Itaú Unibanco (ITUB), Latin America’s largest private bank, enters September 2025 near its 52‑week high as fundamentals show strong profitability but mixed top‑line momentum. Over the last twelve months, the bank posted revenue of 134.78B and net income attributable to common of 42.84B, implying a 31.79% profit margin and 26.95% operating margin. Return metrics remain compelling with ROE at 20.81% and ROA at 1.57%. However, quarterly revenue growth was -8.90% year over year even as quarterly earnings growth reached 10.60%. Shares have a low 5‑year beta of 0.30 and are up 16.87% over the past year versus 17.41% for the S&P 500. Balance‑sheet lines include 415.27B in cash and 1.01T in total debt; operating cash flow (ttm) was -40.66B. The forward annual dividend rate is 0.04 (0.52% yield), with the next ex‑dividend date on 10/2/2025.

Key Points as of September 2025

- Revenue: ttm at 134.78B; quarterly revenue growth (yoy) at -8.90% indicates softer top‑line momentum.

- Profit/Margins: Profit margin 31.79%; operating margin 26.95% underscore resilient profitability.

- Earnings & returns: Net income (ttm) 42.84B; ROE 20.81%; ROA 1.57%; diluted EPS (ttm) 0.75.

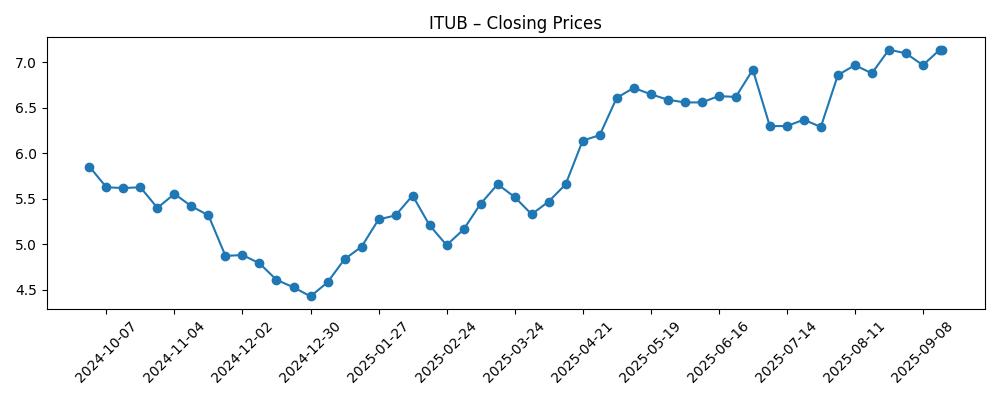

- Share price/technicals: 52‑week high 7.23 and low 4.42; recent weekly close near 7.14; 50‑day MA 6.70 vs 200‑day MA 5.88; 52‑week change 16.87% vs S&P 500 at 17.41%.

- Dividend: Forward dividend 0.04 (0.52% yield); trailing dividend 2.39 (33.47% yield); payout ratio 80.31%; ex‑div 10/2/2025; dividend date 1/9/2026.

- Balance sheet & liquidity: Total cash (mrq) 415.27B; total debt 1.01T; operating cash flow (ttm) -40.66B; beta (5Y) 0.30.

- Sales/Backlog: Not disclosed in provided data; revenue trend shows -8.90% yoy decline.

- Market cap: Not provided in the supplied figures.

- Shareholder base & short interest: Institutions hold 25.61%; shares short 82.68M (8/29/2025); short ratio 2.76; short % of float 1.55%.

Share price evolution – last 12 months

Notable headlines

- Cresset Asset Management LLC Raises Holdings in Itau Unibanco Holding S.A. (ITUB)

- American Century Companies Inc. Raises Stake in Itau Unibanco Holding S.A. (ITUB)

- Ameriprise Financial Inc. Increases Stake in Itau Unibanco Holding S.A. (ITUB)

- Invesco Ltd. Acquires 216,519 Shares of Itau Unibanco Holding S.A. (ITUB)

- Itau Unibanco Holding S.A. (ITUB) Shares Purchased by Amundi

- CW Advisors LLC Grows Stake in Itau Unibanco Holding S.A. (ITUB)

- Ieq Capital LLC Makes New Investment in Itau Unibanco Holding S.A. (ITUB)

- Advisors Asset Management Inc. Acquires 11,670 Shares of Itau Unibanco Holding S.A. (ITUB)

- Itaú Unibanco (NYSE: ITUB) Reaches New 52‑Week High After Dividend Announcement

Opinion

Institutional accumulation has featured prominently in recent headlines, and it often signals confidence in liquidity, governance, and medium‑term earnings resilience. For ITUB, this activity coincides with shares hovering near the 52‑week high of 7.23 and a 52‑week change of 16.87% against 17.41% for the S&P 500. The technical backdrop is constructive, with the 50‑day moving average at 6.70 above the 200‑day at 5.88, and recent weekly closes approaching 7.14. These supports, paired with a 0.30 beta, suggest a steadier ride than the broader market. Yet price leadership ultimately needs earnings follow‑through. The bank’s -8.90% quarterly revenue growth contrasts with 10.60% quarterly earnings growth, implying that mix, cost discipline, or credit outcomes are doing the heavy lifting while headline revenue lags. Sustaining this gap is possible in the near term, but a healthier outlook depends on stabilizing top‑line trends.

