JPMorgan Chase enters the next three years from a position of strength: revenue is expanding, profitability remains high, and the stock has re-rated as investors price in steadier net interest income and a recovering fee cycle. Trailing revenue stands at 167.13B, while management’s third‑quarter update and external data points signal better dealmaking, payments growth, and ongoing expense discipline. Shares have outperformed the market over the last year (52‑week change 36.45%), supported by scale advantages and a balance sheet that can flex with the interest‑rate path. The near‑term debate is straightforward: if rates drift lower but the yield curve steepens, net interest income may hold up as funding costs ease; if cuts are faster, spread pressure could re‑emerge, leaving fees to do more work. For the banking sector, where regulation and credit cycles set the tempo, JPMorgan’s size and technology push offer resilience but not immunity. The setup for the next three years hinges on rate normalization, credit quality, and how quickly investment banking and payments can compound.

Key Points as of October 2025

- Revenue – Trailing 12‑month revenue is 167.13B with quarterly revenue growth of 8.80% year over year.

- Profit/Margins – Profit margin is 34.72% and operating margin 43.71%; return on equity sits at 16.44%, underscoring strong profitability for a diversified bank.

- Sales/Backlog – Headlines indicate a rebound in dealmaking and investment banking activity; specific backlog data not disclosed.

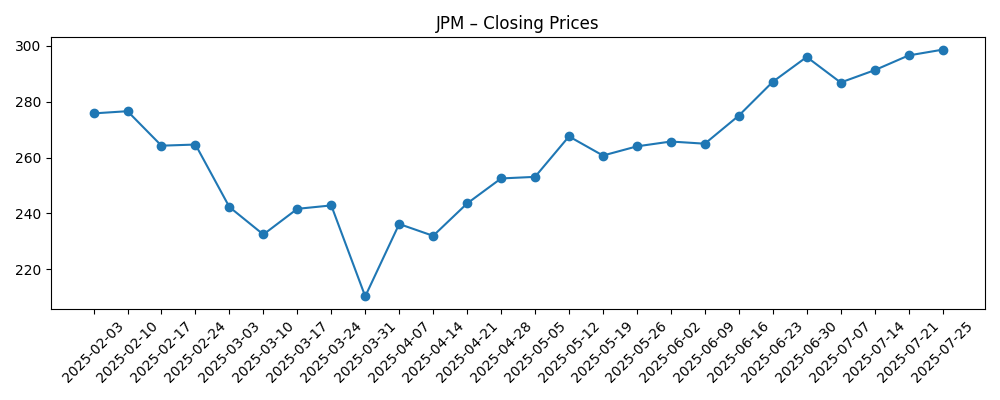

- Share price – Recent weekly close was about 304.15 (10/27), up 36.45% over 52 weeks; trading within a 202.16–318.01 range; beta 1.13.

- Analyst/investor tone – JPMorgan strategists flag hedge funds’ cautious equity exposure, suggesting market sensitivity to macro data despite improved bank fundamentals.

- Market cap – Mega‑cap status; exact market capitalization not disclosed here, but share count (2.72B) and recent price imply a very large valuation.

- Dividend/capital return – Forward annual dividend rate is 6 with a 2.00% yield; payout ratio is 27.49%.

- Balance sheet/liquidity – Total cash of 1.68T vs total debt of 1.14T; current and debt/equity ratios not disclosed.

- Short interest – 26.01M shares short (0.96% of float), short ratio 2.81, indicating limited bearish positioning.

Share price evolution – last 12 months

Notable headlines

- JPMorgan Chase & Co. Reports Third-Quarter 2025 Financial Results

- Goldman Sachs, JPMorgan, and Citi surged past expectations as Wall Street bankers get busy again

- Here’s JPMorgan Chase’s blueprint to become the world’s first fully AI-powered megabank

- JPMorgan Acquires Digital Payment Provider Enroute Systems

- JPMorgan's Dimon backs easing of quarterly earnings requirement, Bloomberg News reports - Reuters

- JPMorgan Strategists Say Hedge Funds Cautious on Equity Exposure

- Jamie Dimon wants to hire bankers in hot sectors for the firm's new $1.5 trillion bet on America

- JPMorgan Chase & Co. Expands Carbon Tracking Capabilities with New Platform

Opinion

JPMorgan’s recent trend line looks constructive. Trailing profitability is strong (profit margin 34.72%) and revenue growth is positive at 8.80% year over year, while press coverage of the third quarter points to upside from a rebound in advisory and underwriting. That mix matters: as net interest income (the spread between asset yields and funding costs) normalizes with the rate cycle, fee businesses can carry more of the earnings load. Trading and payments typically provide ballast in slower lending environments; adding a digital payments asset should help diversify revenues further. The share price sitting near the upper end of its 52‑week range signals market confidence that earnings power is durable into 2026, though volatility in macro data can quickly test that view.

