Wal‑Mart de Mexico S.A.B. de C. (WMMVY) enters late‑2025 with resilient top‑line momentum but softer earnings, as modest same‑store growth and expanding e‑commerce offset inflation relief at the checkout. The company’s trailing profit margin is 5.04%, while quarterly revenue growth slowed to 4.9% year over year, pointing to a classic retail mix: volume holding up, ticket growth moderating. Margins have felt pressure from logistics investments, wage inflation, and promotions, yet operating discipline and cash generation continue to support dividends and store remodels. Shares have firmed over the past six months alongside other Latin American staples retailers, reflecting defensive positioning and a low‑beta profile. Sector‑wide, food and essentials chains are cycling post‑pandemic price normalization while accelerating omnichannel services to retain traffic. For investors, the setup is a quality operator with stable cash flow but near‑term profitability headwinds: the trajectory of costs, price elasticity, and digital penetration will likely determine how much of the recent re‑rating can be sustained into 2026.

Key Points as of November 2025

- Revenue – Revenue (ttm) reported at 1T; quarterly revenue growth (yoy) at 4.90% indicates steady demand.

- Profit/Margins – Profit margin 5.04%; operating margin 7.87%; gross profit 241.25B; EBITDA 95.56B; diluted EPS 1.57.

- Sales/Backlog – Retail model has no formal backlog; same‑store sales and traffic metrics were not disclosed in the provided data.

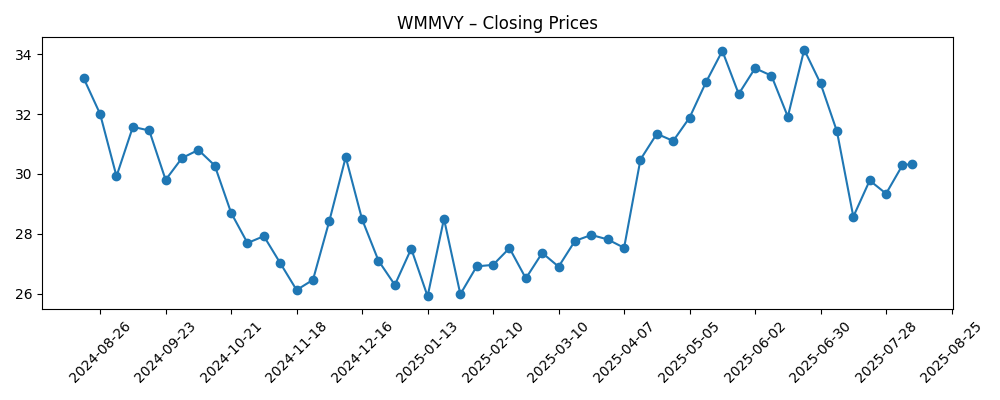

- Share price – 52‑week change +17.63% vs S&P 500 +15.57%; trading near 50‑day MA 31.28 and 200‑day MA 30.29; 52‑week range 24.30–35.78; beta 0.24.

- Balance sheet & liquidity – Total cash 35.18B; total debt 79B; debt/equity 35.35%; current ratio 0.95; operating cash flow 78.03B; levered free cash flow 22.85B.

- Dividends – Forward dividend 0.58 (yield 1.75%); trailing yield 3.94%; payout ratio 40.81%; last ex‑dividend date 12/9/2024.

- Analyst view – Consensus ratings/targets not disclosed; sentiment supported by defensive category mix and recent outperformance.

- Market cap – Data not disclosed in the provided snapshot; shares outstanding 1.73B; float/short interest not provided.

- Qualitative – Headlines highlight supply‑chain efforts, ESG initiatives, regulatory watch, and continued e‑commerce expansion.

