UniCredit’s shares have rerated over the past year, outpacing European peers as investors priced in stronger earnings and a cleaner balance sheet. A key shift is the stock’s 56.13% advance alongside solid top line momentum, with trailing revenue of 24.82B, supported by higher net interest income, stable costs, and improving fee franchises. The change has been driven by a supportive rate backdrop, portfolio pruning, and a pivot to digital distribution and partnerships, which are widening the bank’s reach while lowering unit costs. This matters because European banks are transitioning from pure interest‑rate trades to execution stories where operating discipline, technology delivery, and credit vigilance set the winners apart. For sector investors, UniCredit now screens as a self‑help case with cyclical tailwinds fading but structural levers building, including potential benefits from approved M&A and fintech tie‑ups. The next phase will test whether margin resilience and fee growth can offset a gentler rate cycle and rising competition from digital‑first offerings.

Key Points as of October 2025

- Revenue: Trailing revenue stands at 24.82B with quarterly revenue growth of 10.20% year on year.

- Profit/Margins: Profit margin is 42.71% and operating margin 71.61%; return on equity is 16.34%.

- Sales/Backlog: Loan growth or backlog metrics not disclosed; management focus appears on fees and digital cross‑sell.

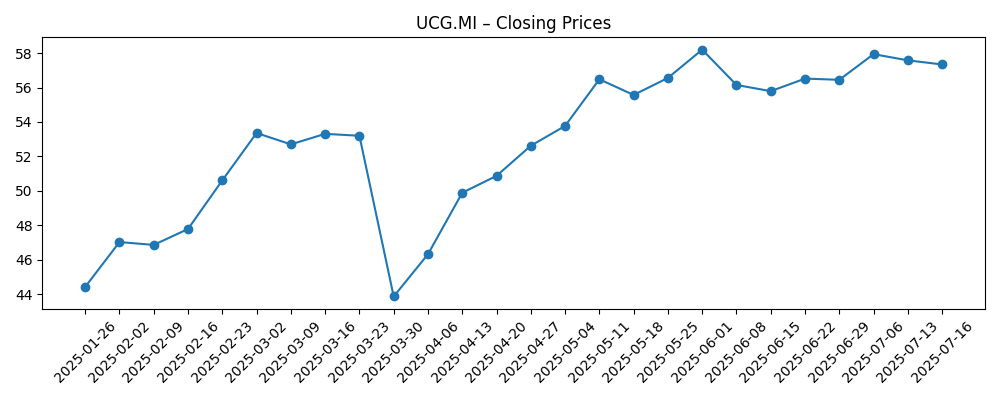

- Share price: Up 56.13% over 52 weeks; 52‑week high at 69.82 with the latest weekly close near 62.69; trades above the 200‑day moving average of 55.57.

- Analyst view: Consensus data not provided; debate centers on sustainability of net interest income and capital returns as rates normalize.

- Market cap: Not disclosed in provided data; float is 1.56B shares and institutions hold 51.53%.

- Capital return: Forward dividend yield 3.82% with a payout ratio of 36.36% (ex‑dividend 4/22/2025).

- Strategy/competition: EU approval of a rival‑bank acquisition, a fintech stake, and big‑tech partnerships signal an offensive, fee‑led growth agenda.

- Balance sheet: Total cash 172.98B vs total debt 216.86B; operating cash flow (ttm) −1.15B reflects typical bank‑sector volatility.

Share price evolution – last 12 months

Notable headlines

- UniCredit: Third Quarter Results 2025

- UniCredit to Enhance its Digital Banking Services by 2026

- UniCredit Agrees to Acquire Major Stake in Italian Fintech

- EU Regulators Approve UniCredit's Acquisition of Rival Bank

- UniCredit's New CEO Outlines Vision for 2026

- UniCredit's Partnership with Amazon to Deliver Fintech Solutions

Opinion

UniCredit’s latest snapshot shows a bank that has converted a favorable rate environment and tighter cost discipline into visible operating leverage. Revenue is expanding while profitability remains elevated, with profit and operating margins indicating strong efficiency. The quality of earnings matters more than the headline growth: investors appear to be rewarding the mix of net interest income resilience and a gradual rebuild in fee income, helped by product simplification and digital distribution. The negative operating cash flow reported on a trailing basis is not uncommon for banks given balance‑sheet dynamics, but it bears monitoring as a proxy for funding and loan‑book shifts. Put together, the contour of results supports the share price rerating and frames the question for the next leg: can UniCredit sustain returns as the rate cycle softens?

