Tokyo Electron (8035.T), a leading wafer fab equipment supplier, enters late 2025 with solid profitability despite a mixed capex cycle. Over the last twelve months, revenue reached ¥2.43T with a 26.33% operating margin and 22.08% net margin; return on equity sits at 29.39%. Quarterly revenue growth remains slightly negative (−1.0% year over year) and quarterly earnings declined −6.6%, reflecting lumpy orders. Cash of ¥367.51B and a 2.97 current ratio underpin flexibility, while operating cash flow of ¥473.35B funds investment and dividends. Shares have been volatile but trade near ¥25,715, between a 52‑week low of ¥16,560 and high of ¥28,540. With a forward dividend of ¥480 (1.89% yield) and exposure to AI and advanced‑node spending, the three‑year setup hinges on order momentum, export rules and regional expansion.

Key Points as of September 2025

- Revenue: ¥2.43T (ttm); quarterly revenue growth −1.0% yoy as the wafer fab equipment cycle normalizes.

- Profit/Margins: Operating margin 26.33%; net margin 22.08%; ROE 29.39% and ROA 16.89% underscore capital efficiency.

- Sales/Backlog: Order visibility tied to AI accelerators and leading‑edge foundry nodes; signs of inventory digestion vs. 2024 but timing uneven.

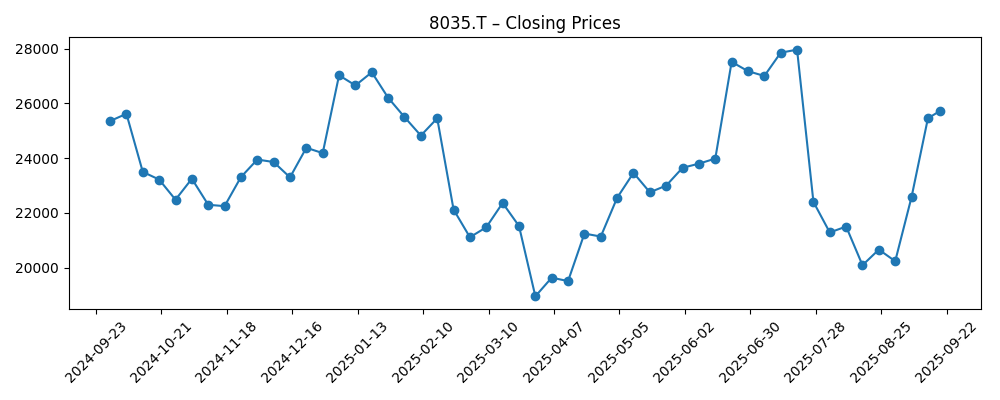

- Share price: Recent close ~¥25,715; 52‑week range ¥16,560–¥28,540; 50‑day MA ¥23,421.90; 200‑day MA ¥23,479.70; 52‑week change +5.34% (vs. S&P 500 +15.52%).

- Cash & Liquidity: Cash ¥367.51B; current ratio 2.97; operating cash flow ¥473.35B; levered free cash flow ¥191.23B; debt not disclosed (mrq).

- Dividend: Forward annual dividend ¥480 (1.89% yield); trailing ¥592 (2.33%); payout ratio 50.21%; ex‑dividend date 2025‑09‑29.

- Market cap: Implied around ¥11.8T using ¥25,715 share price and 458.11M shares; float 437.61M; beta 1.26.

- Earnings trend: Quarterly earnings growth −6.6% yoy, reflecting cautious customer capex timing despite AI‑related demand pockets.

- Investor focus: Cycle durability into 2026–2027, export controls, and geographic expansion (notably India) to support multi‑year TAM.

Share price evolution – last 12 months

Notable headlines

- Tokyo Electron expands India footprint as Japan ups chip investment (Digitimes)

- Advantest tops TEL in market value after 19 years, driven by AI chip testing boom (Digitimes)

- India's chip drive gains momentum but foreign giants hold back investments (Digitimes)

Opinion

Tokyo Electron’s expansion in India could prove strategically important over a three‑year horizon. For complex deposition, etch, and clean tools, proximity to customers and a trained service workforce are critical. An India footprint can lower service response times, deepen local talent pipelines, and strengthen long‑run relationships as the country scales design, OSAT, and potential foundry projects. While near‑term revenue is unlikely to be materially impacted, seeding capability today positions TEL to capture incremental orders as India’s policy framework and subsidies catalyze equipment deployments. Combined with Japan’s push for semiconductor self‑reliance, this move diversifies operational exposure beyond legacy hubs, potentially smoothing cycles and enhancing resilience against supply‑chain bottlenecks and geopolitics over the next 2–3 years.