The bigger question is sustainability. If rate cuts are gradual and the yield curve steepens, funding costs may fall faster than asset yields, supporting net interest margins. If cuts are steeper, margin pressure would require fees and efficiency to do more. Management’s technology agenda—positioning JPM as a “fully AI‑powered” bank—aims to bend the cost curve via automation, risk analytics, and personalized servicing. With a payout ratio of 27.49% and low short interest, capital return capacity and positioning look supportive, but the credit cycle remains the swing factor: consumer delinquencies and commercial real estate stress can change the calculus even for a scale leader.

Within the industry, JPMorgan’s breadth in wholesale banking, consumer finance, and payments confers cross‑cycle resilience and pricing power in select niches. The firm is recruiting in high‑growth verticals and embedding AI across workflows, which could reinforce its share of advisory, market‑making, and transaction banking. Regulation is the counterweight: capital and liquidity rules evolve, and compliance costs can blunt efficiency gains. Still, diversified earnings streams typically command a more stable multiple than monoline lenders, especially when fee income rises as a share of the total.

For the equity narrative, the mix shift between net interest income and fees is pivotal. A stronger, broader fee engine reduces earnings volatility and can support a premium to traditional bank valuations if credit costs remain contained. Conversely, a rapid compression in spreads without a commensurate pickup in capital markets or payments would likely compress the multiple. The technology story adds an execution variable: evidence that AI and modernized platforms lower unit costs and lift client acquisition could underpin a higher through‑cycle return profile; missteps, cyber incidents, or customer friction would challenge it. Investors will focus on how these vectors—rate path, fees, credit, and tech execution—interact rather than move in isolation.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Soft‑landing economy with modest growth, gradual rate cuts, and a steeper curve. Net interest income holds as funding costs ease. Investment banking and payments compound on regained share and automation. Technology programs deliver measurable efficiency gains, supporting strong profitability and consistent capital returns. |

| Base case | Mixed macro with uneven growth. Net interest margins drift lower but stabilize; fee recovery in advisory, underwriting, and payments offsets part of the pressure. Credit normalization is manageable. Regulation phases in without major surprises. Valuation tracks steady earnings and dividend growth. |

| Worse case | Sharp slowdown or credit shock. Faster rate cuts compress spreads. Investment banking softens and trading revenue normalizes. Commercial real estate stress and higher consumer delinquencies elevate credit costs. Regulation tightens capital requirements, constraining buybacks. The equity multiple de‑rates until the cycle clears. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate path and yield‑curve shape, which drive net interest income and funding costs.

- Credit quality trends in consumer lending and commercial real estate.

- Capital markets cycle and deal pipeline, affecting fees from advisory, underwriting, and trading.

- Regulatory changes to capital and liquidity frameworks, and outcomes from annual stress tests.

- Execution on AI and payments strategy, including cyber resilience and cost efficiency.

- Capital return decisions (dividends and buybacks) relative to earnings trajectory.

Conclusion

JPMorgan’s setup for the next three years is defined by a balance of sturdy profitability and shifting macro currents. High margins and double‑digit revenue growth on a trailing basis give management room to navigate rate normalization, while headlines point to healthier fee engines in advisory, underwriting, and payments. The stock’s strong 12‑month performance suggests investors are already underwriting resilience; sustaining that narrative will require evidence that fee momentum and technology‑driven efficiency can offset any spread compression and credit normalization. Within U.S. large‑cap banks, scale, diversified revenues, and execution on AI position JPMorgan to remain a core franchise even as regulation and competition evolve. Watch next 1–2 quarters: net interest margin trajectory; investment‑banking fee conversion from pipeline; consumer credit trends; progress on AI deployment and payments integration; capital return after stress tests. The path from here is less about one line item and more about the mix—how lending spreads, fees, costs, and risk interact through the cycle.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.