BYD Company Limited (1211.HK) is a Chinese new‑energy manufacturer spanning passenger electric and plug‑in hybrid vehicles, batteries, energy storage and electronics. It sells mass‑market to premium models domestically and abroad, and competes with Tesla, Geely/SAIC, Li Auto, NIO, XPeng and global legacy automakers.

Financially, BYD reports trailing‑12‑month revenue of 847.26B and net income of 41.92B, implying a 4.97% profit margin and 2.00% operating margin. ROE stands at 21.79%. Quarterly revenue grew 14.00% year over year, while quarterly earnings fell 29.90% yoy. Cash totals 147.43B versus 50.19B debt (current ratio 0.76). Operating cash flow is 151.11B with levered free cash flow at -2.95B. The stock’s forward dividend yield is 1.36% with a 17.58% payout ratio.

Key Points as of September 2025

- Revenue scale and growth: TTM revenue 847.26B; the most recent quarterly revenue growth was +14.00% yoy, reflecting robust unit momentum despite intensifying competition.

- Profit and margins: TTM profit margin 4.97% and operating margin 2.00%; TTM net income 41.92B. Quarterly earnings growth of -29.90% yoy underscores price‑war pressure on profitability.

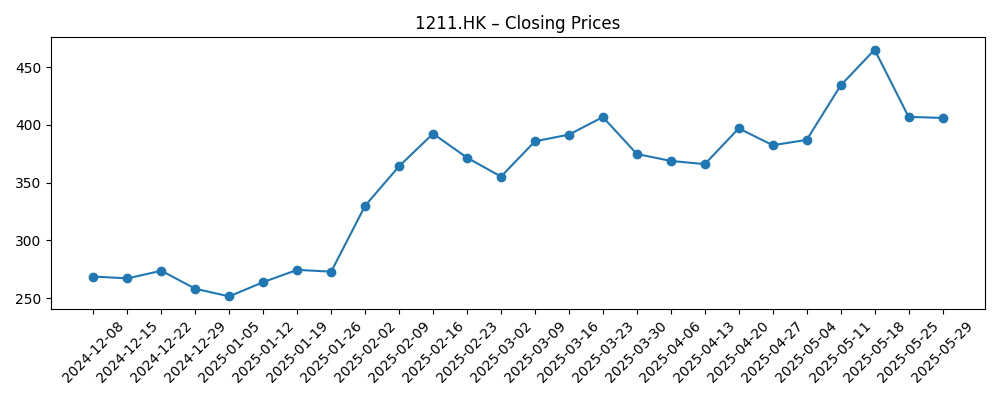

- Share price and trend: Last close 106.30 (Sep 23, 2025). 52‑week change +32.27%; high 158.867 and low 80.333. Trading below 50‑day (115.224) and 200‑day (117.263) moving averages and ~32% below the May 2025 peak (~155.07).

- Market cap: Implied ≈HK$391B using 3.68B shares outstanding at HK$106.30.

- Balance sheet and liquidity: Total cash 147.43B vs total debt 50.19B; current ratio 0.76.

- Cash flow: Operating cash flow 151.11B; levered free cash flow -2.95B.

- Dividend and actions: Forward annual dividend rate 1.45 (yield 1.36%); payout ratio 17.58%; ex‑dividend 6/10/2025. Last split 6:1 on 7/30/2025.

- Sentiment: September news highlighted the first profit drop in three years and Berkshire Hathaway’s full exit, keeping sentiment cautious.

- Trading dynamics: Avg 3‑month volume 34.7M; beta (5Y monthly) 0.32.

Share price evolution – last 12 months

Notable headlines

- BYD Profit Drop Shows Even EV Leader Isn’t Safe in Price War — Yahoo Entertainment

- BYD stock drops as Warren Buffett's Berkshire Hathaway fully exits stake — Yahoo Entertainment

- BYDDF: BYD Stock Sinks After First Profit Drop in 3 Years — Yahoo Entertainment

- Rival BYD’s Shares Slump in China after Q2 Profit Plunge — Biztoc

Opinion

Two developments reshaped the narrative in September: BYD’s first profit drop in three years and Berkshire Hathaway’s full exit. Together they reinforced what the tape had signaled since May’s peak — pricing pressure is eroding near‑term earnings power and compressing the multiple.

Even so, scale and vertical integration remain potent moats. With 847.26B in TTM revenue and 151.11B of operating cash flow, BYD has strategic room to navigate discounts, while a -2.95B levered free cash flow and a 0.76 current ratio argue for tight working‑capital control.

International mix and product cadence likely decide whether margins re‑expand. If export growth and higher‑trim hybrids offset domestic discounting, the 4.97% net margin can stabilize; if not, rallies may fade below the 50–200‑day averages as investors wait for proof of pricing discipline.

For shareholders, the 6:1 split boosts liquidity and the 1.36% forward yield (17.58% payout) adds modest carry. But sentiment remains headline‑driven; absent evidence that the price war is normalizing, volatility should persist and valuation could stay range‑bound.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative | Equity implication |

|---|---|---|

| Best | Export growth, premium trims and battery cost advantages offset domestic discounting; operating discipline lifts margins while cash generation funds capacity and software features. | Re‑rating toward quality growth as profitability improves and volatility declines; dividend capacity expands. |

| Base | Price competition remains but eases; mix improves gradually with steady overseas traction; cash flow stays solid, funding selective capex and model refreshes. | Range‑bound multiple; returns track earnings growth with periodic swings around newsflow. |

| Worse | Prolonged price war and tariff headwinds; mix downgrades and inventory pressure strain working capital; free cash flow remains subdued. | De‑rating and elevated volatility; focus shifts to balance‑sheet resilience and capital preservation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Intensity and duration of China EV price competition and discounting cycles.

- Export growth vs. tariff and regulatory risks in key markets.

- Battery technology, cost curve progress, and energy‑storage attach rates.

- Working‑capital discipline and free‑cash‑flow trajectory relative to capex.

- Model pipeline, brand mix, and average selling price sustainability.

- Headline risk: profit trend and large‑holder moves affecting sentiment.

Conclusion

BYD enters the next three years with clear strengths — scale, vertical integration, and healthy operating cash flow — but faces a visible profitability challenge from the industry’s price war. The latest metrics show a 4.97% profit margin and 2.00% operating margin alongside a -29.90% quarterly earnings growth rate yoy, reminding investors that volume gains do not automatically translate into earnings per share. Balance sheet and liquidity indicators are mixed: 147.43B in cash versus 50.19B in debt is supportive, yet a 0.76 current ratio and negative levered free cash flow call for tight execution. Shares trade below the 50‑ and 200‑day averages after a strong 52‑week gain, reflecting a reset in expectations following the profit drop and Berkshire’s exit. On balance, a base case of choppy but positive progress appears reasonable, with upside tied to export mix and disciplined pricing, and downside if discounting endures. Evidence of margin stabilization will likely be the pivotal re‑rating catalyst.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.