Johnson & Johnson (JNJ) enters September 2025 with resilient fundamentals and a steadier share price. The healthcare giant reports $90.63B in trailing 12‑month revenue, a 25.0% profit margin, and $30.25B in EBITDA, supported by $23.03B in operating cash flow and $11.08B in levered free cash flow. The stock has rebounded toward its 52‑week high of $181.16, closing recently around $178, while maintaining a low 0.39 beta and a forward dividend yield near 2.91% with a 53.75% payout ratio. Balance‑sheet capacity remains ample with $18.88B in cash against $50.76B in debt and a current ratio of 1.01. Headlines center on a $2B U.S. manufacturing investment, tariff‑policy uncertainty, and mixed analyst sentiment, including a $200 target from Citi and a scenario for $250 outlined by Forbes. This note outlines a three‑year outlook through September 2028.

Key Points as of September 2025

- Revenue – Trailing 12‑month revenue of $90.63B; revenue per share $37.65; quarterly revenue growth (yoy) 5.8%.

- Profit/Margins – Profit margin 25.00%; operating margin 28.91%; net income $22.66B; diluted EPS 9.34.

- Cash flow – EBITDA $30.25B; operating cash flow $23.03B; levered free cash flow $11.08B; payout ratio 53.75%; forward dividend yield 2.91%.

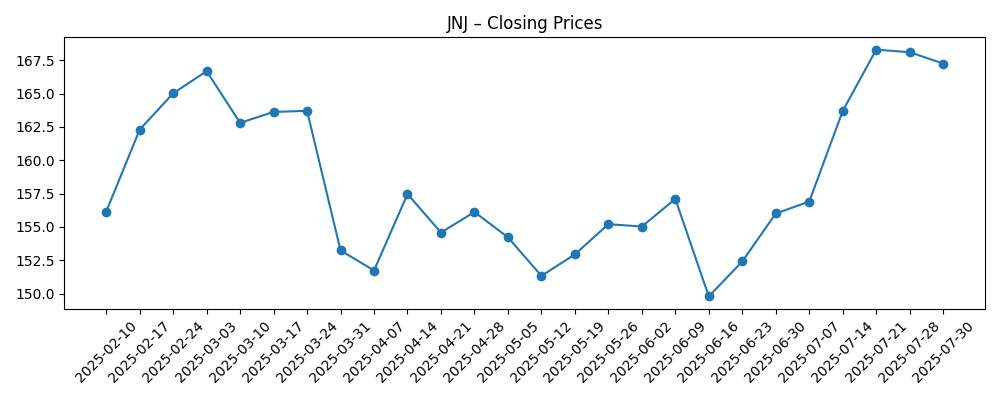

- Share price – Recent close ~$178.06; 52‑week range $140.68–$181.16; 50‑day MA $169.95; 200‑day MA $157.95; beta 0.39; 52‑week change 7.84% vs S&P 500 at 17.09%.

- Analyst view – Citi lifts price target to $200; Forbes frames a path to $250; Wall Street Zen rating cited as “Hold.”

- Market cap – Approx. $429B (2.41B shares × ~$178.06); institutions hold 74.37%; short interest 0.78% (short ratio 2.26).

- Balance sheet – Total cash $18.88B; total debt $50.76B; current ratio 1.01; debt/equity 64.69%.

- Sales/Backlog – Quarterly revenue growth 5.8% yoy; MedTech and pharma product cadence remain key to 2026–2028 sales trajectory.

- Trading/flow – Avg 3‑month volume 8.46M; unusual options activity reported in late August 2025.

Share price evolution – last 12 months

Notable headlines

- Johnson & Johnson: JNJ Stock To $250? [Forbes]

- Johnson & Johnson to Invest $2 Billion in New North Carolina Facility [Yahoo Entertainment]

- How Recent Pharma Tariff Delays Could Impact J&J’s Share Price in 2025 [Yahoo Entertainment]

- Citi Lifts Johnson & Johnson (JNJ) Price Target to $200 on MedTech Strength [Yahoo Entertainment]

- Johnson & Johnson Target of Unusually High Options Trading (NYSE:JNJ) [ETF Daily News]

- Johnson & Johnson (NYSE:JNJ) Rating Lowered to “Hold” at Wall Street Zen [ETF Daily News]

- Johnson & Johnson Stock (JNJ) Sickens Despite U.S. Manufacturing Pledge to Beat Tariffs [Biztoc]

Opinion

JNJ’s latest headlines point to a strategic tilt toward capacity and supply resilience. The announced $2 billion North Carolina facility suggests management is preparing for longer‑term demand in MedTech and select pharma categories while buffering geopolitical frictions. Domestic production can mitigate tariff volatility and logistics risk, potentially protecting gross margins that currently support a 25.0% profit margin and 28.91% operating margin. The capital outlay also signals confidence in a multi‑year product cadence and could improve lead times, an important factor for hospital procurement. While near‑term construction costs weigh on free cash flow, the company’s $23.03B in operating cash flow and low beta profile offer ballast. Over three years, successful ramp‑up, validation, and quality metrics at the new site would be key to translating capex into share‑gain and pricing durability.

