Honda Motor Co. (7267.T) enters the next three years balancing margin repair with a measured electrification push. The stock has stabilized around 1,631 by 19 September 2025, up 5.36% over the past year and trading above its 200‑day moving average of 1,470.00. Fundamentals show trailing revenue of 21.62T, a 2.95% profit margin and 4.57% operating margin. Cash of 4.17T against 11.87T in total debt and a 1.30 current ratio anchor liquidity, while a 4.27% forward dividend yield and 47.25% payout ratio support total return. Recent headlines point to a product refresh, including a hybrid Prelude, alongside mixed sentiment — a tepid Acura ADX review and a “Reduce” consensus rating roundup. With low beta (0.32) and steady free cash flow, Honda’s risk profile looks measured, but near‑term revenue and earnings growth are soft.

Key Points as of September 2025

- Revenue: 21.62T (ttm); quarterly revenue growth (yoy) -1.20%; revenue per share 4,788.39.

- Profit/Margins: Profit margin 2.95%; operating margin 4.57%; net income 637.85B; EBITDA 1.42T.

- Sales/Backlog: Quarterly earnings growth (yoy) -50.20%; no disclosed backlog figures in the snapshot.

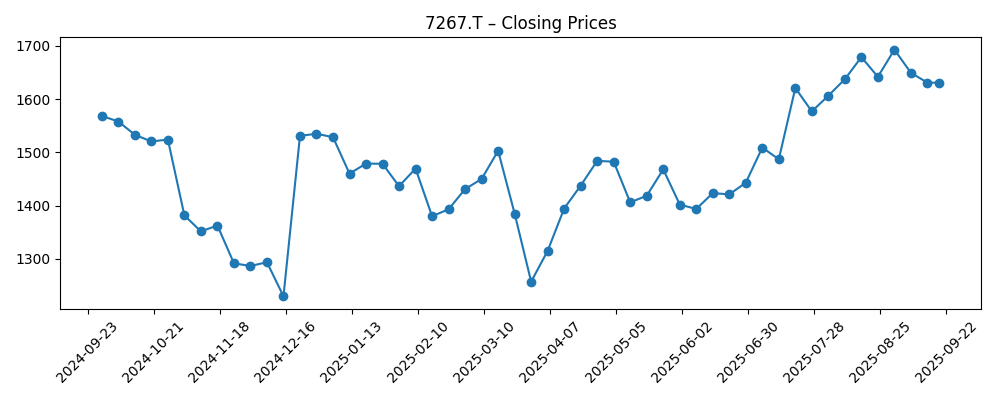

- Share price: Last weekly close 1,631.0 (19 Sep 2025); 52-week high 1,730.00 and low 1,156.00; 50-day MA 1,612.49; 200-day MA 1,470.00; beta 0.32; 52-week change 5.36%.

- Analyst view: One roundup cites a consensus rating of “Reduce.”

- Market cap: Not stated in the snapshot; shares outstanding 3.89B; float 3.73B; insiders 3.02%; institutions 39.61%.

- Balance sheet: Total cash 4.17T; total debt 11.87T; debt/equity 98.42%; current ratio 1.30; operating cash flow 459.07B; levered FCF 593.41B.

- Dividend/Corporate actions: Forward dividend rate 70 with 4.27% yield; ex-dividend date 9/29/2025; trailing dividend 68.00; last split 3:1 on 10/2/2023.

Share price evolution – last 12 months

Notable headlines

- Honda to release hybrid version of Prelude

- All-New 2025 Acura ADX Is Stylish But Tepid

- Ieq Capital LLC Makes New Investment in Honda Motor Co., Ltd. (HMC)

- Raymond James Financial Inc. Grows Stock Holdings in Honda Motor Co., Ltd.

- HighTower Advisors LLC Has $1.32 Million Stake in Honda Motor Co., Ltd.

- Northwestern Mutual Wealth Management Co. Raises Stock Position in Honda Motor Co., Ltd.

- Cresset Asset Management LLC Reduces Stock Holdings in Honda Motor Co., Ltd.

