Qualcomm enters the next three-year stretch with a cleaner setup: revenue growth has reaccelerated, margins remain robust, and the product roadmap is anchored by on‑device AI across smartphones, PCs and automotive. Over the past six months, the shares moved from a volatile spring to a steadier fall as investors weighed a new flagship Snapdragon cycle, an agreement to acquire Arduino to deepen its developer reach, and fresh automotive collaborations. Trailing twelve‑month revenue of $43.26B and a 26.77% profit margin underline the cash engine funding R&D, dividends and selective M&A. What changed is the narrative—less about a post‑pandemic handset slump and more about premium Android mix, edge AI features and content gains per device—while a UK antitrust suit and macro uncertainty still temper enthusiasm. This matters because semiconductors remain cyclical but are increasingly driven by compute at the edge; companies that convert design wins into multi‑year platforms can defend pricing and smooth cash flows. Qualcomm’s execution against that transition will frame the stock’s path.

Key Points as of October 2025

- Revenue: trailing twelve months at $43.26B; quarterly revenue growth year over year of 10.30%, with quarterly earnings growth at 25.20%.

- Profitability/Margins: profit margin 26.77% and operating margin 26.65%; return on equity 44.62%; diluted EPS (ttm) 10.37.

- Sales/Backlog: backlog data not disclosed; management focus appears on premium Android and AI-on-device with Snapdragon 8 Elite Gen 5, plus ongoing automotive/IoT design-win activity.

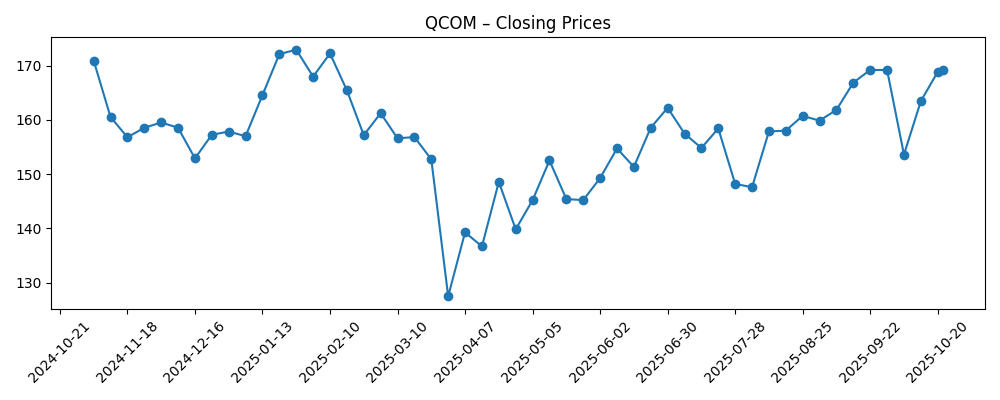

- Share price: last weekly close on 2025-10-22 at 169.27; 50‑day MA 162.54 and 200‑day MA 156.91; 52‑week range 120.80–182.10; 52‑week change 1.34% vs S&P 500 at 16.18%.

- Analyst/Positioning: institutional ownership 81.02%; short interest 2.47% of float (23.83M shares; short ratio 3.1); beta 1.23. Street rating/targets not disclosed in this snapshot.

- Market cap: not disclosed here; shares outstanding 1.08B. Dividend profile: forward yield 2.11% and payout ratio 33.20% (ex‑dividend 12/4/2025).

- Balance sheet and cash generation: cash $10.01B vs debt $14.79B; current ratio 3.19; operating cash flow $12.66B and levered free cash flow $5.47B; debt/equity 54.35%.

- Qualitative: product roadmap highlighted by Snapdragon 8 Elite Gen 5; proposed acquisition of Arduino broadens developer reach; collaboration with QCraft supports automotive ambitions; UK antitrust lawsuit introduces legal risk.

Share price evolution – last 12 months

Notable headlines

- Qualcomm buys open-source electronics firm Arduino - Reuters

- QUALCOMM (QCOM) Agrees to Acquire Arduino - Yahoo

- Qualcomm Announces Snapdragon 8 Elite Gen 5 Mobile Platform - Yahoo

- QCraft Globalizes With European HQ And Collaborates With Qualcomm - Yahoo

- QUALCOMM Incorporated (QCOM) Sued Over Antitrust Violation on Smartphone Chips in the UK - Yahoo

- What’s Powering Qualcomm’s $87 Billion Cash Machine? - Forbes

- How QCOM Stock Doubles To $360 - Forbes

- Qualcomm Stock Dominance At A Discount - Forbes

- QUALCOMM (QCOM) Leverages Adobe GenStudio to Streamline Global Marketing - Yahoo

Opinion

The latest set of figures suggests Qualcomm’s growth has re‑ignited at a healthier quality mix. Double‑digit revenue growth alongside faster earnings growth signals both operating leverage and richer product mix, likely reflecting premium Android launches and AI‑capable chipsets. Margins near the mid‑20s and robust ROE point to the enduring contribution of the licensing model, which monetizes the broader ecosystem beyond just unit volumes. Cash conversion remains solid, supporting dividends and selective acquisitions. The near‑term stock narrative, however, still tracks handset demand cycles and China exposure, which historically add volatility to quarterly prints.