Shares have regained momentum, sitting near the 52‑week high of $181.16 and above both the 50‑day ($169.95) and 200‑day ($157.95) moving averages. With a forward dividend yield near 2.91% and a 53.75% payout ratio, the income case remains intact, aided by a 0.39 beta that historically tempers drawdowns. Still, the 52‑week return of 7.84% lags the S&P 500’s 17.09%, underscoring investors’ preference for secular growth elsewhere. Low short interest (0.78%) and reports of unusual options activity point to a market positioning that is neither crowded nor complacent. Into 2026, the stock’s path likely hinges on whether revenue growth can remain at or above recent 5.8% yoy levels while preserving margin discipline.

Sell‑side and media views have turned incrementally constructive on MedTech, with Citi’s $200 target and a Forbes scenario toward $250 framing the debate. For JNJ to earn those outcomes, execution would need to pair steady top‑line growth with consistent cash conversion, using the balance sheet (cash of $18.88B versus debt of $50.76B) to fund pipeline, manufacturing, and tuck‑in deals without diluting returns. Institutional ownership of 74.37% implies a base of long‑term holders who may reward predictability more than upside surprises. Over a three‑year horizon, catalysts such as product launches, manufacturing milestones, and clarity on tariff timing could trigger periodic re‑ratings, but sustained outperformance depends on operational follow‑through rather than narrative alone.

Risks are not trivial. Pricing frameworks and tariff policies remain moving targets, and any unfavorable turn could pressure volumes or mix. Regulatory timelines and trial outcomes can shift, affecting near‑term sales trajectories in both pharma and devices. While leverage is manageable, the company will need to balance shareholder returns with investment, keeping free cash flow healthy (levered FCF currently $11.08B) to fund growth and dividends. Given JNJ’s defensive attributes and cash generation, downside should be cushioned versus higher‑beta peers, yet relative returns may lag if broader markets continue to favor faster‑growing names. The base case is a compounding story driven by MedTech execution and operational resilience.

What could happen in three years? (horizon September 2028)

| Scenario | What it looks like | What could drive it |

|---|---|---|

| Best | Sustained sales expansion with stable margins; successful U.S. capacity ramp supports supply reliability; shares hold above prior highs and sentiment improves. | Strong MedTech uptake, timely product clearances, effective tariff mitigation, and continued cash conversion supporting reinvestment and dividends. |

| Base | Steady, low‑volatility compounding; stock tracks earnings and dividends; valuation remains near historical norms with periodic swings around support/resistance levels. | Revenue growth near recent trend, disciplined opex, incremental portfolio renewals, and balanced capital allocation. |

| Worse | Growth slows and margins compress; multiple de‑rates; stock gravitates toward defensive trading patterns below recent peaks. | Adverse pricing/tariff policy, regulatory delays, competitive pressure in key categories, and operational hiccups at newer facilities. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Tariff and pricing policy outcomes affecting U.S. manufacturing economics and realized pricing.

- MedTech and pharma product cadence, including regulatory approvals and competitive responses.

- Execution on the new North Carolina facility and broader supply‑chain reliability.

- Capital allocation balance between dividends, investment, and potential M&A under existing leverage.

- Macro and FX swings that move hospital budgets and international demand for devices and therapies.

Conclusion

JNJ’s setup into 2028 blends dependable cash generation with tangible growth options. The company’s $90.63B revenue base, robust margins, and $23.03B in operating cash flow provide room to fund capacity, pipeline, and the dividend, while a 0.39 beta offers portfolio ballast. Near‑term, tariff timing and pricing frameworks are the key wildcards, but the decision to invest $2B in a U.S. facility should improve resilience and may enhance customer stickiness. Share performance has improved toward the 52‑week high, yet relative returns still trail the broader market, keeping expectations contained. Against that backdrop, upside depends on consistent execution in MedTech and select pharma franchises, complemented by balanced capital deployment. For long‑term investors seeking durable, lower‑volatility compounding with income, JNJ remains a credible core holding; for momentum‑oriented holders, catalysts from product or policy milestones will likely dictate entry points.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.