Koç Holding’s shares have been choppy into October as investors recalibrated Türkiye’s macro path and the group’s multi‑sector exposures. The stock recently closed at 171.8 TRY, reflecting a year marked by swings in risk appetite as domestic rates stayed restrictive and the lira’s path remained central to positioning. The main change is not a single event, but a reset in expectations: tighter financial conditions and uneven global demand have shifted focus from cyclical upside to earnings quality, cash generation, and how a diversified conglomerate balances export‑led businesses with domestically sensitive ones. This matters because Koç is often treated as a proxy for the Turkish economy; it sits across energy, autos, and consumer durables, where pricing power and foreign‑exchange (FX) discipline can make the difference between headline growth and sustainable value creation. For sector investors, the signal is clear: volatility is likely to persist, but diversified portfolios with credible capital allocation and hedging play a larger role in defending return profiles.

Key Points as of October 2025

- Revenue: Consolidated figures are not disclosed in the provided materials; mix remains anchored in energy, autos, and consumer durables.

- Profit/Margins: Margin data is not disclosed; earnings quality likely hinges on refining spreads and export‑led autos/appliances mix.

- Sales/Backlog: Backlog is not typically reported at the holding level; order visibility in autos/appliances is contract‑driven; data not provided.

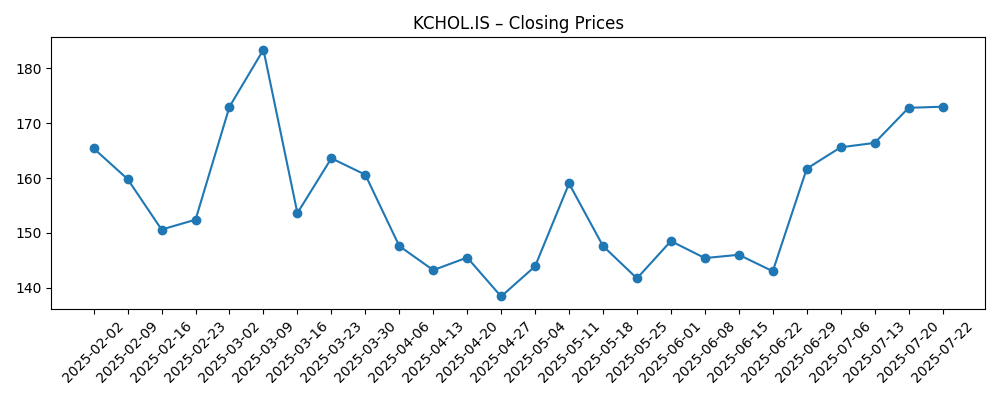

- Share price: KCHOL.IS closed at 171.8 TRY on Oct 24, 2025; traded within roughly 138.4–186.5 TRY over the past six months.

- Analyst view: No consensus or rating data in the snapshot; focus remains on capital allocation, FX risk management, and governance.

- Market cap: Not disclosed in the provided data.

- Qualitative: FX (foreign exchange) swings in USD/TRY and EUR/TRY affect input costs and translation; diversified export exposure offers a partial hedge.

- Macro sensitivity: Türkiye’s interest‑rate path shapes domestic demand and funding costs across the portfolio.

Share price evolution – last 12 months

Notable headlines

Opinion

The share price pattern through 2025 tells a story of alternating optimism and caution. A spring drawdown likely reflected tighter domestic financial conditions and a cautious stance on cyclical names with FX exposure. The subsequent rebound into late summer suggested investors were willing to re‑risk on signs of improving operating discipline and export momentum. The pullback into October, followed by a partial recovery, fits a market testing whether improved pricing, hedging, and cost control can offset persistent macro noise. In this context, Koç’s diversified footprint is a feature, not a bug: it blunts single‑segment shocks but also forces investors to price a complex earnings mix.

The quality of any beat or miss over the next few quarters will hinge more on mix and cash conversion than headline growth. Energy earnings typically ride refining spreads and feedstock dynamics, while autos and appliances lean on export orders and product cycles. If FX risk is tightly managed—through natural hedges, cost pass‑through, and prudent leverage—then volatility in reported figures can decline even if the macro backdrop remains unsettled. Conversely, if domestic demand softens while spreads and exports wobble, consolidation effects could amplify downside to margins. Sustainability of upside, therefore, rests on capital discipline and the cadence of portfolio reinvestment.

Within Türkiye’s market, conglomerates are often treated as macro bellwethers. That can compress or expand the multiple faster than fundamentals change. The current narrative rewards balance sheets that handle higher funding costs, and businesses with export breadth or pricing power. For Koç, energy transition projects, product electrification in mobility and appliances, and operational upgrades can improve resilience. The flip side is regulatory oversight and policy shifts, which can re‑price returns on capital quickly across regulated or politically sensitive sectors.

How this translates to valuation over three years will likely depend on whether the group can show steadier free cash flow, less FX‑induced volatility, and a visible roadmap for reinvestment and distributions. Clearer capital allocation—what is core vs. non‑core—would help investors underwrite a tighter range of outcomes. If confidence builds that earnings are less hostage to macro swings, a higher quality narrative can emerge; if not, the stock may continue to trade as a macro proxy, with the multiple tracking shifts in domestic rates and risk appetite.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best case | Macro stabilization in Türkiye lowers funding costs and tamps FX volatility. Energy margins normalize at healthy levels, autos/appliances gain share in export markets, and execution on efficiency and energy‑transition projects lifts returns. Clearer capital allocation reduces conglomerate discount and supports a more durable valuation. |

| Base case | Normalization is bumpy but trending better. FX swings persist yet are manageable with hedging and pricing. Segment performance is mixed, with energy and exports offsetting softer domestic demand. Cash generation funds steady reinvestment and distributions, and the multiple tracks earnings. |

| Worse case | Renewed macro stress raises rates and weakens demand. FX shocks pressure costs and translation, refining spreads compress, and export orders slow. Higher financing costs and regulatory frictions weigh on returns, prompting valuation compression and a wider conglomerate discount. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Türkiye’s monetary policy path and inflation, driving FX moves and funding costs.

- Energy refining margins and feedstock dynamics across the value chain.

- Export demand and model cycles in autos and appliances.

- Capital allocation decisions (asset rotations, capex pace, buybacks/dividends) and governance signals.

- Regulatory and tax shifts affecting energy, industrials, and consumer markets.

- Access to FX liquidity and external financing conditions.

Conclusion

Koç Holding enters the next three years with a familiar trade‑off: diversified buffers against single‑sector shocks versus exposure to Türkiye’s evolving macro regime. The stock’s swings between roughly mid‑140s and high‑180s this year, and a recent 171.8 TRY close, reflect that push‑pull. The investment narrative should pivot on whether the group can show steadier free cash flow, disciplined reinvestment into energy transition and product electrification, and tighter FX management that reduces earnings volatility. If those pieces line up, the conglomerate discount can narrow as investors underwrite more predictable returns; if they do not, the shares may continue to track shifts in domestic rates and risk appetite. Watch next 1–2 quarters: refinery spreads and energy margins; export order momentum in autos/appliances; FX hedging efficacy and pricing pass‑through; domestic demand elasticity under tight financial conditions; capital allocation signals around core vs. non‑core assets.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.