Novo Nordisk’s share price has whipsawed over the past year, leaving the stock down 55.44% even as operating trends stayed broadly positive. What changed is the narrative: red‑hot demand for GLP‑1 medicines (for diabetes and obesity) ran ahead of supply, competition intensified, and policy noise around drug prices and tariffs rose, amplifying sentiment swings. Why it changed: second‑quarter results topped expectations and management signaled continued U.S. growth, but delivery bottlenecks and headlines about rival launches and generics kept the focus on execution rather than momentum. It matters for investors because the franchise mix is still tilting toward higher‑margin obesity therapies and late‑stage metabolic assets, while capacity expansions and selective M&A aim to diversify beyond a single blockbuster. Quarterly revenue growth of 12.90% suggests underlying demand remains resilient, yet the sector is shifting from scarcity to scale, with pricing, payer dynamics, and manufacturing reliability increasingly decisive. In big‑cap biopharma, durability of innovation and supply chain credibility are becoming as important as clinical efficacy.

Key Points as of October 2025

- Revenue: ttm 311.94B; quarterly revenue growth (yoy) 12.90%, signaling sustained demand for metabolic therapies.

- Profitability: profit margin 35.61% and operating margin 43.52%; ROE 79.17% underscores capital efficiency.

- Sales/Backlog: formal backlog not disclosed; supply has been a constraint, with Denmark capacity expansion intended to improve fill rates.

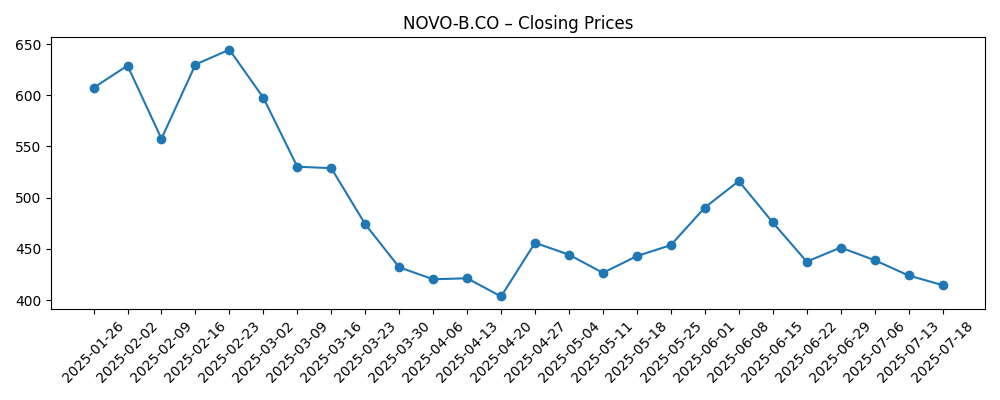

- Share price: 52‑week range 287.60–820.20; latest weekly close 366.0 (Oct 16, 2025). 50‑day MA 357.05; 200‑day MA 460.66.

- Analyst view: Q2 beat on strong obesity sales (Reuters); management commentary pointed to continued U.S. growth amid rising competition (FT/Bloomberg).

- Market cap: not disclosed in provided data; liquidity healthy with 3‑month average volume 7.48M; beta 0.33.

- Balance sheet and cash flow: cash 18.93B; debt 99.27B; current ratio 0.78; operating cash flow 121.53B; levered FCF 26.44B.

- Qualitative: competitive intensity with Eli Lilly; regulatory/pricing and tariff headlines present risk; U.K. approval for Wegovy broadens addressable market.

Share price evolution – last 12 months

Notable headlines

- Novo Nordisk Q2 earnings beat expectations on strong obesity drug sales (Reuters)

- Novo Nordisk invests $2 billion to expand production in Denmark (Reuters)

- Novo Nordisk's Wegovy wins UK approval, expanding obesity drug market (Bloomberg)

- Novo Nordisk forecasts growth despite potential competition from Pfizer (Financial Times)

- Novo Nordisk v Eli Lilly: return of the weight-loss wars (The Economist)

- Novo Nordisk faces generic competition threat for diabetes drug (Wall Street Journal)

- Novo Nordisk's investment in AI technologies to boost R&D (Financial Times)

- Denmark's Novo Nordisk expects continued growth in US market (Bloomberg)

- Akero Therapeutics to be acquired by Novo Nordisk for up to $5.2B (Seeking Alpha)

- Trump's new tariffs on drugs, trucks and furniture: Top Story (Yahoo)

Opinion

The numbers depict a business still compounding, even as the equity rerates. Revenue growth of 12.90% alongside a 43.52% operating margin suggests demand is exceeding the friction from capacity and payer checks. The Q2 beat pointed to obesity medicines driving the mix, but the quality of growth hinges on how quickly supply catches up and whether the sales curve normalizes from shortages to steady volumes. With a profit margin of 35.61% and robust operating cash flow, Novo Nordisk has the financial muscle to fund scale and pipeline optionality; the current ratio of 0.78, however, underscores working-capital tightness while the network is expanded.

