Solid Power (SLDP) has re-rated sharply in 2025 on partnership headlines and faster top-line growth, putting its technology and execution into a three-year “prove it” phase. Over the past year, the stock is up 361.79%, reflecting renewed optimism that its sulfide solid-state cells are nearing meaningful field trials. The company still generates limited revenue but reported faster growth and carries $230.93M in cash, which reduces near-term funding pressure even as losses remain heavy. The rally appears tied to expanded collaboration with automakers and a strategic manufacturing agreement, signaling a path from pilot output toward scaled validation. That matters because EV-battery investors are separating credible timelines from hype while carmakers weigh safety, energy density and cost against incumbent lithium-ion chemistries. If Solid Power converts R&D programs into supply agreements, the narrative could shift from technology option to commercial roadmap; if milestones slip, momentum can reverse quickly. The broader battery sector remains volatile as capital chases demonstrable durability, manufacturability and unit economics.

Key Points as of October 2025

- Revenue: trailing 12-month revenue of 22.67M with quarterly year-over-year growth of 48.60%; revenue per share 0.13.

- Profitability: operating margin (ttm) -343.12%; net loss (ttm) -93.53M; diluted EPS (ttm) -0.52; gross profit (ttm) 952k.

- Liquidity and balance sheet: total cash 230.93M; total debt 8.8M; current ratio 19.33; debt/equity 2.37%.

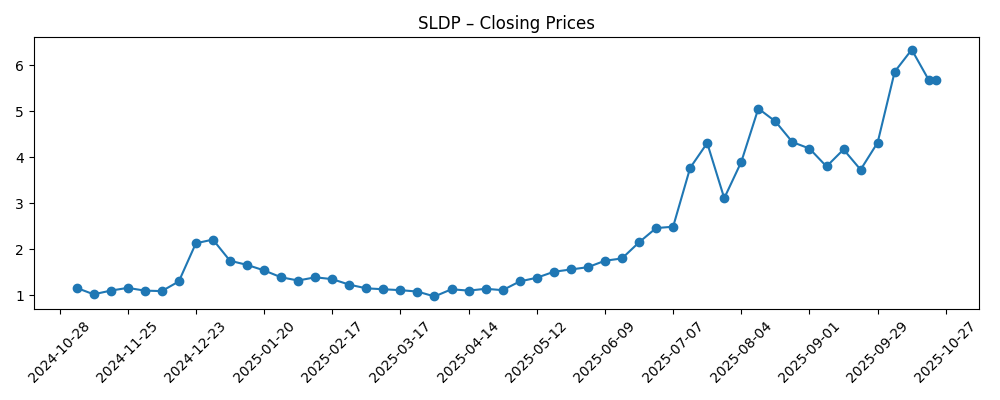

- Share price and volatility: latest weekly close (Oct 23, 2025) 5.69; 52-week change 361.79%; 50-day MA 4.70 vs 200-day MA 2.50; 52-week high/low 8.05/0.68; beta 1.78.

- Sales/backlog: no backlog disclosed; revenue remains primarily from development and services tied to program milestones rather than product shipments.

- Analyst/positioning: analyst consensus not provided; short interest 19.76M shares (11.01% of float) with short ratio 1.89 indicates active two-way positioning.

- Market cap: not disclosed here; shares outstanding 181.28M and float 163.38M underscore small-cap dynamics and potential volatility.

- Strategic context: headlines point to an expanded OEM partnership and a manufacturing agreement that aim to bridge pilot-scale output to automotive-grade validation.

Share price evolution – last 12 months

Notable headlines

- Solid Power Reports Second Quarter 2025 Financial Results

- Solid Power and BMW Expand Partnership on Solid-State Batteries

- Solid Power Announces Strategic Manufacturing Agreement

- Solid Power Appoints New CEO to Lead Next Phase

Opinion

Investors rewarded Solid Power for faster top-line growth and credible signals of customer engagement, but the quality of results is still pre-commercial. A 48.60% year-over-year revenue gain comes off a low base (22.67M ttm), and gross profit remains thin at 952k, reflecting development-service economics rather than product gross margin. Operating margin at -343.12% and EBITDA of -84.88M show the heavy R&D and scaling costs required to qualify solid-state cells for automotive duty cycles. The positive offset is liquidity: 230.93M in cash against 8.8M of debt and a 19.33 current ratio lowers near-term balance-sheet risk while the company advances techno-economic milestones. The core question into 2026–2027 is whether milestone revenues can transition toward recurring product revenue without an outsized increase in cash burn.

