GSK’s shares have firmed into October as investors digest a vaccine-led second-quarter beat, a fresh US approval in respiratory, and encouraging HIV trial updates. The setup marks a shift from repair to execution: revenue is steady at 31.63B over the last twelve months, but mix is tilting toward higher-margin launches and established vaccines. The stock recently hovered near 1,620.0, reflecting defensiveness and a pipeline narrative that is starting to clear. The change is driven by two forces. First, product momentum in vaccines and respiratory adds visibility into flu and RSV seasons. Second, cash generation and a recalibrated R&D focus suggest more disciplined capital allocation, even as near-term liquidity remains tight and leverage elevated. For sector investors, this matters because large-cap pharma valuations hinge on proof that late-stage assets can offset pricing pressure and patent cycles. The broader industry faces strict reimbursement in Europe and intensifying competition in metabolic disease, yet vaccine demand and infectious disease treatments remain resilient profit pools that can support stable cash flows.

Key Points as of October 2025

- Revenue: Trailing twelve-month revenue stands at 31.63B with quarterly revenue growth of 1.30% year over year; mix tilting toward vaccines and specialty medicines.

- Profit/Margins: Profit margin 10.82% and operating margin 30.52%; return on equity 28.33% signals capital-efficient earnings.

- Sales/Backlog: No formal backlog disclosure; visibility largely tied to seasonal vaccine ordering cycles and launch uptake in respiratory and HIV.

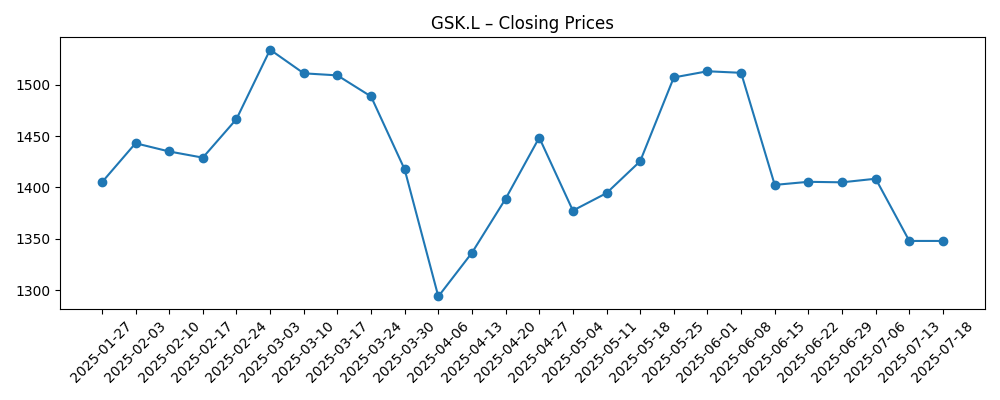

- Share price: Latest weekly close 1,620.0 (2025-10-24); 52-week high 1,684.50; 50-day/200-day moving averages at 1,531.84 and 1,452.90; 52-week change +13.67%; low beta at 0.29.

- Analyst view: Street consensus not disclosed here; recent coverage highlights a Q2 vaccine-driven beat and fresh US respiratory approval, with focus on sustainability of growth.

- Market cap & equity base: Market capitalization not disclosed in provided data; shares outstanding of 4.02B indicate large-cap scale and liquidity.

- Cash & balance sheet: Operating cash flow 7.72B and levered free cash flow 5.48B; total cash 3.62B vs total debt 17.35B; current ratio 0.87 suggests tight near-term liquidity.

- Income to dividends: Forward annual dividend yield 3.89% with payout ratio 74.97%; signals income support but leaves less buffer for shocks.

- Competitive position: Strength in vaccines; US respiratory approval and positive HIV readouts reinforce a focused R&D strategy.

Share price evolution – last 12 months

Notable headlines

- GSK raises 2023 earnings forecast after strong vaccines and consumer health sales (Reuters)

- GSK wins US approval for its new respiratory drug (Financial Times)

- GSK Q2 2025 Earnings: A Beat on Vaccine Sales (GSK Investor Relations)

- GSK's new HIV treatment shows promising trial results (Bloomberg)

- GlaxoSmithKline shifts focus to vaccine R&D amid rising demand (Wall Street Journal)

Opinion

Recent results show a company leaning on durable franchises while seeding new growth. Revenue growth of 1.30% year over year is modest, yet earnings leverage is evident: quarterly earnings growth of 23.00% suggests mix and cost control are doing more of the work than sheer volume. The 30.52% operating margin looks healthy for a vaccines-led portfolio, where scale and manufacturing efficiency matter, and a 10.82% profit margin indicates room to absorb pricing friction without sacrificing reinvestment. The key question for sustainability is whether vaccine strength and the newly approved respiratory asset can offset slower areas in general medicines. Seasonality is a double-edged sword: it amplifies periods of outperformance, but also creates a tougher compare in off-peak quarters. Investors will likely parse the quality of beats by separating recurring vaccine demand from one-offs such as launch stocking or favorable product mix.