- Honda Motor Co., Ltd. Receives Consensus Rating of “Reduce” from Brokerages

Opinion

Honda’s next leg likely hinges on execution in hybrids and the cadence of new models. The planned return of the Prelude as a hybrid underscores a pragmatic strategy focused on efficiency and brand heritage rather than an all-in EV pivot. That may resonate with buyers wary of charging infrastructure, helping stabilize volumes and mix. Still, recent commentary around the 2025 Acura ADX being “stylish but tepid” hints that product desirability must improve to support pricing power. With profit and operating margins in the low single digits and quarterly revenue and earnings growth running negative, any stumble on launches could prolong margin pressure. Against this backdrop, the company’s ample cash, manageable liquidity, and a covered dividend are meaningful buffers while management works on product and cost levers.

Technically, shares have rebuilt momentum after late-2024 volatility, climbing above the 200-day moving average and holding near the 50-day trendline. The 52-week high is within reach, but the recent pullback toward the mid-1,600s shows supply remains active into strength. Low beta suggests muted swings versus the broader market, which suits income-oriented holders attracted by the forward yield. For capital appreciation, however, the setup likely requires either sustained improvements in margins or clearer signs that the new model wave can lift revenue. If the stock can consolidate above its 50-day average and sentiment improves from a “Reduce” stance, the path to a retest of the highs remains open.

Institutional flow headlines present a mixed but constructive picture: some managers added to positions while others trimmed. In aggregate, this implies a market still calibrating to Honda’s slower near-term growth and the cost of transition. The crucial question is whether product differentiation — particularly in hybrids — can support pricing without heavy incentives. Honda’s scale and manufacturing discipline can help, but the margin structure leaves less room for error. Meanwhile, the dividend policy appears sustainable under current cash generation, offering ballast if valuation multiples wobble. If management can articulate a clearer software and services roadmap around connected features and driver-assist, that could add a higher-margin layer to the story.

On balance, the three-year outlook is a tug-of-war between cyclical auto demand and secular drivetrain shifts. A steady hybrid portfolio could maintain utilization and protect returns on assets and equity, though those returns are modest today. The downsides revolve around competitive pricing, regulatory changes, and potential cost inflation in batteries and electronics. The upsides include operational efficiency, favorable model reception, and disciplined capital allocation. With liquidity intact and leverage contained, Honda has time to execute — but the market is signaling it wants proof of accelerating growth before awarding a richer multiple. Patience and selectivity may be rewarded, especially for investors prioritizing total return over rapid capital gains.

What could happen in three years? (horizon September 2025+3)

| Scenario | Path | What it means |

|---|---|---|

| Best | Hybrid-led launches gain traction; premium brand perception improves; cost discipline and supply stability lift operating efficiency; investor sentiment shifts from “Reduce” to neutral/positive. | Margins expand, cash generation strengthens, and the dividend remains secure with scope for incremental increases; shares sustain above long-term trend. |

| Base | Solid but unspectacular demand; mixed model reviews; steady cost control offsets input pressures; product cadence maintains share without major pricing power. | Earnings stabilize; dividend policy holds; stock tracks close to broader indices with low volatility, oscillating around key moving averages. |

| Worse | Launch slippages or weak reception for key models; intensified pricing competition; component cost or regulatory burdens outpace savings. | Margins compress; cash conservation becomes priority; sentiment stays cautious; shares lag, testing support levels and constraining capital return flexibility. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Product execution and reception, especially for hybrids (e.g., Prelude) and North American line-up competitiveness.

- Margin trajectory relative to input costs and incentives, with progress on manufacturing efficiency and procurement.

- Capital allocation discipline — sustaining the dividend, managing leverage, and pacing investment in electrification.

- Regulatory and trade developments affecting emissions standards, safety features, and supply chain costs.

- Currency and macro demand trends that influence export pricing and consumer affordability.

- Analyst and institutional sentiment shifts from recent “Reduce” bias, including changes in ownership flows.

Conclusion

Honda’s three-year setup blends income resilience with operational rebuilding. Trailing revenue scale is substantial, but profitability is thin, and recent growth metrics are subdued. Management’s pragmatic tilt toward hybrids — reinforced by the Prelude’s return — aligns with buyer preferences in key markets and may support volume without overextending on capital-heavy EV bets. The dividend appears supported by current cash generation and balance sheet capacity, offering an anchor while product cycles mature. Technically, shares sit above long-term averages with a low beta profile, suggesting a smoother ride than more volatile peers. For upside, investors will look for clearer evidence of margin improvement and stronger model pull, particularly in North America where brand perception mixed with the Acura ADX commentary. Absent that, the base case is a range-bound trajectory with yield as the primary contributor to total return. Selective accumulation on weakness may suit patient holders awaiting execution milestones.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.