The share price has shifted from distress to momentum. A 361.79% 52-week gain, 50-day moving average above the 200-day, and a 52-week range of 0.68–8.05 indicate a strong trend but also wide trading bands. Short interest at 11.01% of float and a short ratio of 1.89 suggest active two-way views, which can amplify moves on news, good or bad. With beta at 1.78, the stock tends to swing more than the market. For long-horizon holders, that volatility is a feature only if it coincides with steady technical progress and clearer commercialization gates; otherwise it raises financing and execution risk.

Within the EV battery landscape, Solid Power sits at the intersection of performance promises (energy density and safety) and manufacturability constraints (materials handling, yield, and cost). The reported expansion of an OEM partnership and a strategic manufacturing agreement point to a pragmatic route from pilot lines toward automotive validation. That is critical because OEM qualification requires repeated, consistent cell performance across many cycles and formats. If third-party validation converges with line-capable processes, the company could gain pricing power relative to niche suppliers while staying below the scale of integrated Asian incumbents.

Valuation today is less about current earnings and more about the option value on commercialization. Deep losses and minimal gross profit argue for caution on near-term multiples, but each de-risking data point—durability, safety, manufacturability, and customer commitments—can shift the narrative toward an earnings-power framework. Conversely, any slippage in cell performance, safety incidents, or partner timelines could compress the multiple quickly, especially given the elevated short interest and beta. Over the next three years, the stock’s path is likely to mirror milestone cadence: credible pilot-to-production progress supports a higher strategic premium; delays would refocus attention on cash burn and potential dilution.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | OEM pilot programs validate cycle life and safety, manufacturing yields improve on sulfide processing, and strategic agreements evolve into limited-volume supply for premium models or stationary applications. Milestone revenue grows, cash burn moderates relative to progress, and the company accesses non-dilutive funding or partner prepayments. |

| Base | Technical progress continues but at a measured pace. Programs remain in extended validation with incremental milestones and modest revenue. Cash burn persists as the company scales pilot capacity and process controls. Partnerships are maintained, but volume supply decisions are deferred pending further data. |

| Worse | Cell durability or manufacturability bottlenecks delay validation. Partners slow development timetables, capital markets tighten, and the company raises capital on unfavorable terms. Competitive chemistries narrow the perceived advantage, and the storyline reverts to technology risk over commercialization. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on technical milestones (cycle life, safety, manufacturability) in OEM programs.

- Conversion of partnerships or manufacturing agreements into revenue-bearing supply arrangements.

- Cash burn trajectory versus liquidity (230.93M cash; -64.45M operating cash flow ttm) and any funding actions.

- EV adoption trends and policy incentives affecting battery demand and supply-chain localization.

- Competitive announcements in solid-state and advanced lithium-ion chemistries that shift buyer interest.

- Short interest dynamics (11.01% of float) and overall market risk appetite (beta 1.78).

Conclusion

Solid Power enters a pivotal three-year stretch with accelerating, albeit small, revenue, substantial negative margins, and a cash position that can support continued development. The share price recovery and active short interest show that investors are now trading milestones, not models—each data point on durability, safety, and yield could move the stock disproportionately. Partnerships and a manufacturing agreement give the company a line of sight to validation steps that matter for eventual commercialization, but the income statement still reflects a pre-revenue profile with heavy R&D. The sector remains volatile as OEMs balance performance, cost and manufacturability. Watch next 1–2 quarters: partner validation milestones and any conversion into supply commitments; pilot-line output consistency and yield; cash burn versus liquidity; and any shift in revenue mix toward product-based sales. Clear progress can support a more durable narrative; setbacks would refocus attention on financing risk and execution timelines.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.