The balance sheet and cash flows frame the next leg. Operating cash flow of 7.72B and levered free cash flow of 5.48B provide funding for R&D and dividends, but the current ratio at 0.87 and total debt of 17.35B highlight the need for disciplined allocation. A forward dividend yield of 3.89% with a 74.97% payout ratio supports the income case, yet it raises the bar for maintaining cash conversion through the cycle. The share price trading above both the 50-day and 200-day moving averages, alongside a low 0.29 beta, underscores the stock’s defensive appeal. That defensiveness, however, can cap multiple expansion unless launches deliver visible, repeatable growth. Put simply: cash is solid, liquidity is tight, and execution on launches will determine whether operating momentum persists.

Industry dynamics are a mixed backdrop. Reimbursement pressure in core European markets and shifting US pharmacy benefit dynamics can temper price and volume, especially in older general medicines. Conversely, vaccines remain one of the steadier profit pools due to public-health demand and tender structures that reward capacity and reliability. The US approval in respiratory, coupled with positive HIV trial signals, suggests GSK is reinforcing areas with better pricing resilience and clinical differentiation. Competitive intensity is rising across respiratory and infectious disease, but regulatory wins can strengthen formulary access and bargaining power. Execution on manufacturing scale-up and supply-chain reliability will be critical to preserve margins in the face of input-cost volatility.

For valuation, the narrative is transitioning from repair to selective growth. If management can convert launch approvals into sustained uptake and keep margins near current levels, investors may ascribe a steadier, mid-cycle multiple despite sector-wide pricing debates. Conversely, a slowdown in vaccine orders or weaker-than-hoped HIV data would re-center attention on leverage and the high payout ratio, pressuring the equity story back toward “bond proxy” status. Over the next three years, the balance between pipeline proof points and policy headwinds should determine whether the stock is viewed as a stable cash compounder or a high-yield defensive with limited growth. Evidence of repeatable R&D productivity and disciplined capital allocation is likely to be the swing factor.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Vaccine demand remains strong across multiple seasons, the new respiratory launch scales smoothly in the US, and HIV assets post confirmatory data and approvals. Pricing pressure is manageable through contracting and mix, sustaining high operating margins. Strong cash generation enables steady dividends and targeted pipeline investments, supporting a more growth-tilted narrative. |

| Base case | Vaccines provide steady mid-single-digit growth with typical seasonality, respiratory ramps at a measured pace, and HIV contributes but remains competitive. Pricing headwinds offset part of the mix benefits, keeping earnings growth moderate. Cash flows fund dividends and core R&D, while balance-sheet metrics improve gradually through disciplined spending. |

| Worse case | Vaccine ordering normalizes below recent peaks, respiratory uptake is slower due to competitive access hurdles, and HIV readouts underwhelm. Tighter reimbursement in key markets compresses margins, forcing reprioritization of R&D and cost controls. Cash coverage of the dividend narrows, constraining strategic flexibility and weighing on the equity narrative. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Launch execution and regulatory outcomes for the new respiratory therapy and late-stage HIV assets.

- Vaccine season dynamics (flu/RSV) and tender wins that shape volume and mix.

- Pricing and reimbursement changes in the UK/EU and US that affect legacy general medicines and new launches.

- Cash conversion versus dividend commitments amid leverage and a sub-1.0 current ratio.

- Foreign-exchange movements affecting reported results and margins.

- Industry competition and any legal or compliance developments impacting brand reputation or costs.

Conclusion

GSK enters the next three years with a clearer growth mix: resilient vaccines, a newly approved respiratory asset, and an HIV pipeline showing promise. The financial profile pairs robust operating cash flow with tight near-term liquidity and meaningful leverage, making execution the fulcrum for the equity story. Sector headwinds in pricing are real, but areas where GSK is leaning in—vaccines and differentiated specialty medicines—tend to carry better demand visibility and stickier access. Sustaining a high operating margin while advancing launches would keep the stock anchored as a low-beta, income-bearing name with improving growth optics. Watch next 1–2 quarters: vaccine order patterns and inventory normalization; early prescription trends for the respiratory launch; HIV clinical and regulatory milestones; pricing and access updates in major markets; free cash flow progression versus dividend outlays. Delivery on these items should determine whether the narrative shifts toward steady compounding or reverts to a defensive, yield-first profile.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.