Share price evolution – last 12 months

Notable headlines

- Wal‑Mart de Mexico experiencing supply chain challenges (Bloomberg, Aug 30, 2025)

- Wal‑Mart de Mexico's ESG commitments and future plans outlined (WSJ, Jul 20, 2025)

- Regulatory changes in Mexico could affect operations (Bloomberg, Jun 28, 2025)

Opinion

Recent figures sketch a familiar retail trade‑off: healthy sales with pressure below the gross line. Quarterly revenue growth of 4.9% year over year contrasts with quarterly earnings growth of −9.2%, implying investments, wage inflation, and promotions compressed profitability. The 5.04% profit margin versus a 7.87% operating margin also suggests higher non‑operating and tax drag. Even so, gross profit and EBITDA levels point to a business still generating scale benefits, while low beta signals investors view WMMVY as a defensive anchor within a volatile macro backdrop.

Sustainability hinges on cash discipline and execution. With operating cash flow of 78.03B and levered free cash flow of 22.85B, Walmex has capacity to fund logistics, technology, and store upgrades while maintaining dividends (payout ratio 40.81%). A 0.95 current ratio reflects tight working capital typical for grocery/discount formats, keeping management focused on inventory turns, shrink, and supplier terms. If efficiency gains offset wage and last‑mile costs, margins could stabilize without sacrificing price leadership.

Within Mexico’s staples retail, competitive dynamics favor scale: nationwide distribution, data‑driven assortment, and private‑label development help defend share against regional chains and convenience formats. Headlines flag ongoing supply‑chain tuning and regulatory watch, both manageable with Walmex’s purchasing power and local sourcing. Digital penetration is a swing factor: omnichannel can protect traffic and ticket, but last‑mile and fulfillment add cost that must be balanced with service levels.

For the equity story, defensiveness and cash generation underpin the multiple, while the market will likely pay up for evidence that e‑commerce and automation can improve unit economics. Currency adds another layer for ADR holders, and regulatory clarity may influence capex pacing. After a 52‑week gain and a low volatility profile, the narrative into 2026–2028 likely shifts from “resilient sales” to “margin quality,” with valuation supported if costs normalize and digital scales profitably.

What could happen in three years? (horizon November 2028)

| Scenario | Narrative |

|---|---|

| Best case | Logistics automation and disciplined promotions lift margins; omnichannel reaches efficient scale with improved last‑mile density; stable regulation and solid consumer demand support steady comps and free‑cash‑flow growth, reinforcing a dependable dividend profile and a stronger quality premium. |

| Base case | Sales grow modestly with essentials demand; cost inflation is offset by mix and productivity, keeping margins broadly stable; digital continues to gain share with breakeven economics; valuation tracks earnings growth with limited multiple expansion. |

| Worse case | Sticky cost inflation and higher compliance costs erode margins; competitive pricing heats up as peers chase traffic; supply‑chain bottlenecks and FX volatility weigh on ADR sentiment, forcing slower capex and a more cautious growth cadence. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on cost control and logistics efficiency versus wage and last‑mile inflation.

- Consumer demand resilience in Mexico for food and essentials; promotional intensity in the sector.

- Regulatory and compliance changes affecting labor, pricing, or sourcing.

- E‑commerce profitability and unit economics (delivery density, basket size, returns).

- FX translation for ADR holders and macro volatility impacting risk appetite.

- Capital allocation discipline across dividends, remodels, and technology investments.

Conclusion

WMMVY’s set‑up blends dependable demand with near‑term margin friction. Revenues continue to climb, but earnings compression underscores the cost of holding share while building omnichannel capabilities. Balance‑sheet flexibility and solid cash generation give management room to keep investing without stretching the dividend, while low beta and staples exposure frame a defensive profile that investors often favor late in the cycle. The medium‑term question is whether logistics, automation, and mix can offset wage and delivery costs enough to lift margins as digital scales. If supply‑chain initiatives and regulatory clarity progress, the narrative could shift from “protecting volumes” to “expanding profitability.” Watch next 1–2 quarters: traffic versus ticket mix; gross‑margin discipline against promotions; e‑commerce fulfillment efficiency; wage and logistics inflation; and any regulatory updates that alter cost structures or pricing latitude.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.