The headline that Advantest overtook TEL in market value spotlights a shifting center of gravity within the semiconductor capital‑equipment complex. AI‑era testing intensity has surged, rewarding test vendors with a near‑term growth premium. For TEL, this is less a condemnation than a reminder that product mix and exposure to the most capacity‑constrained nodes determine equity leadership in each phase of the cycle. TEL’s profitability remains strong—operating margin 26.33% and net margin 22.08%—but sustaining multiple expansion may require clearer evidence that gate‑all‑around, high‑NA EUV process steps, and advanced packaging will translate into a broader tool refresh. A pivot of orders toward leading‑edge logic and HBM‑centric memory can re‑accelerate bookings, but investors will likely wait for backlog inflection signals before paying up.

Shares have been volatile in 2025, swinging from late‑June strength to a sharp drop in late July–August before rebounding toward the 50‑ and 200‑day moving averages. With a 52‑week gain of 5.34% against the S&P 500’s 15.52%, TEL has underperformed broader equity indices, reflecting the industry’s digestion phase. The balance sheet provides optionality—cash of ¥367.51B, current ratio 2.97, and robust operating cash flow of ¥473.35B—supporting shareholder returns and R&D. The 1.89% forward yield and 50.21% payout ratio indicate commitment to distributions, though buyback flexibility and organic investments will likely be calibrated to order momentum. A beta of 1.26 suggests continued above‑market volatility as investors handicap the timing and breadth of the next equipment upcycle.

Macro and policy remain wildcards. Export controls and licensing frameworks can shift tool mix and timing, affecting China‑exposed sales and service revenues. Conversely, incremental subsidies in Japan, the U.S., and India may pull forward capacity at advanced nodes and specialty processes, benefiting TEL’s deposition/etch franchises and services annuity. Over three years, the base case is a gradual recovery into 2026–2027 as AI compute, HBM, and advanced packaging demand propagate into new wafer capacity and process complexity. Execution on India expansion and continued penetration at leading foundries would support mix and margin durability, while competitive intensity and tool qualification cycles will dictate how quickly that translates into top‑line reacceleration.

What could happen in three years? (horizon September 2025+3)

| Scenario | Outlook |

|---|---|

| Best | AI and 2 nm ramps broaden across logic and memory; India footprint enables faster service and incremental wins; orders re‑accelerate across deposition/etch with margins holding near current levels; share price retests prior highs as backlog builds and cash returns persist. |

| Base | Gradual recovery through 2026–2027 as inventory digestion ends; mix tilts to leading‑edge while mature nodes remain subdued; margins steady with productivity gains; shareholder returns continue via a stable dividend policy. |

| Worse | Export restrictions tighten and China demand weakens; advanced‑node timing slips; competitive pricing pressures margins; orders stay choppy and visibility shortens, keeping the stock range‑bound below recent peaks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Customer capex at leading foundries and memory makers, especially AI‑driven nodes and HBM capacity.

- Export controls, licensing, and geopolitics affecting shipment timing and regional mix.

- Product cycle execution in deposition, etch, clean, and advanced packaging, including tool qualifications.

- Competitive dynamics versus global peers; pricing and service differentiation.

- Cash deployment (R&D, M&A, buybacks, dividends) relative to order visibility and free cash flow.

- Supply‑chain reliability and cost inflation across components and logistics.

Conclusion

Tokyo Electron exits a digestion phase with strong profitability and balance‑sheet flexibility, positioning it to benefit as the next capex upcycle broadens. The company’s ttm revenue of ¥2.43T, operating margin of 26.33%, and ROE of 29.39% indicate durable competitiveness, while cash generation (¥473.35B operating cash flow) supports both reinvestment and a 1.89% forward dividend yield. Over the next three years, key swing factors are the pace of AI‑led capacity adds, export‑control outcomes, and the success of geographic diversification, notably India. A best‑case path features broadening advanced‑node orders and stable margins; the base case suggests a measured recovery into 2026–2027; a downside case would stem from tighter controls and delayed ramps. With beta above 1 and shares hovering near long‑term averages, investors should expect volatility but also leverage to any confirmed turn in bookings and backlog.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.