On sustainability, free cash flow and a strong current ratio give management room to invest through cycles while absorbing integration costs from Arduino and stepping up AI at the edge. Debt is manageable against cash generation, though the path to structurally higher margins likely depends on continued success in premium tiers and RF front‑end attach. Competitive pressures—from rival mobile SoCs and potential customer insourcing—are live, keeping pricing power a function of total platform value (CPU/GPU/NPU, modem, connectivity, and software). That makes execution in software tools and developer ecosystems as critical as silicon roadmaps.

Strategically, diversification is inching forward. Automotive digital cockpit and ADAS pipelines are multi‑year ramps with longer visibility than phones, and collaborations like QCraft hint at momentum. The proposed Arduino acquisition could expand developer reach across embedded and IoT, improving time‑to‑market for partners and seeding future silicon demand. Meanwhile, Snapdragon 8 Elite Gen 5 positions Qualcomm to ride the on‑device AI wave in handsets and potentially AI PCs, where local inference, latency, and privacy drive use‑cases that cloud alone cannot satisfy.

How this reshapes the equity story: the more investors view Qualcomm as a diversified edge‑AI and automotive platform with a durable licensing annuity, the more the multiple can hinge on medium‑term cash flows rather than handset units. Conversely, regulatory risk—illustrated by the UK antitrust suit—plus macro softness or export restrictions could cap re‑rating. Over three years, the balance between AI‑led content gains and legal/geo risk will likely determine whether the stock earns a steadier, higher‑quality narrative or remains tethered to smartphone cycles.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | On‑device AI becomes a must‑have across premium and mid tiers; Snapdragon 8 Elite Gen 5 families anchor multiple OEM cycles, AI PCs gain traction, and automotive design‑wins convert to revenue faster than expected. Licensing remains stable, legal overhangs resolve without major remedies, and free cash flow expands, supporting a sturdier, growth‑plus‑income profile. |

| Base | Handset demand is choppy but gradually improves; Qualcomm grows in line with premium Android and autos, offsetting pockets of unit weakness. Licensing stays largely intact, legal outcomes are manageable, and cash generation funds steady investment and dividends. Multiple tracks the sector with modest re‑rating on diversification. |

| Worse | Smartphone recovery stalls and key customers increase insourcing; AI PC adoption is slower than expected, automotive ramps slip, and regulatory actions force changes to licensing terms. Pricing pressure compresses margins and weighs on cash flow, keeping the equity narrative tethered to cyclical handset volumes. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution of the Snapdragon AI roadmap (mobile and PC) and share in premium Android tiers.

- Conversion of automotive design‑wins into revenue and margins; pace of new platform awards.

- Outcomes of regulatory/legal actions (e.g., UK antitrust suit) and any impact on licensing terms.

- China demand, export controls, and OEM inventory cycles affecting smartphone and IoT volumes.

- Foundry supply and node transitions (e.g., leading‑edge capacity/pricing) influencing cost and mix.

- Integration of Arduino and effectiveness in expanding developer ecosystems and embedded adoption.

Conclusion

Qualcomm’s setup into the next three years is defined by two forces pulling in opposite directions: a strengthening product cycle in on‑device AI and automotive, and persistent legal and macro headwinds. The company pairs healthy profitability with solid cash generation, giving it room to invest behind Snapdragon platforms, nurture developer ecosystems via Arduino, and support dividends. If premium Android mix, RF attach, and AI PCs collectively offset handset cyclicality, the earnings base could look steadier and less tied to quarterly unit swings. Conversely, regulatory outcomes and customer insourcing remain the swing factors. Watch next 1–2 quarters: flagship Snapdragon 8 Elite adoption at key OEMs; early signals from AI PC launches; cadence of automotive design‑win conversions; any developments in the UK antitrust case; and trajectory of gross margin mix. The sector backdrop—cyclical yet increasingly pulled by edge AI—favors platform vendors with ecosystem leverage; Qualcomm’s ability to turn design wins into multi‑year revenue streams will likely define the stock narrative.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.