EssilorLuxottica (EL.PA) enters the next three years with a mix of premium-brand momentum, steady top-line growth, and a valuation that assumes continued execution. The owner of Ray‑Ban, Oakley and leading lens franchises delivered trailing 12-month revenue of 27.24B and a profit margin of 8.74%, while quarterly revenue growth of 5.50% suggests resilience in discretionary eyewear. Shares are up 27.20% over 12 months and recently traded near 266.5, below the 52-week high of 298. Investors are watching two fronts: the Ray‑Ban smart-glasses partnership with Meta, and optionality around optics assets such as Nikon, where EssilorLuxottica is reportedly weighing a larger stake. With a market cap of 122.07B, a forward P/E of 32.47, and a 1.49% dividend yield, the next leg likely hinges on margin discipline, innovation, and capital allocation.

Key Points as of September 2025

- Revenue: TTM revenue of 27.24B; quarterly revenue growth (yoy) 5.50%; revenue per share 59.74.

- Profit/Margins: Profit margin 8.74%; operating margin 14.25%; EBITDA 5.63B; gross profit 16.89B; ROE 6.44% and ROA 3.58%.

- Cash flow & balance sheet: Operating cash flow 4.91B; levered free cash flow 3.07B; total debt 14.05B vs cash 2.79B; debt/equity 36.58%; current ratio 0.97.

- Sales/Backlog: Global retail/wholesale and licensing channels underpin visibility; quarterly earnings growth (yoy) 1.60%.

- Share price: 266.5 (2025-09-15); 52-week high 298.00, low 202.10; 50-day MA 256.18; 200-day MA 253.77; beta 0.75; 52-week change 27.20%.

- Analyst view: Forward P/E 32.47 vs trailing 51.40; PEG 2.69, implying expectations for earnings growth and margin progress.

- Market cap & multiples: Market cap 122.07B; enterprise value 132.96B; EV/Revenue 4.88; EV/EBITDA 19.83; Price/Sales 4.49; Price/Book 3.23.

- Dividend & ownership: Forward annual dividend rate 3.95 (1.49% yield); payout ratio 76.70%; insiders 36.89%, institutions 29.25%; shares outstanding 461.16M.

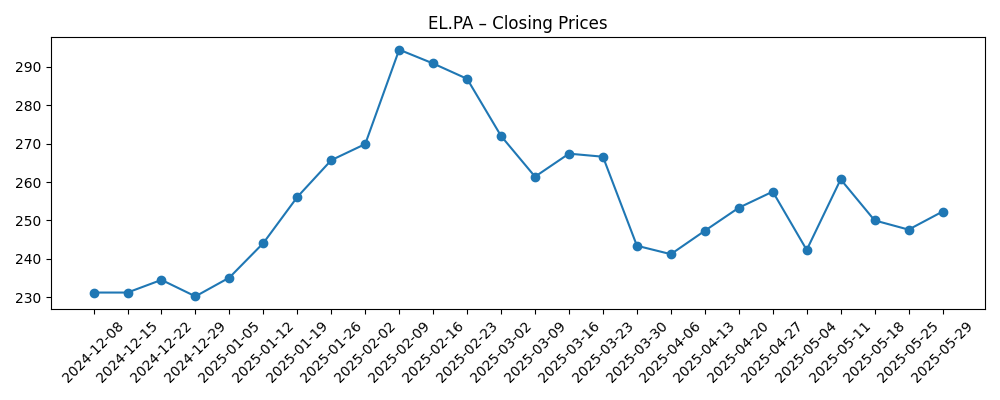

Share price evolution – last 12 months

Notable headlines

- EssilorLuxottica Weighs Doubling Its Investment in Nikon [PetaPixel]

- Nikon Jumps 21% on EssilorLuxottica Interest in Stake Boost [Yahoo Entertainment]

- Meta Has Already Won the Smart Glasses Race [Wired]

- It’s time for Meta to add a display to its smart glasses [The Verge]

Opinion

The reported interest in boosting exposure to Nikon highlights EssilorLuxottica’s long-standing strategy of deepening its optics know‑how and supply resiliency. Beyond any financial stake, closer industrial ties could strengthen lens materials, coatings, and precision manufacturing shared across ophthalmic and sunglass portfolios. It may also reinforce distribution and brand credibility in Japan and broader Asia, important regions for premium eyewear. The trade‑off is capital intensity: with total debt at 14.05B and cash at 2.79B, any deal must clear a high bar for return on invested capital and avoid undue balance‑sheet strain. Execution risk includes governance complexity and regulatory review. Still, selective, technology‑centric investments can complement EssilorLuxottica’s integrated model, supporting pricing power and differentiation while preserving optionality for future partnerships or bolt‑on transactions.