Profitability is the key pillar of the investment case. A 31.79% profit margin and 26.95% operating margin, together with 20.81% ROE, anchor the bull argument that ITUB can continue compounding book value, even if growth is uneven. The bank also carries substantial resources with 415.27B in cash against 1.01T in total debt, typical for a large universal bank, though operating cash flow at -40.66B (ttm) reminds investors that banking cash flows can be volatile across cycles. The low 0.30 beta indicates that the stock tends to move less than the market, which could appeal to investors prioritizing stability. Still, the near‑term setup is not without tension: if revenue softness persists, valuation support must come from efficiency and risk costs. A period of flat revenue with strong returns can still be attractive, but it narrows the margin for error.

Capital returns add complexity. The forward annual dividend rate of 0.04 (0.52% yield) contrasts sharply with a trailing dividend of 2.39 and a 33.47% trailing yield, a figure that can reflect timing effects in ADR distributions. The payout ratio of 80.31% places a premium on future earnings consistency. With an ex‑dividend date on 10/2/2025 and dividend date on 1/9/2026, near‑term flows can support trading interest, especially as coverage from earnings remains solid. However, if growth underperforms, management may prioritize capital buffers over distributions. Meanwhile, short interest is low (82.68M shares; short ratio 2.76; short % of float 1.55%), reducing the likelihood of outsized moves driven by covering, but also signaling a broadly constructive consensus that can limit contrarian upside.

Looking out three years, the base case rests on gradual normalization of revenue after the -8.90% quarterly decline, while earnings compound from a high return base. If ROE remains close to 20.81% and credit costs behave, ITUB can defend its premium to domestic peers with a low beta profile. In a better environment—with improving loan demand, benign asset quality, and stable funding—the bank could maintain earnings growth consistent with the recent 10.60% quarterly trend, supporting ongoing dividends even with a high payout policy. Conversely, weaker domestic activity or higher funding costs could push revenue and returns lower, pressuring the payout. Overall, recent institutional buying and technical momentum are supportive signals, but the durability of margins and the path of top‑line recovery will likely determine whether the stock can extend gains from near 52‑week highs.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Revenue stabilizes and improves from the recent -8.90% quarterly decline; earnings growth trends at or above the recent 10.60%; ROE sustained at or above 20.81%. Dividend continuity supported by solid profitability and low beta (0.30) helps attract steady inflows. |

| Base | Top line gradually normalizes while margins remain resilient near recent levels. Earnings growth moderates but stays positive; dividend policy remains intact given the 80.31% payout ratio and adequate earnings coverage. Technicals hover around long‑term averages. |

| Worse | Macroeconomic headwinds weaken revenue and compress returns below recent benchmarks; funding and credit costs rise. Distribution policy becomes more conservative despite prior trailing yield metrics; price retreats from the 52‑week high region toward support areas. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Brazil macro and policy rates – revenue sensitivity and funding costs can reinforce or reverse the -8.90% revenue trend.

- Asset quality and credit costs – key swing factor for sustaining 10.60% earnings growth and 20.81% ROE.

- Capital returns – dividend sustainability (forward 0.04; payout ratio 80.31%; ex‑div 10/2/2025) as a valuation anchor.

- FX and ADR mechanics – currency moves can distort reported yields (e.g., 33.47% trailing yield) and investor perceptions.

- Market technicals and flows – 50‑/200‑day moving averages (6.70/5.88), low beta (0.30), and institutional buying versus modest short interest (2.76 ratio).

Conclusion

Itaú Unibanco’s setup into 2028 balances attractive returns and stability against a softer revenue backdrop. The bank’s profit margin of 31.79%, operating margin of 26.95%, and ROE of 20.81% show durable efficiency, while quarterly earnings growth of 10.60% suggests operating leverage and credit outcomes are supportive. Shares trade near a 52‑week high of 7.23 with momentum reinforced by the 50‑day average above the 200‑day and a low 0.30 beta. Dividend signals are mixed: a modest forward yield (0.52%) sits alongside a high trailing figure and an 80.31% payout ratio, keeping the focus on earnings durability. Institutional accumulation and low short interest add a favorable demand backdrop. Over three years, a base case of stable returns with gradual top‑line normalization appears reasonable; upside requires clearer revenue acceleration, while downside stems from macro or asset‑quality shocks. On balance, the risk‑reward skews constructive but tethered to execution.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.