underscores regulatory and competitiveness pressures that can shape sourcing, localization, and software requirements. Against this backdrop, Aptiv’s breadth across wiring, connectors and ADAS positions it to participate in the software‑defined vehicle transition without being overly reliant on any single OEM or model cycle.

What this means for the equity story is a tug‑of‑war between multiple expansion on EV/safety content and the reality of cyclical auto demand and OEM bargaining power. If Aptiv converts awarded programs on time, sustains double‑digit operating margins, and demonstrates recurring software/service attach where applicable, the narrative can tilt toward durable cash generation and gradual deleveraging — conditions that typically support higher multiples for suppliers with technology exposure. Conversely, slippage in program ramps, price pressure, or a broader auto downturn could refocus investors on balance‑sheet leverage and earnings volatility, compressing the multiple. Near term, the stock’s beta (1.55) and recent outperformance versus the S&P 500 emphasize sensitivity to macro prints and auto production schedules.

What could happen in three years? (horizon October 2028)

| Outcome | Narrative |

|---|---|

| Best case | EV adoption accelerates in Europe and stabilizes in North America; Aptiv executes on high‑voltage and ADAS launches with strong take‑rates, keeps operating margins around low‑double digits, and uses healthy free cash flow to reduce leverage. Software‑defined vehicle wins expand content per vehicle, supporting a premium technology‑supplier narrative. |

| Base case | Global auto production is range‑bound; EV mix rises gradually. Aptiv delivers steady content growth offset by OEM price pressure and FX, holding margins near current levels. Cash generation funds selective investment and maintains balance‑sheet flexibility; valuation tracks execution and macro swings. |

| Worse case | Auto demand weakens and EV adoption pauses; program delays and pricing concessions erode margins. Working‑capital needs rise, constraining cash flow and limiting deleveraging. The market reframes Aptiv as a cyclical supplier first, delaying multiple expansion until conditions improve. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on 2026–2027 high‑voltage and ADAS program launches (timing, yields, and warranty performance).

- OEM pricing and production schedules amid EV mix shifts and regional demand variability.

- Margin sustainability versus input costs and cost‑down pressures; ability to offset with design/content wins.

- Free cash flow delivery and balance‑sheet trajectory relative to 8.35B total debt and investment needs.

- Regulatory and trade developments affecting EV incentives, safety mandates, and localization requirements.

- M&A or portfolio actions (e.g., divestments/partnerships) that reshape growth mix and capital allocation.

Conclusion

Aptiv’s setup into 2026–2028 is a balance of supportive EV/safety content trends and familiar auto‑cycle risks. The company’s 11.00% operating margin, 19.79B in ttm revenue, and solid free cash flow provide resilience, while the stock’s recovery and recent analyst interest reflect improving confidence in program execution. Still, quarterly earnings volatility and an OEM customer base focused on cost underscore that the path to multiple expansion runs through consistent backlog conversion, stable margins, and disciplined capital use. Sector signals — EU EV growth alongside broader volume stagnation and supplier restructuring — favor scaled technology suppliers that can localize and deliver at cost. For Aptiv, the narrative can compound positively if launches stay on track and cash supports selective investment and deleveraging. Watch next 1–2 quarters: backlog conversion on high‑voltage/ADAS programs; pricing dynamics with key OEMs; free cash flow cadence versus tooling/working‑capital needs; and any portfolio moves that clarify long‑term mix.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.