Smart glasses remain a visible swing factor. External commentary suggests Meta’s Ray‑Ban line has strong momentum, and calls for richer displays underscore a likely upgrade path that plays to EssilorLuxottica’s industrial and brand strengths. The Ray‑Ban name provides mainstream reach and fashion credibility that many consumer electronics brands lack, while EssilorLuxottica’s lens expertise can improve comfort, optics, and prescription integration. The risk is category volatility: product cycles are fast, regulatory scrutiny around cameras and privacy is rising, and form‑factor trade‑offs are unforgiving. Even if unit volumes stay niche, the halo effect can lift Ray‑Ban awareness and store traffic. If the category scales, the partnership could become a durable profit pool, supported by premium pricing and services around lenses, prescriptions, and after‑sales care across the group’s retail network.

Valuation embeds meaningful execution. A forward P/E of 32.47 against a trailing 51.40 and a PEG of 2.69 implies investors expect sustained earnings growth and gradual margin expansion from a 14.25% operating margin base. Profit margin at 8.74% leaves room for mix upgrades (premium frames, advanced lenses) and cost discipline. EV/EBITDA of 19.83 reflects quality and stability—supported by a 0.75 beta—but also narrows the margin for error. Cash generation is a strength: operating cash flow of 4.91B and levered free cash flow of 3.07B comfortably fund a 1.49% dividend yield (payout ratio 76.70%) and selective M&A. With a current ratio of 0.97 and debt/equity of 36.58%, management has room, but should pace investments thoughtfully, focusing on high‑return projects and tight working‑capital control to protect flexibility through cycles.

Shares have been constructive but choppy: the stock surged to 294.5 in February 2025, retreated toward 233.4 by late June, and recovered to 266.5 by mid‑September. The 50‑day and 200‑day moving averages at 256.18 and 253.77, respectively, point to an improving trend, while the 52‑week change of 27.20% signals relative strength. From here, the path likely hinges on tangible progress in margin uplift and evidence that connected eyewear can be more than a novelty. Positive news on optical technology partnerships (e.g., Nikon) or compelling product iterations with Meta could support the multiple, while a discretionary spending slowdown or competitive product launches could pressure sentiment. In our view, sustained execution on mix, retail productivity, and cash discipline will matter more than headline growth alone to keep valuation supported.

What could happen in three years? (horizon September 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Premium lens and frame mix deepens, connected eyewear scales with stronger use‑cases, Asian distribution expands (helped by closer Nikon ties), and retail productivity improves. Margins trend higher with disciplined capex and steady cash returns, sustaining a quality multiple. |

| Base | Core eyewear delivers steady growth; smart glasses remain supportive but niche. Incremental margin gains come from mix and operating efficiencies. Capital allocation prioritizes organic investment and selective bolt‑ons, keeping leverage and payouts balanced and valuation broadly stable. |

| Worse | Consumer demand softens, competitive AR features leapfrog, and regulatory or integration challenges impede partnerships or deals. FX and input‑cost pressures limit margin progress, free cash flow tightens, and the valuation multiple compresses until execution reaccelerates. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on margin expansion and mix upgrade across lenses and premium frames.

- Smart‑glasses traction and product roadmap with Meta, including regulatory/privacy developments.

- Capital allocation outcomes (e.g., potential Nikon stake changes), leverage, and cash conversion.

- Consumer demand trends in discretionary retail and macro conditions in the U.S., Europe, and Asia.

- Competitive intensity from global eyewear brands and tech entrants in connected wearables.

- FX movements and supply‑chain costs affecting gross margin and inventory turns.

Conclusion

EssilorLuxottica’s three‑year setup blends resilient fundamentals with optionality. The company’s scale in lenses and iconic frames underpins steady growth, while retail integration and services support recurring cash flow. Valuation is not cheap, but a forward P/E of 32.47 alongside a PEG of 2.69 suggests investors will reward dependable earnings compounding and credible margin uplift from a 14.25% operating base. Two catalysts could define the period: a deeper, technology‑centric alignment with Nikon that fortifies optical leadership, and an expanding connected‑eyewear category where Ray‑Ban’s brand and EssilorLuxottica’s lens expertise are clear advantages. Offsetting risks include consumer softness, competitive product cycles, and execution around capital deployment, given 14.05B of debt and a 0.97 current ratio. On balance, disciplined investment, innovation in lenses and wearables, and continued cash generation (OCF 4.91B, FCF 3.07B) position the group to defend its premium and compound value through 2028.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.