Sustainability hinges on three levers. First, fee momentum: partnerships and fintech investments can diversify revenues away from pure rate sensitivity. Second, cost control: ongoing simplification and technology migration can preserve operating margins even if net interest margins edge down. Third, credit quality: a measured risk appetite and benign loss experience will be crucial should macro conditions wobble. Capital return remains an underpinning, with the forward dividend yield and payout ratio signalling capacity, but the market will look for clarity on buyback cadence and buffers relative to regulatory minima. If management can deliver steady fees and costs while keeping impairments contained, today’s profitability can transition from cyclical to more structural.

Within the European banking landscape, competitive dynamics are shifting toward platforms that combine strong local franchises with scalable technology and partnerships. UniCredit’s EU‑cleared acquisition, fintech stake, and a channel tie‑up with a large e‑commerce ecosystem collectively target distribution breadth and cross‑sell, which could enhance pricing power in selected segments without materially raising balance‑sheet intensity. Execution will be key: integration discipline, data architecture, and customer experience will determine whether these moves translate into higher retention and wallet share. Regulation continues to shape strategy, from capital requirements to consumer protection, implying that growth vectors must be both compliant and capital‑light.

These industry currents influence valuation. If UniCredit demonstrates that fee‑led growth and efficiency can offset a gentler rate cycle, the equity story may evolve from a “rate proxy” to a “structural improver,” supporting a more resilient multiple through the cycle. Conversely, if rates fall faster than expected, or if integration distracts from core delivery, the narrative could revert to cyclical sensitivity and compress the multiple. In practice, investors will likely triangulate on returns versus cost of equity, trend in impairments, and evidence of digital monetization. The burden of proof is on execution, but the strategic posture—leaner, more digital, and more partnered—gives management several ways to defend profitability.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | Rates normalize gently, fee income scales through digital channels and partnerships, and integration benefits from approved M&A flow to costs and cross‑sell. Credit losses stay benign, enabling consistent capital returns and a sturdier, less cyclical earnings mix that supports a premium versus domestic peers. |

| Base | Gradual rate cuts compress net interest margins but are offset by measured fee growth and cost discipline. Credit costs revert toward long‑run averages without stress. Capital return remains steady and the valuation holds near sector averages as the story shifts from macro to execution. |

| Worse | A sharp macro slowdown in core markets drives higher non‑performing loans, while regulation tightens and integration proves complex. Digital investments take longer to monetize, operating leverage fades, and the equity de‑rates toward more cyclical European banks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- ECB rate path and the pace of net interest margin compression or stabilization.

- Asset quality trends in Italy and Central & Eastern Europe, including non‑performing loan formation.

- Execution on digital rollout, fintech partnerships, and approved M&A integration.

- Regulatory capital requirements and the consistency of dividends/buybacks.

- Macro growth, inflation, and competitive intensity in core retail and corporate markets.

Conclusion

UniCredit enters the next phase with elevated profitability, tangible revenue momentum, and a broader strategic toolkit that blends traditional banking with digital distribution and partnerships. The equity has already rerated on the back of strong margins and capital discipline, but the three‑year question is whether the bank can shift its earnings mix enough to cushion a gentler rate cycle while keeping risk costs anchored. Approved M&A and fintech moves create optionality on fees and scale, yet they also raise the execution bar on integration and technology delivery. For sector investors, the balance of cyclical moderation and structural self‑help will set the narrative and the multiple. Watch next 1–2 quarters: net interest margin trajectory; fee growth from partnerships; credit costs and coverage; integration milestones on approved deals. Delivery against these checkpoints will determine whether UniCredit maintains its momentum or reverts to a rate‑sensitive profile.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.