Execution is the bridge between fundamentals and the share price. The company is investing in Denmark manufacturing and signaling U.S. momentum, but investors will want evidence of sustained fill rates, stable rebate dynamics, and broader international uptake following U.K. approval. Debt of 99.27B versus 18.93B in cash is manageable given cash generation, yet it raises the bar on capital allocation discipline as the firm balances dividends, capex, and selective M&A. In that context, acquiring Akero Therapeutics reads as a strategic bet to deepen the metabolic and liver portfolio, diversifying future revenue streams beyond a single GLP‑1 product cycle.

Industry dynamics are shifting from a supply‑constrained scramble to a scale and access contest. Eli Lilly’s competing therapies, potential entrants from Pfizer, and emerging generics for older diabetes drugs intensify the need for differentiation through efficacy, tolerability, delivery convenience, and real‑world outcomes. Pricing power is likely to be negotiated rather than assumed, as payers push for value and governments scrutinize drug costs; tariff headlines add another layer of uncertainty for cross‑border supply chains.

These dynamics can reshape Novo Nordisk’s equity narrative over the next three years. A credible path to global capacity, multi‑asset obesity and metabolic franchises, and AI‑enabled R&D efficiencies could support a premium multiple. Conversely, slower scale‑up, pricing pressure, or safety perceptions could compress the multiple even if volumes rise. With beta at 0.33, the stock historically moved less than the market, but recent drawdowns show idiosyncratic risk dominates. The next phase will likely reward operational proof points—reliable supply, broad access, and incremental innovation—over headline scripts alone.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | Capacity expansions come online smoothly, easing shortages and enabling broad international uptake of obesity therapies. Payer access stabilizes with outcomes‑based arrangements, while pipeline additions (including metabolic and liver assets) extend the franchise. Competitive pressure moderates as differentiation in efficacy and delivery is maintained, supporting strong margins and a durable premium narrative. |

| Base | Supply improves in stages, matching demand in key markets but with periodic bottlenecks. Competition intensifies, leading to more targeted pricing and higher rebates, yet overall category growth remains solid. The pipeline contributes selectively, offsetting gradual erosion in older diabetes products. Valuation normalizes around steady mid‑cycle growth expectations. |

| Worse | Scale‑up encounters delays, regulatory or tariff headwinds raise costs, and payer pushback limits access. Competitors gain share with new formats or combinations, while generic erosion in legacy products accelerates. The market narrative pivots to margin pressure and execution risk, compressing the multiple despite category growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Supply ramp and manufacturing reliability for obesity and diabetes medicines across major regions.

- Payer and pricing dynamics in the U.S. and Europe, including potential tariff or regulatory changes affecting drug costs.

- Competitive responses from Eli Lilly and potential new entrants, including label expansions and delivery innovations.

- Pipeline execution, including integration of acquired assets and progress in metabolic and liver indications.

- Erosion in older diabetes franchises from generic competition and its impact on mix and margins.

- Capital allocation balance between capex, M&A, and dividends amid leverage and cash flow considerations.

Conclusion

Novo Nordisk enters the next three years with rare strengths—category‑defining demand, high margins, and strong cash generation—tempered by an execution to‑do list that markets are watching closely. The share price reset reflects uncertainty about supply normalization, competition, and policy overhangs more than a collapse in underlying fundamentals. If capacity comes through and access remains broad, the company can pivot from scarcity to scale while extending its metabolic leadership via targeted R&D and acquisitions. Conversely, bottlenecks, payer pushback, or faster‑than‑expected erosion in older diabetes drugs could keep the multiple subdued. Watch next 1–2 quarters: backlog conversion and fill rates; U.S. payer and pricing developments; international uptake post‑approvals; cadence of capacity additions; integration of acquired pipeline assets. The storyline from here is less about headline prescriptions and more about proving repeatable, reliable delivery and access at global scale—conditions that would underpin steadier growth and a more durable equity narrative.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.